15:53 PM, 16th October 2023, About 7 months ago 32

Text Size

Dear Mr Neidle

As you have refused to speak to me on a recorded Zoom call on two separate occasions I am publishing this open letter in the hope of appealing to your better nature.

Before I emigrated to Malta in 2016 I lived in Norfolk for 30 years, just down the road from where you live now. My family still do.

Like you, I was a workaholic. I couldn’t switch off. It cost me my first marriage, but that’s another story, I am now happily re-married.

Whilst living in Norfolk and working night and day I was a commercial finance broker. I was also one of the founders of the NACFB (National Association of Commercial Finance Brokers). All the work I did for the NACFB was pro-bono.

After many years of hard graft, I could afford the big house and the nice cars. I probably didn’t have as much money as you do but I was very proud to be employing 300 people. In 2008 my company ranked at number 38 in The Sunday Times Profit Track 100. However, as a result of a loss of credibility, not of my making, I had to lay off all 300 staff and put my company into hibernation, a state the company remains in to this day. You can read about what happened by clicking on the linked snippet from the Mortgage Strategy magazine article at the time, or in the articles linked below.

I became very depressed following the collapse of The Money Centre and my failed marriage. I missed the daily interaction with people who shared my values and passion for property investment. Close friends and family suggested that I start a blog to “facilitate the sharing of best practice in the UK Private Renting Sector”, so that’s what I did. You’re reading it now and it has become a reasonably successful business in its own right over time. However, it wasn’t always like that. There have been many times since the collapse of The Money Centre that I have struggled to make ends meet. Thankfully, low interest rates provided cashflow within my property portfolio at a time I needed it most, and I was able to scrape together extra money by taking on short-term consultancy contracts to help solicitors and accountancy firms with their marketing.

A further knock-back occurred three years after starting my blog when the West Bromwich Mortgage Company sent me a letter regarding a lifetime tracker rate mortgage I had taken to purchase one of my Buy-To-Let properties. They had unilaterally decided to increase the margin they were charging over Bank Base Rate by 2%, which I knew they could not do. They also issued a veiled threat to call in mortgages within 30 days, a clause they had embedded deeply within their T&C’s. I was having none of that, so I used my blog to reach hundreds of landlords in a similar position. We first took the case to the Ombudsman, who messed us around before saying we had no case. I then took the case to the High Court who also ruled against us. Finally, after a further two and a half years of yet more pro-bono work the Court of Appeal upheld the case. You can read more about this via the link below.

https://goughsq.co.uk/ca-hands-decision-pag-118-v-west-bromwich/

I would also like to add that we received no support whatsoever from the industry. I was besmirched and laughed at by many in the industry, including the NRLA, for taking on the case. But that all changed after it was won. Property118 had become the landlords champion and I won a Lifetime Achievers Award.

Very shortly after that, George Osborne announced new rules in his Summer 2015 budget making privately owned rental property business owners the only form of UK business that would no longer be able to offset finance costs against their income. It was a travesty, but despite significant campaigning, it was clear the government was not going to back down. This affected me personally and hundreds of thousands of subscribers to my blog. When I realised that campaigning was yielding no results I went back to the Barristers that had taken on and defeated the West Brom. They came up with several solutions, one of which was incorporation, but that only applied to professional landlords with much larger property rental businesses. However, there were solutions for smaller landlords too, for example, amending beneficial ownership between spouses to fully utilise tax allowances and the lower tax bands. The business model is essentially that Property118 takes on the role of fact finding, introducing and liaising with barristers who then engage clients directly to give the advice and deal with implementation.

It went well for a while, but in 2016 our recommended approach to incorporation, without needing to refinance (all in accordance with HMRC manuals I might add), was attacked via The Telegraph Newspaper. Your friends from Blick Rothenberg put the boot in then in much the same way as they are again doing with you now. Their allegations in 2016 are no different to those in your recent articles. How are we still in business then one might well ask. Why haven’t mortgage lenders called in all those supposedly defaulted mortgages? Why haven’t HMRC engaged DOTAS or created a Spotlight? The answer is obvious to most, everything is being done right.

The attacks we endured in 2016 caused massive stress and loss of credibility for our business, but we pulled through. For me, the timing could not have been worse. I had just relocated to Malta, so again I had to take on short-term contract work to put food on the table.

I explained in my last article that your attacks transcend tax policy. They have since become even more personal and increasingly deranged.

