Tag: Aldermore

Landbay cuts BTL rates, while Aldermore unveils new products

Landbay has unveiled reductions across its buy to let product range, with interest rates falling by as much as 0.25%.

The lender has...

BTL mortgages: Aldermore, TMW, Foundation and Accord anno...

Several buy to let mortgage lenders have announced interest rate reductions this week, offering better deals for BTL investors in the...

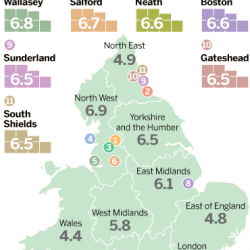

Landlords help to boost local economies

The significant financial contribution being made by landlords to regional economies when supporting local trades has been revealed.

MT Finance is the latest BTL lender to cut rates

MT Finance is the latest buy to let lender to announce a rate reduction on its 16 BTL products, effective immediately.

The specialist...

The best city for buy to let investment revealed

The best city for buy to let investors isn’t London – it’s a city that has robust property prices and strong rental...

News Flash – 80% LTV available on New Build Flats!!

Ever since the Credit Crunch it has been very hard to finance new build flats on Buy to Let mortgages with lenders criteria either...

Buy to Let Mortgage products and market update – es...

Having just updated the Buy to Let mortgage products on our own in house Buy to Let Mortgage sourcing system and calculator I thought...