10:45 AM, 14th December 2017, About 7 years ago 1

Text Size

Portico London estate agents recently put on a sell-out investment seminar, where a host of industry experts gathered to share their insight on some hot property topics.

One of the first experts to speak was Carla Sateriale, Senior Policy Advisor for UK Finance. Carla and her team represent the first charge mortgage market, and as part of that, they’ve maintained a good dialogue with the Bank of England.

Consequently, Carla was able to share some extremely interesting insight into the latest lending changes for landlords, including:

Here’s what she had to say:

Why Is The PRA Targeting Buy-to-let Landlords?

We’ve already seen that the Treasury isn’t shy about introducing tax changes that specifically target landlords. But why did the PRA in further rules? Isn’t the central bank supposed to be apolitical? As an arm of the Bank, shouldn’t the PRA also be independent?

Carla took us back to 2015, when the PRA started to conduct an internal review of the buy-to-let mortgage sector. What they did was examine the growth plans of 31 lenders, which made up 90% of the market. They looked at the medium-term plans of these lenders for expanding their net lending, and the underwriting criteria that was needed to do that.

At the time, it was common underwriting practice for a loan to have a 125% interest cover ratio, under a 5% interest rate.

Carla explained that by extrapolating the growth plans of the market as a whole, the PRA concluded that there was a significant risk that lenders would have to relax their underwriting standards in order to hit their growth plans.

This prompted the micro-prudential intervention that we saw introduced in last year. Before we needed to ask, Carla explained that a “micro-prudential intervention” means that the rules are about ensuring mortgage lenders can withstand economic shocks.

She said: “It has nothing to do with protecting borrowers, or fairness in the housing market—it’s about ensuring that the debt banks are issuing is robust.

Now, the obvious follow on question is—was there data to justify this intervention? Here I’m going to give you some background on the market context.”

Buy-To-Let Vs Residential Loans

If you’ve been in the market for buy-to-let mortgages in the past several years, no doubt you’ve noticed that there is substantially more choice in both products and lenders now than there was a few years ago.

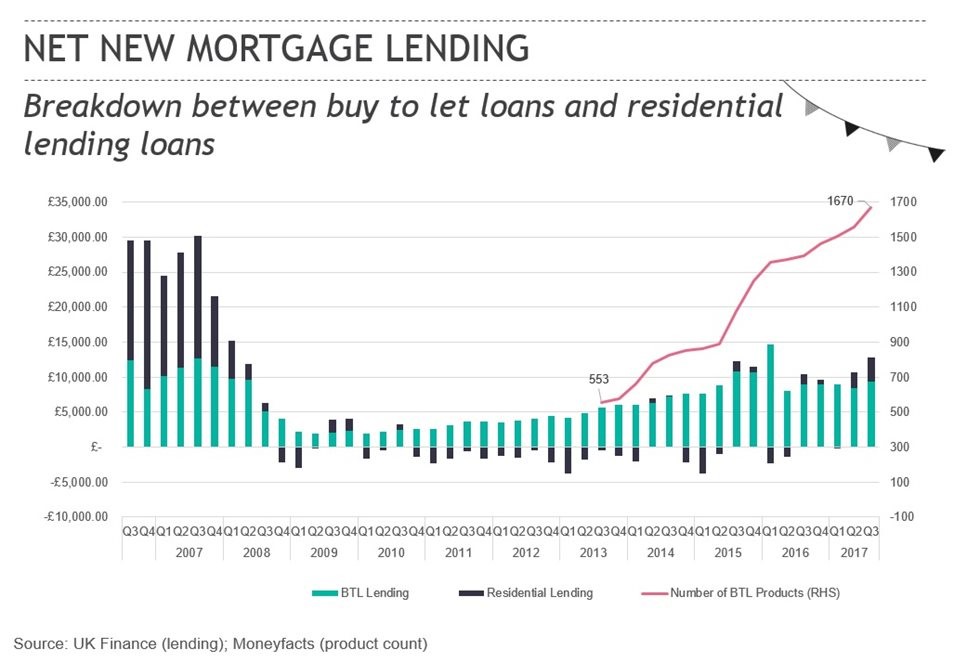

The graph below shows the breakdown between buy-to-let loans and residential lending loans, using data from the company, Moneyfacts. The pink line in the chart above shows the number of buy-to-let products, plotted on the right-axis. Although the data only starts in 2013, you can see pretty clearly that the number of products available has grown massively recently—and Carla explained that this growth reflects the importance of the property investor in helping to drive net mortgage lending.

What you might not be aware of however, is that, for mortgage lenders, buy-to-let played an ever more important role over the past few years. The height of the bars in the chart shows net lending each quarter over the past decade. The bright blue portion shows how much was due to buy-to-let lending, while the indigo portion shows how much was due to residential lending.

What you might not be aware of however, is that, for mortgage lenders, buy-to-let played an ever more important role over the past few years. The height of the bars in the chart shows net lending each quarter over the past decade. The bright blue portion shows how much was due to buy-to-let lending, while the indigo portion shows how much was due to residential lending.

