10:25 AM, 3rd March 2014, About 10 years ago

Text Size

Since publishing this article our campaign has raised over £450,000 and legal action has now commenced. The official closing date for borrowers to be represented in this action was 28th March 2014. However, it may still be possible to be included in the representative action by paying additional fees to cover administration and Court fees to be added to the list of represented claimants. For further details please Contact Carla Morris-Papps at Cotswold Barristers – telephone 01242 639 454 or email carla@cotswoldbarristers.co.uk

Borrowers representing 84 mortgage accounts affected by the West Bromwich Mortgage Company 1.9% rake hike to their tracker rate mortgage margins attended a secret meeting of paid up campaign members on 27th February 2014. At that meeting it was confirmed that 420 affected mortgages are currently represented by the campaign group.

Property118 had previously created a secure forum for paid up members of the group to discuss various legal strategies, one of which was a proposal to West Brom to consider arbitration as an alternative to Court action. Each member had paid £240 for each affected mortgage plus a contribution to a campaign marketing campaign.

Arbitration was proposed for tactical legal reasons which were explained by the groups advisers, some details of which must remain confidential for legal reasons.

This would have been significantly quicker and cheaper for all concerned and had massive upsides to West Brom in that the outcome would be confidential. In other words, if West Brom had lost the case, nobody would have “officially” known about it other than those who had already paid to be a member of the campaign group. This would have meant the worst case scenario for West Brom would be losing no more than 10% of their reported £19 million of additional annual profits from this rate hike.

West Brom refused!

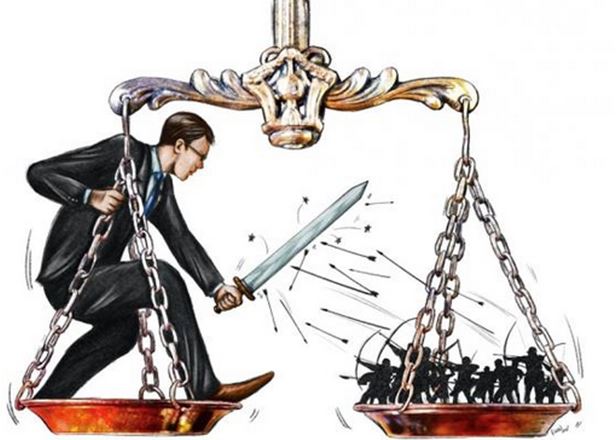

This refusal now plays very nicely into our hands for litigation purposes as it will be frowned upon by the Courts, especially if we lose our case and end up having to pay costs associated with the David and Goliath battle. 😉

The attendees of the meeting voted unanimously to proceed immediately with litigation on the basis proposed by (Mark Smith – Barrister-At-Law) as explained below. Thanks were offered to Justin Selig and his team at The Law Department for his sterling work to date in helping us get to this position. Without their help our campaign may never have got this far.

Litigation will commence during the week of 31st March 2014 with the service of Court Papers. This provides a final opportunity for any remaining affected borrowers to commit to the action by Friday 28th March.

We already have more than double the necessary funds on account to pay our own legal team. Mark Smith has agreed to represent borrowers for a fixed fee of £120 + VAT per affected mortgage subject to there being at least 250 borrowers committed. Further details in his Terms of Business and Instruction letter which can be downloaded by completing the form at the bottom of this page.

Existing campaign members are also reminded that they MUST complete and return the instruction form to Mark Smith to act for them and the required additional funds by 28th March 2014.

The deadline for submission of instructions has now expired, sorry.

The primary concern of existing members that had to be overcome was their potentially unlimited liability to the West Brom’s legal costs in the event of losing the case and the “open cheque book” often associated with legal cases. It was agreed that all fears could be overcome by creating a fund to be held in a BARCO escrow account (BARCO is the Bar Council – the regulators of Barristers). This account will provide evidence to the Courts that we have sufficient funds on account to settle the other sides costs in the event of losing the case and having an adverse costs order awarded against the group.

The first step of the legal action will be a costs hearing, as part of a “Case Management Conference”. This is where both sides must submit their costs budgets for the case to the judge and where the judge decides upon reasonableness. If either side fails to do this then the maximum they can claim for costs against the other side is the Court fee, i.e. £175! It is extremely rare for judges to award costs in excess of the agreed costs budget.

