9:29 AM, 19th October 2023, About 7 months ago 31

Text Size

Recent history in the landlord tax planning sector has imparted a vital lesson: when it comes to your tax adviser, it’s imperative to insist that they guide you toward HMRC’s invaluable manuals and that you scrutinise them with great care. The organisations promoting the Hybrid LLP scheme, which ultimately drew HMRC’s attention with Spotlight 63, boasted professionals adorned with a plethora of qualifications, some of whom seemingly had more letters following their names than in their names. However, these credentials and expensive offices proved meaningless to their unsuspecting victims.

Moreover, any guidance provided by Property118 is first triaged before it is meticulously linked to the pertinent HMRC manuals. It then undergoes a separate rigorous and independent review by a barrister-at-law before any formal advice is dispensed. This Barrister then assumes personal responsibility for advice and its execution. Advice is always bespoke, there is no “scheme”.

Suppose you were a Partner in a prominent Chartered Tax Advisory firm or a solicitor at a large legal practice. Now, picture the shock that would ripple through your professional conscience if you discovered that a publisher like Property118 had brought to your attention the possibility that your advice had severely misinformed thousands of clients.

Can you fathom the despair that might engulf you as you realised that, if the truth were to emerge, you might find yourself inundated with thousands of negligence claims? If you were among the advisors responsible, could you contemplate trying to manipulate a well-known individual skilled in exposing tax evasion? Would you spin a web of intricate arguments to prop up the incorrect advice you had given, in the desperate hope that this individual would come to your defence against the bearer of inconvenient truths?

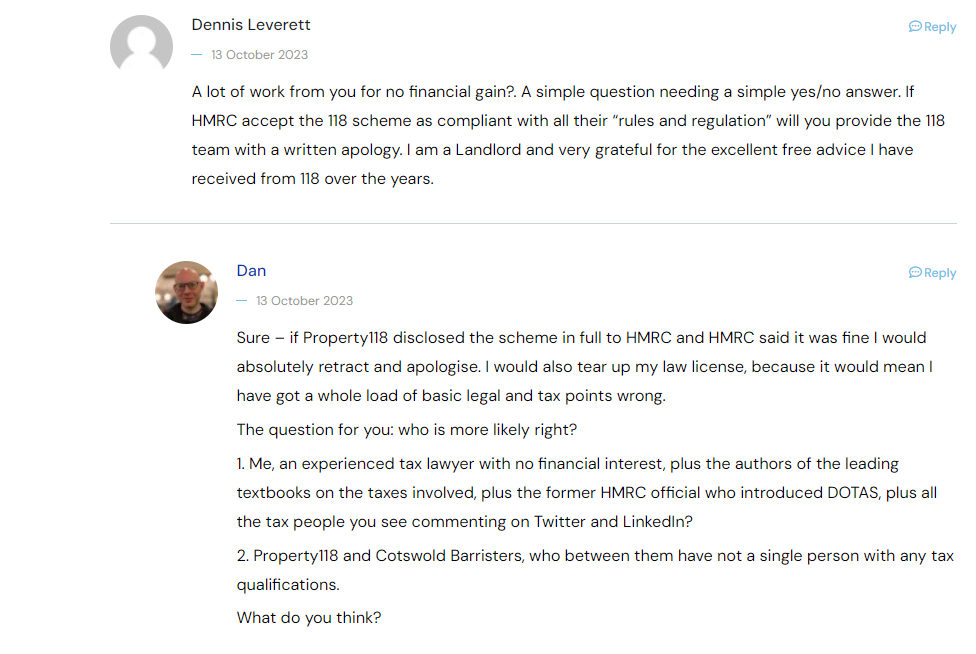

These are all rhetorical questions, naturally, and we acknowledge that this scenario may seem more like a far-fetched conspiracy theory at first glance. However, let’s delve into the specifics of this situation. Dan Neidle has been consistent in one thing, he wants to have a debate on Tax Policy. Maybe he should be more careful what he wishes for!

