9:08 AM, 21st July 2023, About A year ago 11

Text Size

Strikes, rocketing-interest rates and high demand for housing. You would be forgiven for thinking that we were back in the 1970s!

Fashion may have changed drastically since then but with housing affordability at its worst in decades, renters and homeowners now face heading back to the past.

This Property118 investigation turns back the clock to the 70s and looks at the legislation of the 70s including the Rent Act and whether the housing situation has become worse for homeowners and renters.

During the 60s and 70s new legislation was introduced which would have a massive impact on the private rented sector.

Tessa Shepperson, owner of the Landlord Law blog, explains in her blog post that the Wilson government in the 60s passed protective legislation towards tenants.

The first act to be passed was the Protection from Eviction Act 1964 followed by the Rent Act 1965.

She explains some of the new concepts and measures introduced in the act:

Any appeal was to the Rent Assessment Committees (now replaced by the First Tier Tribunal) and fair rents could be reviewed every two years.

The Labour government of the 70s introduced further measures in the Rent Act 1974 and in 1977 the Protection for Eviction Act and the Rent Act 1977 were both passed which consolidated all the earlier legislation.

The Rent Act 1974 introduced the following developments:

Ms Shepperson explains that the Rent Acts of the 70s were not popular with landlords.

She said: “One landlord described them to me as ‘expropriation without compensation’ and a lot of landlords felt the same.

“Few property owners were prepared to allow tenants into a property if this meant the effective loss of that property for two generations (as often happened).

“There were many cases where a property owner allowed someone to live in a property for what was supposed to be a limited period of time (or in one case that I know of, just for a holiday) only to find that they were stuck with them as tenants for decades.”

She also explains the impact of legislation had huge consequences for the private rented sector.

Ms Shepperson said: “One major result of the legislation as a whole was the substantial reduction in the size of the private rented sector. Households living in private rented accommodation went down from about 80% in 1918 to about 8-9% at the end of the 1980s.

“The protective legislation introduced in the 1960s and 1970s were not the sole cause of this, but they were certainly a factor.”

The issue of low rents was also an issue for many landlords during the 70s.

Ms Shepperson said: “There was also the problem of low rents. The ‘fair rents’ were supposed to reflect the market rent. But as over time, there were no genuine market rents, the fair rent levels drifted down and down.

“Landlords, therefore, had little incentive (and often could not afford) to keep properties in good condition and many property conditions deteriorated seriously as a result of this.”

Back to 2023 and the Bank of England has recently raised interest rates to 5% which for many people may seem significantly high.

However, during the 70s, interest rates were sky-high and reached a record of 17% in 1979 which in turn caused mortgage misery for thousands of homeowners.

Coupled with high interest rates and rising house prices could homeowners now face heading back to the 1970s?

Sarah Coles, the head of personal finance at Hargreaves Lansdown, says whilst interest rates are lower than they were in the 70s, houses have almost quadrupled in price.

She explains: “Interest rates are actually lower than they were in the 1970s, when they hit a peak of 17% in 1979.

“However, there are a couple of reasons why the impact at today’s rate of 5% is more profound for any mortgage holder who has to remortgage while rates are so high.

“Houses are enormously expensive compared to where they were back in the 70s – around 65 times more expensive. As a result, we’re having to borrow far more, and the larger our mortgage payments, the bigger the impact of any rate rise.”

Ms Coles added that compared to the 70s, people are borrowing a lot more.

She says: “It’s not just that the monthly payment is so much higher, it’s also bigger as a proportion of our income.

“We’re borrowing far more as a multiple of our earnings than we did back then. Right now, houses cost around nine times earnings, whereas, during the 1970s as a whole, they ranged between four and six times.”

According to House Buyer Bureau, today’s homebuyers have by far the toughest financial task when it comes to housing affordability – with house prices sitting at 8.8 times the average earnings.

The research reveals the average house price throughout the 1970s sat at just £9,277, the equivalent of £68,493 today, after adjusting for inflation.

The managing director of House Buyer Bureau, Chris Hodgkinson, said: “You have to feel for today’s homebuyers who have seen house prices explode over the last decade or two, in particular, while the earnings on offer to them have failed to keep pace.

“As a result, they require over double the level of income to cover the cost of a home compared to their previous counterparts looking to purchase back in the 70s.”

