Property Investment Strategies

Blogs sharing property investment strategies and opinions from UK buy to let property investors and landlords

Keep Portfolio or buy into a REIT?

Hello all, my father is a portfolio landlord who wants to retire. He doesn’t want the hassle of managing property anymore, but has...

Open A Business Bank Account In Minutes

For landlords who need to open a business account FAST we recommend Tide.

In just just a matter of minutes you can open a business...

DOUBLE WHAMMY FOR LANDLORDS Interest Rate Rises AND Secti...

Until the recent interest rate rises started to bite into cashflow, many larger portfolio landlords had taken the decision to pay the...

Unlock the Secrets to Finding Profitable Property Deals

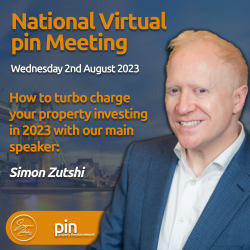

How good are you at finding potential property deals? Are you ready to take your property investing skills to the next level?

I’m...

How Property Investors Can Profit From A Buyers Market?

After a little break from YouTube, Ranjan is back talking about the current state of the property market.

We are firmly in a ‘buyers...

Unlock the Power of Lease Options: Discover the Course

Last week, I did an article about my “The BEST Property Strategy in the Falling Market” webinar which took place last night.

BEST Property Strategy in the Falling Property Market

Would you like to know how you can increase your monthly cash flow, before the end of the year, without having the hassle of having...