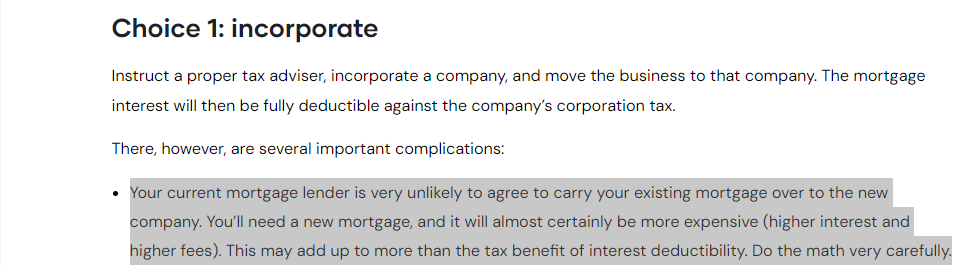

The initial challenge (dating back to 2016) to the concept of Substantial Incorporation Structure arose from an implied understanding that, “normally” in the process of incorporating a property rental business the company would secure new mortgages to purchase properties from the individual owners of the business. Yet, this contradicts the guidelines outlined in the HMRC manuals, as illustrated by the following screenshot from HMRC manual CG65745.

This HMRC manual unequivocally stipulates that HMRC “normally” views an indemnity as the appropriate method for liabilities such as mortgages to be “taken over”. Furthermore, when we factor in ESC/D32, we learn that if a debt is not “taken over” but instead paid off with new funds, it might not qualify for ‘incorporation relief.’

For clients who relied on advisers advocating the belief that incorporating a company typically involves securing new mortgages, this situation could be calamitous. For advisers who led their clients astray on this matter, the potential magnitude of professional negligence claims could be staggering.

This view was supported by the Institute of Certified Practicing Accountants (until they removed their article yesterday) – evidence HERE

The good news is that a website called Wayback Machine is able to show what articles look like historically, so we have used their archive to link back to the article in 2020 from the screenshot below. One has to wonder why they decided to delete the article now.

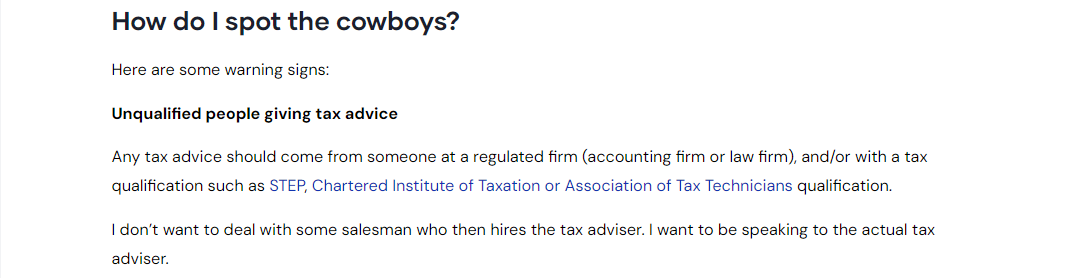

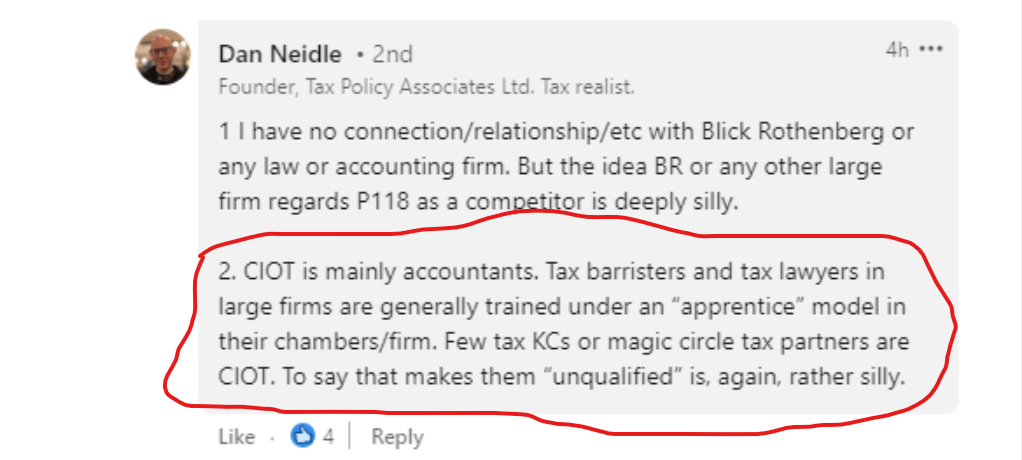

However, these screenshots are taken directly from the website of Tax Policy Associates Limited.