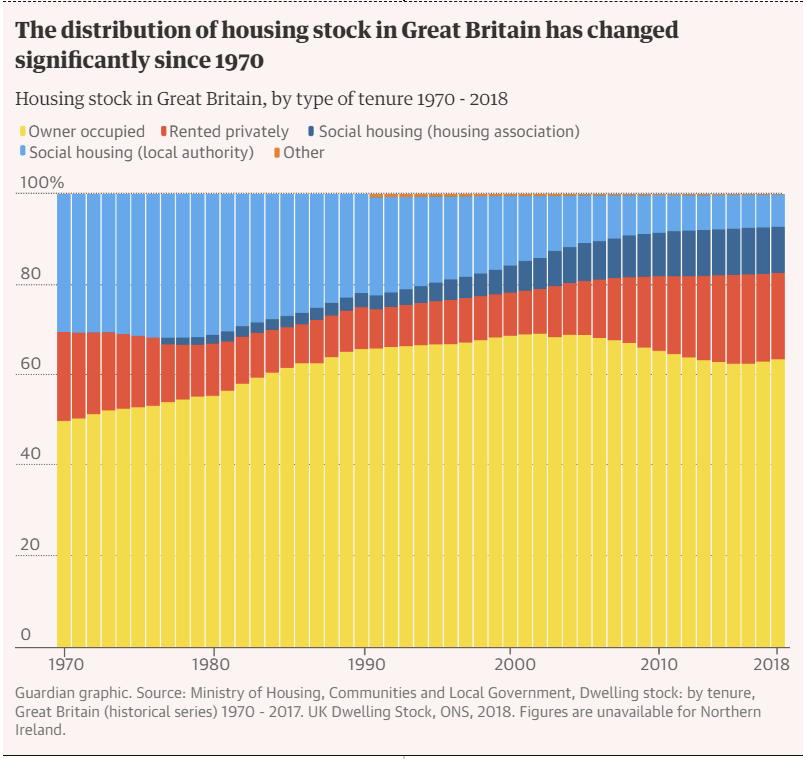

Research by the Guardian newspaper shows that in the 1970s, around a third of all housing available was council housing provided by the local authorities which helped provide affordable homes to those who could not afford to buy.

This is no longer the case.

The percentage of homes provided by councils fell from 32% in 1977 to a mere 9% in 2009. The figure continued to fall the following decade, hitting 7% in 2018.

The Guardian also reveals that the yearly supply of new homes in the UK has declined since the 70s.

In the 70s, there were around 400,000 dwellings built per year, but this has fallen sharply to just under 200,000 since 2018.

The combination of a dramatic decline in new house building and local authority housing has caused a massive explosion in house prices in real terms since the 70s.

The Guardian used research from the Department of Levelling Up which clearly shows the dramatic decline in local authority housing.

The graph also shows that owner-occupied homes have increased since the 1970s, but local authority housing has declined sharply. This decline has been taken up partly by an increase in the PRS and the substantial growth of housing associations.

The period of the greatest decline in the PRS was from the 1980s to the early 2000s due to the Thatcher government’s drive towards home ownership.

Could we be facing a repeat of the 80s with a mass exodus of landlords?

Image courtesy of the Guardian

Student housing charity Unipol is warning that the current student housing shortage is the worst it’s been since the 70s when students slept in sports halls and cars.

Martin Blakey, chief executive of Unipol, says: “You’re beginning to see student housing moving into shortage across the majority of universities – not just the ones you read about.

“The reason is that purpose-built student accommodation has stopped expanding to the extent it was, and we don’t think that’s going to change.

“At the same time, we think there’s a significant decrease in shared houses as landlords are moving back to renting to professionals or leaving the market.”

Last year a survey of 3,000 students by Student Beans revealed almost one in ten (8%) students have had to live in their cars as they could not find any affordable accommodation.

Nearly half (49%) said they have had to sofa surf with friends.

According to research by the accommodation platform StuRents, the UK will face a shortfall of around 450,000 student beds by 2025.

That drop in numbers could see students heading back to the past and having to sofa surf or even live in their cars.

The Rent Acts in the 70s were seen as incredibly ‘anti-landlord’, but could we now be heading back to the dark ages with the Renters’ Reform Bill?

Back in the 70s far more council housing was available than it is today, and property prices were significantly lower.

Whilst we await more details from the Renters’ Reform Bill one thing is for certain, renters and homeowners face an even tougher challenge in today’s housing market than they have seen in recent years – and landlords face a troubling scenario of struggling to evict non-paying tenants. Much like they did in the 1970s.

Previous Article

Is it now time to work with Shelter and Generation Rent?

Whiteskifreak Surrey

Become a Member

If you login or become a member you can view this members profile, comments, posts and send them messages!

Sign Up10:03 AM, 21st July 2023, About A year ago

The whole country is moving back to 1960s-70s...

Wasn't that purpose of brexit?

At least we have black (well, almost) passports...

geester24

Become a Member

If you login or become a member you can view this members profile, comments, posts and send them messages!

Sign Up11:57 AM, 21st July 2023, About A year ago

I remember my dad as a small landlord in the 60s and 70's. Rent books and visiting to collect cash rents. Regulated tenancies, small incremental rent increases and completely out of touch with reality. Maybe paying someone thousands to leave if they wanted or they could hand on the tenancy to a son or daughter (2 generations I believe if they lived there).

Council grants of thousands to do up your rental as there was such a shortage and no money to repair as rents were so low. He worked hard and had a bakers shop in East London. He invested in property and passed on his wisdom to me and I have benefitted greatly and so I am here on this forum

. Here we are again and i can see the same mistakes will be repeated. Build more. Simples

Stella

Become a Member

If you login or become a member you can view this members profile, comments, posts and send them messages!