Now, you can see in the quarters before the financial crisis, net new lending was driven mostly by residential lending. But since then, residential mortgage lending has only made a tiny contribution to net lending—and in many quarters, making a negative contribution.

So from a mortgage lenders’ point of view, buy-to-let has been absolutely crucial for growth. However, this also illustrates the PRA’s concern.

So, this, in a nutshell, is what’s concerning the PRA.

Why Are Portfolio Landlords Being Singled Out?

The bigger question for most of you is, why are portfolio landlords, with four or more mortgaged properties, being singled out in these new rules? And why was four chosen as the threshold and not, say, ten properties?

Carla explained that essentially, “the reasoning behind the portfolio landlord rule is the perception that the more heavily encumbered a portfolio is, the more financially precarious it becomes, and therefore, more likely to fall into arrears.”

This intuitively seems sensible, but we haven’t actually seen data that landlords with larger portfolios are more affected by arrears problems than landlords with fewer properties.

However, there might be reason for the PRA to be concerned with the pace at which investors have grown their portfolios, and how that may square with- lenders’ risk appetite.

Looking at survey research, Carla pointed out that between 2010 and 2016, the proportion of single property landlords has fallen from about 80% to about 60%. Meanwhile, the proportion of landlords with two-to-four properties had gone up by the same amount. So we can take a guess and say that there are a number of landlords who owned a single investment property just a few years ago, and have collected a few more fairly quickly.

She went on to explain that the PRA may be concerned about this because it’s unlikely that you would get all of your mortgage financing from a single lender. The market for buy-to-let financing has quickly become very competitive; and while you may have fit a particular lender’s risk appetite when you originally take out a loan, if you’ve expanded and re-leveraged your portfolio in the interim period, your original lender might view your current risk profile a bit differently. And that’s particularly true if you only have a short history of letting property, or if you find yourself in a higher tax bracket as a result of the recent landlord tax changes.

So, while the new rules will undoubtedly complicate the application and underwriting process for many lenders, it will also provide some assurance to the PRA that they will all be making underwriting decisions with the same information.

Examining a YouGov survey conducted around this time last year, Carla pointed out that about 1 out of 4 buy-to-let landlords would be classed as “portfolio landlords”—which means you’ll have to go through a longer underwriting process that takes a look at your entire property business as a whole.

Carla explained that you can therefore expect to experience a longer application process to pay slightly higher interest rates if you’re a portfolio landlord, and you may have a narrower range of potential lenders.

She went on to say, “A lot of borrowers have reported that the refinancing process has become more difficult recently, and some are worried about being BTL mortgage prisoners. In theory, there shouldn’t be a problem of mortgage prisoners. The PRA guidance has an explicit carve out to exempt pound for pound remortgaging from the stricter rules. Nonetheless, if you’ve expanded your portfolio since the last time you re-financed, lenders may still be interested in applying the wider assessment, even if it’s not a requirement.”

Carla ended her speech by stating that about one in five landlords are thinking about selling all or part of their portfolio—which is a relatively new market development, potentially fuelled by market conditions and the latest PRA changes.

While it’s certainly true that the buy-to-let market is changing, property is still a great, long-term investment, especially compared with other asset classes. Currently we may be in a dip, but, it’s completely natural for the market to have its ups and downs, and we do expect the market to smooth out. After all, the population is rapidly growing, demand for housing in London is stronger than ever, and yet we’re suffering from an acute housing shortage. Until the lack of housing is addressed, rental prices and property prices will remain high.

UK Finance represents nearly 300 of the leading firms providing finance, banking, markets and payments-related services in or from the UK. UK Finance has been created by combining most of the activities of the Asset Based Finance Association, the British Bankers’ Association, the Council of Mortgage Lenders, Financial Fraud Action UK, Payments UK and the UK Cards Association.

Our members are large and small, national and regional, domestic and international, corporate and mutual, retail and wholesale, physical and virtual, banks and non-banks. Our members’ customers are individuals, corporates, charities, clubs, associations and government bodies, served domestically and cross-border. These customers access a wide range of financial and advisory products and services, essential to their day-to-day activities. The interests of our members’ customers are at the heart of our work.

Previous Article

Restrict Non Residents' UK Property Purchases?Next Article

Unanimous MPC vote to keep Bank rate at 0.5%

Gary Dully

Become a Member

If you login or become a member you can view this members profile, comments, posts and send them messages!

Sign Up2:32 AM, 16th December 2017, About 7 years ago

The bottom line impression that I am getting is that potential new landlords are put off, existing BTL Landlords are soon going to be dragged into quitting by HMRC with Section 24, Landlords with large portfolios are trying to finance outside of regulation by using business angels and crowd funding, together with moving out of residential rental and more into change of use, Serviced Accommodation and property development.

Well done you political dumbos, you really are a bunch of morons.

The creative landlords are going where the profits are and that isn’t going to be residential lettings if you legislate it to death.