The most important word used here is “normally“. This is because Neidle’s version is very different to HMRC’s.

The same article then goes on to say …

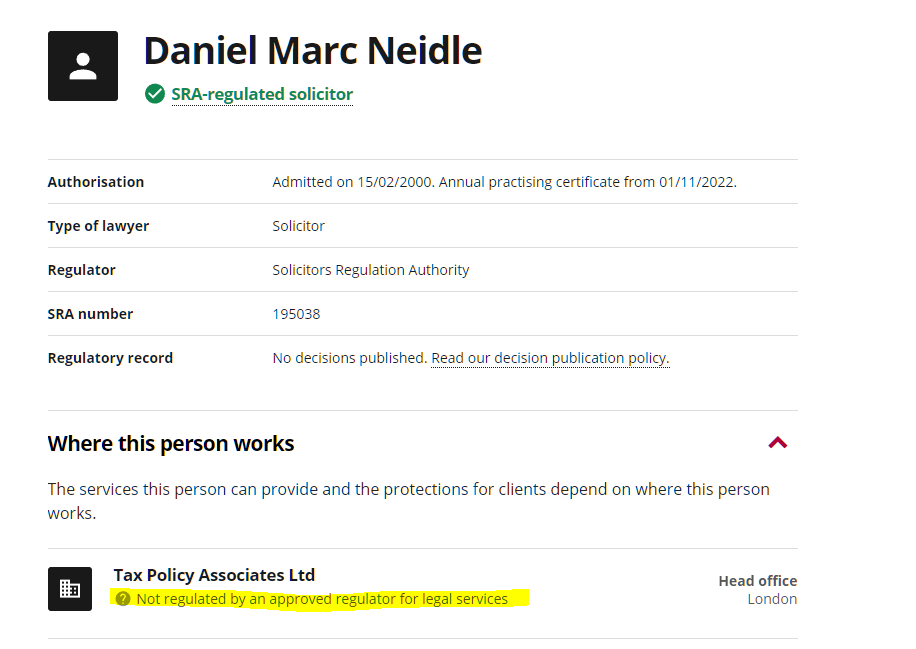

Dan is an SRA-regulated solicitor, but Tax Policy Associates Ltd is NOT regulated by an approved regulator for legal services.

The above is from the Solicitors Regulation Authority website.

The next critical flaw in the rantings of our antagonists is dealt with at point 34 of the advice provided by Felicity Cullen KC. In her statement, she made the point;

“As we understand matters, the possibility of extracting capital from a partnership pre-incorporation and lending funds to the company relies, as a starting point, on the basic principle that a taxpayer can extract capital from a business and replace it with borrowings as explained in HMRC’s Manuals at BIM45700 et seq1.”

The primary intent of any new lending to facilitate the drawdown of their capital before incorporation is not to circumvent tax obligations but to provide continuous support to the business. This support aims to replace the positive capital account balances of business owners, which are tied up in assets that have already been subjected to taxation, with liquid funds accessible from the business owners’ capital accounts. The methods employed for this purpose, including options such as bridging finance, are meticulously documented within the Business Sale and Purchase Agreement and accompanying legal documents. These documents, along with Capital Gains Tax (CGT) computations, are submitted to HMRC by the borrowers’ own accountants.

Let’s examine a scenario in which the business owners hold a £175,000 capital account balance prior to incorporation. The advisor negligently fails to advise the business to secure financing to reimburse this capital. Sometime after the incorporation, the business owners decide to refinance property now owned by the company, with the intention of assisting their children in entering the housing market. How can the business owners withdraw this cash from the company without incurring additional tax liabilities?

The repercussions for the business owners could be nothing short of catastrophic. Remember their capital account balance pre-incorporation was money they had already been taxed on, but to get it back out of the company post-incorporation they would have to pay income tax on it yet again. Negligence claims could be rooted in the additional taxes these clients would now have to pay in order to withdraw money from their companies.