My solicitors have informed me that you wrote to them last week suggesting that I might have been a stakeholder in a business that sold timeshare as investments to low-income people. That is simply absurd. Who is feeding you this information and what does it have to do with tax policy? The only possible connection is that I did take a short-term contract with a company in 2016 when I first arrived in Malta that sold memberships in a luxury car club and Sunseeker yachts to discerning high-net-worth individuals. I advertised them on Property118 for a while, but landlords’ didn’t seem at all interested. Most are all generally very well-grounded folk who prefer to forsake luxuries and invest for retirement and to create legacies. I did manage to find the company premises in Donnington Park race circuit for their SuperCar club through an article I wrote on Property118 though, so they did get some value for their money out of me at least. I suspect they wanted to leverage my credibility with landlords in the belief that my audience would be their target market, the top 5% of earners. How wrong they were if that was the case!

FOR THE RECORD: I have never owned a stake in a timeshare business, nor I have I ever sold timeshare or recruited or trained a timeshare sales force, let alone promoted timeshare as investments. Nor have I ever been involved in timeshare financing in any way. I refuse to spend yet more money on solicitors to defend these ludicrous accusations. Go ahead and write whatever you wish, if you must, I have faith that people will soon see it for what it is. When on earth do you think I would have found the time to do any of that anyway?

You have mentioned in all of your articles that we have not answered any of your tax questions. The reasons for this are simple; a) you are not a regulator, b) your approaches have always been extremely antagonistic, c) you expect us to do so for free and d) you seem intent on twisting information to suit your own narrative. At first I thought you were just barking up the wrong tree, but now I am beginning to think there could be something much more sinister going on.

Maybe I am becoming irrational and barking up the wrong tree now. That can happen when people wind you up enough. Who’s been pulling your strings?

Have you even taken a moment to consider the anxiety your articles have caused to the hundreds of business owners that have incorporated off the back of our recommendations and also the welfare of their families? Some of these might even be feeling suicidal after reading the things you have written. Is your conscience OK with that? What about the 40 people we employ?

I have two questions for you: –

Will you PLEASE agree to be reasonable and at least have a telephone conversation with me before this all gets completely out of hand?

Perhaps better still, I will be in Norfolk for a fortnight as of this weekend to visit family. Maybe you would prefer to discuss this over a pint? I’m really not the monster you think I am.

Yours sincerely

Mark Alexander

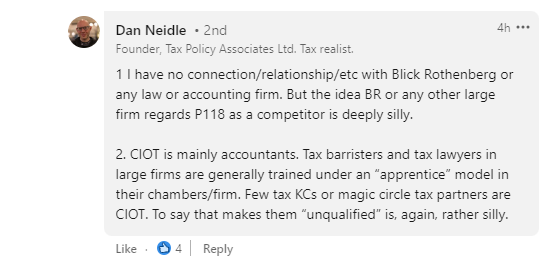

Dan Neidle has since responded to my two questions as follows …

…

…

Previous Article

Homelessness spending hits record highNext Article

Tenants finding rent payments harder to afford - ONS

Susan Bradley

14:25 PM, 17th October 2023, About 7 months ago

I would agree with you if this was happening at the local golf or bridge club as in it is all rather unpleasant and distasteful . I am sure we all know people that we would rather not spend time with unless we really must, but this is commercially damaging.

There are consequences to ignoring this sort of discredit which unfortunately are not limited to Mark and Property118. It has caused immense stress for past clients and it will likely dissuade those considering incorporation with them to reconsider. However, it is NOT incorporation that landlords are being warned about. No, no it is a sensible solution for some. It is Mark and Property118 that people are being made wary of.

It is a perfect example of an ad hominem attack.

1. Short for argumentum ad hominem: A fallacious objection to an argument or factual claim by appealing to a characteristic or belief of the person making the argument or claim, rather than by addressing the substance of the argu-ment or producing evidence against the claim; an attempt to argue against an opponent's idea by discrediting the opponent themself.

I am saddened to see professionals using such tactics. A better approach might have been to say that The Property118 methods had been brought to their attention and that they had referred the matter to HMRC. They would report back if/when there was anything more to say.

We shall all have to wait and see if HMRC issue a stop notice after it has been brought to their attention.

Susan Bradley

14:40 PM, 17th October 2023, About 7 months ago

That last comment was in reply to Zen but I obviously forgot to click on "reply".