Our estimate is that based on the number of affected mortgages being represented, and the possibility of more people now wishing to be represented at this stage, the BARCO account could contain as much as double the other sides costs budget. This is why we are so confident about costs not exceeding the amount of funds that will be held in escrow. In the extremely unlikely event of the groups funds being insufficient to meet a potential costs order the group would have an opportunity to withdraw their case and settle the other sides costs to date.

If/when we win, the contents of the BARCO account will be rolled over to deal with all of the costs associated with the inevitable appeal case and if/when that is won the funds will be returned to members. If we lose, the contents of the escrow account will be used to pay costs awarded to West Brom and the balance of funds will be returned pro-rata to members.

The case will be fought on the basis of a representative action. This means that the ruling of the Courts will only apply to those borrowers who have paid to be represented in the case. There will be no free rides!

We fully appreciate that some affected borrowers will not be able to raise the necessary funds in time to be part of this action so there is a Plan B. Affected borrowers who are not represented may have another opportunity to make claims in a few years time. In the meantime they will continue to pay the higher rate and will probably be expected to forfeit any refund of overpayments in return for a no-win-no-fee arrangement. This could be a far more expensive option, hence the reason why so many affected borrowers are so keen to be part of the imminent legal action.

The legal strategy and process we are undertaking will be a very simple one. There will be no witnesses called so there will be no surprise twists such as those often seen on TV where a new witness or new evidence appears at the last minute. On this basis, we anticipate the case, including any appeal, to be concluded before Christmas.

We will only be asking the Courts to rule on two things:-

1) Based on the documentation produced by West Brom, do they have the right to increase the tracker margin?

2) Based on the documentation produced by West Brom, do they have the right to call in loans within 28 days without the borrower being in default?

There has been lots of discussion about whether West Brom did or did not provide all of the documentation they are now relying upon. This is not relevant to our case.

There has also been much discussion about Unfair Terms in Consumer Contract Regulations; again this is not relevant to our case.

It has been questioned whether in fact the mortgages issued by West Brom were indeed trackers, this cannot be denied by West Brom as this is the basis they report them to the rating standards agencies – see this link

The agreed level of funds to be deposited into the BARCO account is £1,144 per affected mortgage being represented. For example, somebody wishing to have 10 affected mortgages represented will need to deposit a further £11,440 into the BARCO account. Existing members will receive a refund of unused funds which they paid into the client account of The Law Department. New members will need to pay an additional premium of £356 per mortgage to the Property118 marketing fund to equalise the financial contributions and efforts of the forerunners of the group.

Therefore, the net payment per affected mortgage for members will be:

We have created a simple set of instructions explaining how much you need to pay and who you need to pay it to here >>> http://www.property118.com/simplified-payment-instructions-join-west-brom-action/

Remember, if/when we win you will get more than this amount back when you also factor in 100% of the extra 1.9% interest you have been paying which will also be refunded. The worst case scenario is that you will get none of this money back if we lose. If you can live with that you should proceed.

The reason we have chosen this strategy as opposed to buying ATE insurance is that it costs us much less if we win. We are in this to win this. The above strategy means that we all know what we stand to lose and can proceed with our eyes wide open, confident that our liabilities are limited.

If the balance of the BARCO account associated with this action is less than £250,000 by close of business on Friday 28th March 2014 the legal action case will be aborted, funds will be returned to members within 14 days and that will be the end of the line for this campaign for myself and Property118 – at least for 12 months or more anyway. If necessary we will then take another look at Plan B.

Since publishing this article our campaign has raised over £450,000 and legal action has now commenced. The official closing date for borrowers to be represented in this action was 28th March 2014. However, it may still be possible to be included in the representative action by paying additional fees to cover administration and Court fees to be added to the list of represented claimants. For further details please Contact Carla Morris-Papps at Cotswold Barristers – telephone 01242 639 454 or email carla@cotswoldbarristers.co.uk

Previous Article

Buyers Premium Rip-Off At Property AutionNext Article

How crucial is lift for a 2nd floor flat?

Gavin Ewan

17:44 PM, 24th March 2014, About 10 years ago

Reply to the comment left by "Mark Smith (Barrister-At-Law)" at "24/03/2014 - 16:58":

Thank you Mark for your prompt reply , I will do it now

Richard Kent

18:34 PM, 24th March 2014, About 10 years ago

Reply to the comment left by "Anthony Wilson" at "24/03/2014 - 12:23":

Anthony,

Further to what you have said.

If the mortgage deed was void then the lender in this case would have not been able to enforce their interest in the properties nor enforce the hike on the borrowers.