Sign Up12:51 PM, 21st July 2023, About A year ago

Reply to the comment left by geester24 at 21/07/2023 - 11:57

Yes people do not realise what is to come.

I was renting properties in the seventies and it was grim both for landlords and for young people trying to find somewhere to live.

If a property became available only the first person in a long queue of hopefuls would be successful and once they became a tenant they could apply to the rent officer and very often they would have the rent reduced and if the matter was taken to the rent tribunal they usually rubber-stamped what the rent officer had agreed.

They were then tenants for life and could pass the tenancy to their children and sometimes to people who had moved into the property a few months before the tenant died

This RRB has too many similarities and Shelter and Generation Rent might think they are helping tenants but only when property is no longer available will the consequences become clear to them.

Freda Blogs

Become a Member

If you login or become a member you can view this members profile, comments, posts and send them messages!

Sign Up12:58 PM, 21st July 2023, About A year ago

Great resume, which captures many of the core features that have led to the housing crisis we are currently experiencing.

Yet with the RRB, the Government is hellbent and cynically steering the country (for the sake of a few votes) into a complete housing disaster, ably supported by its cronies at Shelter and Generation Rent.

Have we learned nothing from history?

Martin O'Hearne

Become a Member

If you login or become a member you can view this members profile, comments, posts and send them messages!

Sign Up14:18 PM, 21st July 2023, About A year ago

It’s not often that a government can see the results of newly proposed legislation long before it becomes law, but the state of the PRS is there for everyone to see and the truth is very bad for tens. it’s taken some realising from our “smart” politicians, but my bet is The Renters Reform Bill will be kicked into the very long grass, and even Kier Starmer won’t run with it if he becomes PM.

Stella

Become a Member

If you login or become a member you can view this members profile, comments, posts and send them messages!

Sign Up15:49 PM, 21st July 2023, About A year ago

I should also mention that if you decided to sell a property in the seventies where the tenant had security of tenure then the market value would be about 50% less than the true market value and if you needed a mortgage to buy the property some local councils might lend on them but building societies or banks would not consider them.

Martin Roberts

Become a Member

If you login or become a member you can view this members profile, comments, posts and send them messages!

Sign Up18:45 PM, 21st July 2023, About A year ago

I remember the 70s well.

Inflation, sky high interest, strikes, Kate Bush…

Reluctant Landlord

Become a Member

If you login or become a member you can view this members profile, comments, posts and send them messages!

Sign Up18:58 PM, 21st July 2023, About A year ago

Reply to the comment left by Martin Roberts at 21/07/2023 - 18:45

no change from now then (though not sure about KB!)

Moshe Strugano

Become a Member

If you login or become a member you can view this members profile, comments, posts and send them messages!

Sign Up17:51 PM, 22nd July 2023, About A year ago

The reason is that purpose-built student accommodation has stopped expanding to the extent it was, and we don’t think that’s going to change.

AnthonyJames

Become a Member

If you login or become a member you can view this members profile, comments, posts and send them messages!

Sign Up23:37 PM, 22nd July 2023, About A year ago

I was a student in London from 1982-1985 and remember spending 2-3 weeks each summer cycling around the city trying to find accommodation for October. Demand was massive, supply very low and poor quality. No mobile phones or internet, so you always carried a huge bag of change to use in BT call boxes for whenever you got a promising number via Evening Standard, Time Out, etc. I wasted a fortune on missed calls and properties that had already gone. Lots of rooms in houseshares went to other people in established social networks, so outsiders had it tough, as always.

My first year was in a student hall, then lodging alone with a young family in Herne Hill, then a "company let" with 3 friends in Roehampton which was a 30-40 minute cycle into South Kensington via Putney.

In a gap year before my PhD I then lived in a classic bedsit in North Kensington, which I later learned was one of Peter Rachmann's old playgrounds. My landlord, a Croatian nationalist who fought on the wrong side in WW2 and was a refugee from Tito's Yugoslavia, endlessly bemoaned the Rent Acts. He lived a very frugal life in one of his house's basements, but this may just have been habit. His best mate was an Irish builder who was able to get development loans and built his fortune by always keeping a proportion of his renovations to rent rather than always selling to recycle his capital. My landlord's problem was that he sat and held: he didn't renovate and develop as well.

It was unheard of to get mortgages for the sole purpose of renting - lenders were terrified of lifetime tenants and rent control. "Company lets" were somehow exempt from the rules that applied to every other landlord: I don't know how, but lots of estate agents had corporate landlords on their books, which was useful if you could find rent buddies to be able to afford to rent a whole house.

The 1989 Act was a true revolution but from memory only really got going in 1995ish with the widespread launch of "buy to let" mortgages. Generation Rent rarely know this history and believe they are somehow uniquely penalised. They have simply no idea of how poor quality rental housing used to be and how the supply has improved. This improvement is of course now being reversed by deliberate policy of all the political parties, in league with so-called charities like Shelter and almost the entire media and local government establishment, who have a Pavlovian ideological hostility to the PRS. Tenants will unfortunately reap what these activists sow, and the campaigners will naturally always find a way to blame the landlord for their own policy errors..