Mark Alexander - Founder of Property118

14:44 PM, 17th October 2023, About 7 months ago

Reply to the comment left by Susan Bradley at 17/10/2023 - 14:25

Spot on yet again.

Another good word to describe what is going on here is SOPHISTRY.

"the clever use of arguments that seem true but are really false, in order to deceive people"

See https://dictionary.cambridge.org/dictionary/english/sophistry

Sarah83

15:25 PM, 17th October 2023, About 7 months ago

Can you not go directly to HMRC and ask them for their final word on this, or does tax not work like that? Surely it would be relatively straight forward for them to clear this up?

Honest landlord

15:28 PM, 17th October 2023, About 7 months ago

https://www.linkedin.com/posts/david-conlan-799b456_it-has-happened-as-i-have-predicted-activity-7119980451665952768-NdUs?utm_source=share&utm_medium=member_ios

This is not good. Looks like the crusader DN caused problems for all incorporated businesses. An unintended consequence of a bit of fame going into someone’s head

Blodwyn

15:42 PM, 17th October 2023, About 7 months ago

I suggest that 24 years at Clifford Chance including 12 as a tax partner is a sufficient qualification for this thread of conversation?

Whatever qualifications we may possess is a matter of fact. How useful a matter of degree.

Move forward?

Bickering is time wasted?

Mark Alexander - Founder of Property118

16:15 PM, 17th October 2023, About 7 months ago

Reply to the comment left by Sarah83 at 17/10/2023 - 15:25

I wish it was as simple as going to HMRC and asking them to solve the argument. Sadly though it isn't. HMRC cannot be seen to approve or promote anything beyond what they say in their own manuals relating to legislation.

Investigations are particular to each tax-payer, so the fact that 22 HMRC investigations into our clients have been closed is relatively meaningless wiithout being able to show the world the full details of that case. No client would ever agree to their personal financial affairs being shared in that manner. For example, would you share your bank statements, mortgage statement, tenancy agreements, mortgage documents, tax returns etc. for the whole World to see?

Hopefully this response will help you to understand the position we find ourselves in.

If Dan Neidle had not have been so egotistical as to appoint himself as judge, jury and executioner we would not be in the position we are now where so many people are be worried unnecessarily. If could have simply reported his concerns to HMRC and the BSB and left them to do their job. Instead, his actions and unfounded allegations are causing misery and confusion for our entire industry.

Susan Bradley

18:59 PM, 17th October 2023, About 7 months ago

Reply to the comment left by Sarah83 at 17/10/2023 - 15:25

No it does not work like that. It would be wonderful if you could say "these are my circumstances, can I do this?" and have them come back with a yes that is fine or no you can't.

If you have full time employment elsewhere you will not likely be able to claim that you are running a business for example. It is the business side of things that make Capital Gains Tax relief a possibility and that might alter whether it is worth incorporating. Every case has to be looked at to see what is achievable. The right thing might be to stay as you are or sell.

I am not concerned with mortgages because I don't have any but because lots of people do I have asked Dan Neidle the following on on his website: "I am not on Linkedin but somebody sent me a link to an article written by someone I think you might approve of and in it it says “…….We have been involved with a significant, mainstream, property lender whose legal department advised us that they were happy with the proposed terms of a deed of trust not requiring a re-mortgage at incorporation……”

So while it might be uncommon would I be right it thinking that it is not illegal?

The chap that wrote it is David Conlan and it is on Linkedin called “Property Letting Business – Transfer to Limited Company – There is no “Master Template”. “Bespoke, bespoke, bespoke”

It is dated yesterday."

He usually answers questions unless another question is almost the same and he would be repeating himself.

Honest landlord

19:13 PM, 17th October 2023, About 7 months ago

Reply to the comment left by Susan Bradley at 17/10/2023 - 18:59

https://www.linkedin.com/pulse/property-letting-business-transfer-limited-company-master-conlan?utm_source=share&utm_medium=member_ios&utm_campaign=share_via

Good post indeed, a pragmatic and sensible approach

Zen

23:04 PM, 17th October 2023, About 7 months ago

Reply to the comment left by Susan Bradley at 17/10/2023 - 14:25

Thanks Susan, I don't claim to know anything about this complex subject but I do know that you should try not to engage with disreputable critics.

Never wrestle with a pig. You both get filthy and the pigs enjoys it.