What everyone calls a mortgage is not the loan itself. The Mortgage is the Deed giving the lender rights over the property.

The word Mortgage (in French) means "death pledge", which means that the pledge ends (dies) when either the obligation is fulfilled or the property is taken through foreclosure.

So, a loan to purchase a house is NOT a mortgage. Contrary to popular belief. Although everyone calls it a mortgage 🙂

Anthony Wilson

19:56 PM, 24th March 2014, About 10 years ago

Reply to the comment left by "Richard Kent " at "24/03/2014 - 18:34":

Richard

This is going to become confusing to most people.. the council of mortgage lenders definition of a mortgage is a loan secured against a property so i think it is safe to treat a loan to purchase a house secured against that house as a mortgage for all intents and purposes.

Unfortunately the pledge does not die when the property is sold or foreclosed.. on a sale with negative equity the borrower still has personal liability for any balance.. which is why so many people did a disappearing act after handing keys back in the 90s.,.

Richard Kent

20:44 PM, 24th March 2014, About 10 years ago

Reply to the comment left by "Anthony Wilson" at "24/03/2014 - 19:56":

Yes,

I agree. In the case of negative equity, I can see how the deed does not die as the lender is still owed money.

One of the reasons for the warning "Your house may be repossessed if you do not keep up..........."

Sure, the Council of Mortgage Lenders can call it what they like but it's technically wrong.

This is a trick question which arises in the CeMAP exams 🙂

Although, as I said, we all call the loan a Mortgage 🙂

We even call them Mortgage Lenders. 🙂

It's a colloquialism.

Richard Kent

21:58 PM, 24th March 2014, About 10 years ago

Here is a useful link which explains why the loans on our houses are not really mortgages. Even though we all think they are and we call them that.............

http://homebuying.about.com/cs/mortgagearticles/a/deedoftrust.htm

But we have to call them something 🙂

Mark Alexander - Founder of Property118

22:39 PM, 24th March 2014, About 10 years ago

Note to all readers.

Don't get sucked into some of the nonsense which has been spouted last weekend with regards to undated mortgage deeds and securitisation. I've seen too many extremist views which claim to prove that money doesn't exist and that you should sell everything and invest only into gold and inverse ETF's and get super rich when the horror story eventually becomes a realisation. The flaw of course in this argument is that if money doesn't exist there is no basis against which to measure wealth because money doesn't exist. You'd be better of trying to work out where the universe ends, what's after that and what came before. The reason I don't recommend spending your time on these things is that you will probably end up in an asylum which is where the majority of people peddling such nonsense actually belong.

.

Auntie P .

7:23 AM, 25th March 2014, About 10 years ago

Reply to the comment left by "Mark Smith (Barrister-At-Law)" at "24/03/2014 - 16:58":

Thank you Mark for this advice. Just a quick question, is it sufficient to email WB as this is my preferred method of communication. It may sound like a silly question but I don't want them to worm their way out of anything by saying they haven't received my letters. Call me paranoid but I just don't trust them one little bit!!

Richard Kent

8:00 AM, 25th March 2014, About 10 years ago

Reply to the comment left by "Mark Alexander" at "24/03/2014 - 22:39":

Was that aimed at me? 🙂

In which case your reply was quite humourous.

Sucked in? Who, where, what? 🙂

My comments were not about proving "that money doesn't exist" 🙂

What I was saying was that technically the Mortgage is the Mortgage Deed and the loan is the loan. The Mortgage Deed being the agreement between you and the lender to pay off the loan etc.

And it's interesting that in the CeMAP morgage advice examinations, this same question about what defines a mortgage arises and one of the wrong answers is something like "The loan used to purchase the property"

But everyone, including me, calls the loan the mortgage.

I'm not trying to confuse you - Honestly 🙂

Mark Alexander - Founder of Property118

8:10 AM, 25th March 2014, About 10 years ago

Reply to the comment left by "Richard Kent " at "25/03/2014 - 08:00":

LOL - sorry Richard, no it wasn't aimed at you. That will teach me not to try to catch up and respond to comments from my iphone whilst drinking coffee in a motorway service station after a full day of travelling!

I have amended my post accordingly.

Glad you appreciated the humorous side of it though 😉

Terence Birch

9:19 AM, 25th March 2014, About 10 years ago

Reply to the comment left by "Ed Atkinson" at "24/03/2014 - 13:51":

Plus five more from me this morning.