There is another extremely insightful article on this topic (which can be read via the link below).

https://www.taxinsider.co.uk/withdrawing-capital-from-your-business-update-on-bim-ta – just in case this one also magically disappears you can find it on Wayback Machine HERE

and also from Wayback Machine and the article that mysteriously vanished yesterday..

Property118 has consistently adhered to a policy of refraining from publicly naming and shaming advisers. Yet, the need to alter this stance might arise if the onslaught of attacks persists. Fortunately, discovering the identities of these advisers isn’t a complex task now that we have established their motives. A cursory examination of the initial articles published by Dan Neidle to assail Property118 will reveal the names of some advisers who have been “assisting” him. A straightforward Google search pairing these names with the word ‘tax’ will reveal their affiliations. With this information in hand, it becomes relatively easy to connect the dots and discern who stands to gain from these attacks. One might even feel a twinge of sympathy for Dan Neidle, as he appears to be unwittingly manipulated and unaware of how he has been exploited.

We have already reported Dan Neidle to his professional body and we will be reporting the rest of the team he has named in his articles to theirs. Unfortunately, very few of his “helpers” agreed to be named. One can only wonder why.

If you are an existing client of Property118 and have decided to engage one of Dan Neidle’s recommended advisers you might want to reconsider parting with your hard-earned money to pay their exorbitant fees.

Well, he did ask, so here are my answers to his question – I think Dan should enjoy the millions he made to enable him to retire at the age of 48. He should put his phone away, spend more time with his family, and enjoy tending to his pansies. The consequences of his egotistical approach are far-reaching. Rather than basking in his own glory by appointing himself as judge, jury and executioner he could simply have reported his concerns to HMRC and the BSB and left them to do their job. He once told The Guardian he had retired early to spend more time with his family and gardening. How is that going I wonder. I suspect his family is not best pleased that he has become a destructive keyboard warrior either. Let’s hope the SRA see it that way too.

We will get through this. As somebody once said, if you’re going through hell, keep going!

An alternative version might be:

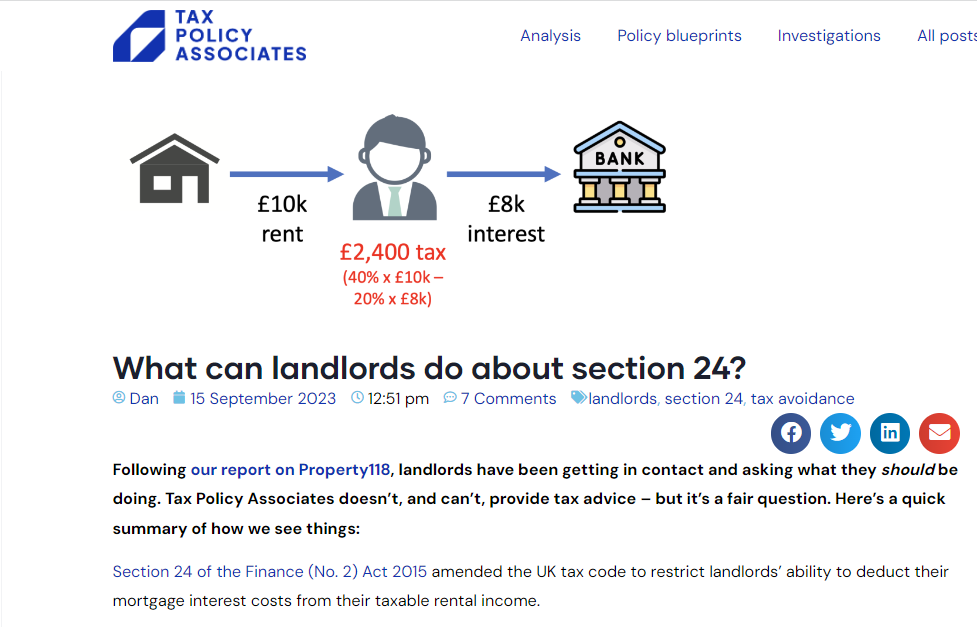

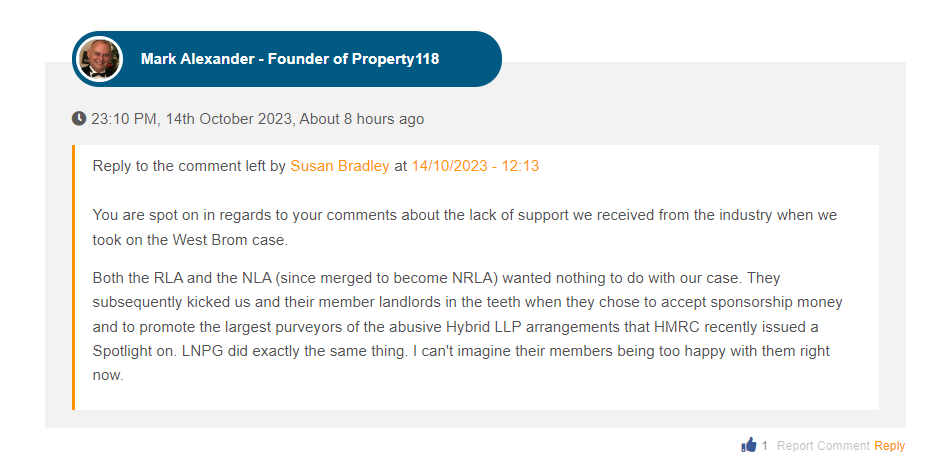

This Venn diagram offers valuable insights into the significant attention garnered by the trial of Property118 on Social Media, led by Dan Neidle. This attention has reached such heights that a prominent national newspaper has seemingly merged Neidle’s critique with HMRC’s Spotlight 63. However, it’s essential to acknowledge that Property118 had already issued warnings regarding the potential misuse of Hybrid LLP structures back in 2018.

Within this Venn diagram, one side represents the core readership of Property118, individuals primarily invested in the UK housing rental business. Dan Neidle, it appears, holds a stark ideological opposition to this group.

On the other side of the diagram, we find tax planning, which some of Neidle’s supporters might perceive as synonymous with “tax dodging.”

At the nexus of the Venn diagram lies the focal market of Property118 and Cotswold Barristers: assisting with business continuity, securing legacies, and planning for retirement among UK landlords. Their expertise also extends to optimising ownership structures for efficiency.

Property118 supporters have been flabbergasted at what Dan Neidle revealed about himself in an interview with The Guardian.

It is noteworthy that Property118 and Cotswold Barristers has consistently demonstrated the legality and ethical soundness of our recommendations over the years. For those who find themselves at the heart of this Venn diagram, it could be argued that there is a moral imperative to consider booking a consultation with us. Such a consultation can explore the opportunities available for your benefit – opportunities that Dan Neidle and his followers vehemently oppose. Your family and personal interests may indeed benefit from this exploration.

It’s concerning to note that DN suggests that many of his contacts hold significant sway over HMRC policy, even contributing to the creation of the tax law books that serve as the foundation for the legal and accountancy professions. There’s a lingering question as to whether they might also exert their influence on updating HMRC manuals. The uncertainty surrounding these questions is disquieting.

Will these individuals successfully lobby HMRC to retroactively categorise our work under DOTAS, a designation that has never been applied in our case before? The potential implications are profound and warrant a watchful eye on the future developments in this arena.

Moreover, will they have the power to convince the next government to revise the regulations governing property rental business owners’ access to the reliefs that currently make incorporation into a Limited Company financially feasible? The prospect is unsettling, as it may affect numerous landlords and their long-term financial planning.

Fortunately, there is absolutely no cause for us to question the integrity and professionalism of HMRC. In contrast to our experience with Dan Neidle, HMRC has consistently proven to be a pleasure to work with. They exhibit reasonableness when it comes to setting practical deadlines for information requests, taking into consideration real-life factors like holidays and the demands of other responsibilities. Their approach has always been characterised by a remarkable level of judiciousness and professional courtesy.

On a more positive note, it’s important to recognise that government cannot turn back the clock on legislation. The clarity we’ve provided regarding the current rules ensures that landlords contemplating incorporation can now take decisive steps forward without unnecessary setbacks, before it’s too late.

Raj Chana

21:27 PM, 22nd October 2023, About 7 months ago

Reply to the comment left by Mark Alexander - Founder of Property118 at 22/10/2023 - 08:41

Mark,

The Google Cache is at the following URL:

http://webcache.googleusercontent.com/search?q=cache:https://www.taxpolicy.org.uk/2023/10/02/kc_insurance/

On the live page, I see the following comment which seems to almost match your description (about Barristers, not KC), but not posted by DN:

Richard Yates

2 October 2023

There are many fine KCs out there, and I am lucky enough to work with some of them. I always remember the advice of Rumpole of the Bailey – barristers are like taxis, you tell them where you want to go.

I will keep look

PS - Posting under a pseudonym (hope that is ok - I am a client though!)

Mark Alexander - Founder of Property118

21:30 PM, 22nd October 2023, About 7 months ago

Reply to the comment left by Raj Chana at 22/10/2023 - 21:27

Thank you

Bruce Patterson

5:17 AM, 25th October 2023, About 7 months ago

Well played Mark - truly outstanding work

Mark Alexander - Founder of Property118

10:21 AM, 25th October 2023, About 7 months ago

Further evidence of skullduggery by DN in his Tweets today. He knows that we have been warning against the abuse of Hybrid LLP's since 2018 and yet he has intentionally dragged our name through the mud yet again by inferring that we have been recommending Hybrid LLP's to landlords. He seems intent on ruining us!

The article itself makes no mention of Property118, Cotswold Barristers or the Substantial Incorporation Structure (SIS) but Dan Neidle knows that too. He wrote the article!

Blodwyn

12:22 PM, 25th October 2023, About 7 months ago

Let's get one thing clear. Tax Avoidance is laudable, a good thing, why on earth pay more than your fair share? The law is not framed by accountants, Mr Neidle or Property 118's tax whizzkids. Parliament passed it. If there is an exploitable loophole, use it! If advisors fail to point it out to a client, they are negligent? Parliamentary writers do their best with the proposed Law. Then, (some vested-interest) MPs make a mess of it? Don't forget and this is not a Party point, MPs represent a cross-section of society, from the dim to the bright and a lot of in between? Just look at both front benches?

Legal history is full of Libel cases. The sons of a former PM(?) who said someone trashing their father was a liar? He sued and the sons won the case. Equally, Oscar Wilde sued, lost and then went to jail. If you are brave enough, have deep pockets and think you are right, say nasties to your opponent. But be careful!!!

Seething Landlord

13:02 PM, 25th October 2023, About 7 months ago

Blodwyn, you said "If there is an exploitable loophole, use it!"

Perhaps you should add "but beware of GAAR".

"The GAAR provides a statutory mechanism for HM Revenue & Customs (HMRC) to counteract tax avoidance arrangements which, although within the letter of the law, are not what was intended by parliament."

Mark Alexander - Founder of Property118

13:12 PM, 25th October 2023, About 7 months ago

You are absolutely correct.

That’s why everything has to be considered within the spirit of the law too.

The various relief we have been discussing are intended to allow business owners to transition between ownership structures without being penalised by taxation.

Seething Landlord

13:44 PM, 25th October 2023, About 7 months ago

Reply to the comment left by Mark Alexander - Founder of Property118 at 25/10/2023 - 13:12

And guess who introduced GAAR - the landlords' favourite chancellor, Mr George Osborne.

Blodwyn

14:32 PM, 25th October 2023, About 7 months ago

This is so unfair, we the humble robbed punters instructed to second guess the supposedly well qualified and extremely well paid ones and always construe the option against the taxpayers' interest? "Here is the law. BTW, we've messed it up, we always do but we don't know where. You find it but we'll clobber you if you obey the law to your own advantage! Like Kafka town, we'll hit you until you tell us what you have done wrong by your obedience to the written word. You earn your corn, we don't earn ours but will have yours to make it up"

Seething Landlord

15:06 PM, 25th October 2023, About 7 months ago

It's no more unfair than George's other masterpieces, S24 and the additional 3% on sdlt.