9:31 AM, 6th April 2023, About A year ago 1

Text Size

The UK’s average house price grew by 0.8% in March, the second month running that prices have picked up after February’s 1.2% rise, Halifax says.

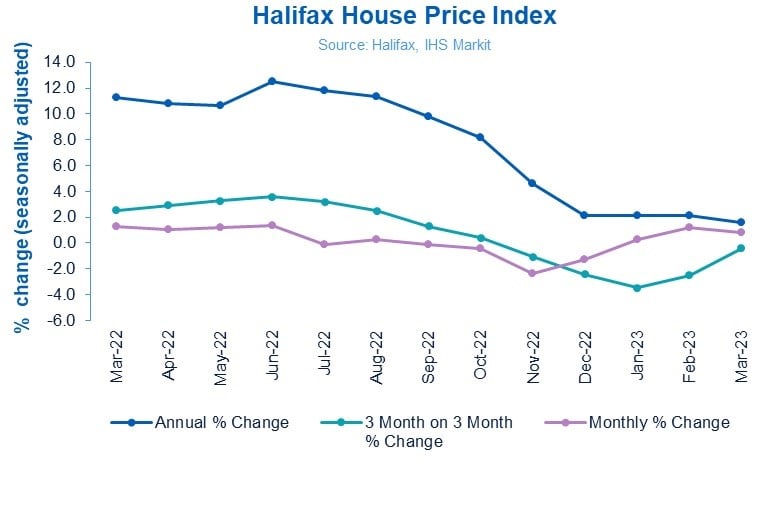

However, the lender says that the annual rate of house price growth continues to slow and was 1.6% in the year to March.

In February the year-on-year rise was 2.1%.

Halifax says that the average property now costs £287,880, up from February’s figure of £285,660.

Kim Kinnaird, the director of Halifax Mortgages, said: “The UK housing market continues to show resilience following the sharp downturn at the end of 2022, with average property prices rising again in March.

“On an annual basis, house prices were 1.6% higher than a year ago – this is the weakest rate of annual growth in nearly three-and-a-half years (October 2019), having fallen markedly since June 2022’s peak of +12.5%.”

She added: “However, overall, these latest figures continue to suggest relative stability in the housing market at the start of 2023 and align with many other recent industry surveys and data.

“The principal factor behind this improved picture has been an easing of mortgage rates.

“The sudden spike in borrowing costs that we saw in November and December has now been largely reversed, and while rates remain much higher than the average of the last decade, across the industry a typical five-year fixed rate deal (75% LTV) is down by more than 100 basis points over the last few months.

“It’s also important to recognise that the labour market, a key indicator for house prices, remains strong, with unemployment at a historical low of 3.7%, and pay growth continues to look robust.”

James Forrester, the managing director of Barrows and Forrester, said: “It’s high time that those spouting prophecies of a property market crash and a 40% reduction in house prices are held accountable.

“Not only has the market weathered the storm of higher borrowing costs and the cost-of-living crisis, but house prices have already started to rebound following just a few short months of marginal decline.”

Marc von Grundherr, a director of Benham and Reeves, said: “Those of us on the ground have seen a sustained level of market activity since the start of the year and it was only a matter of time before this initial interest started to restimulate the market, reversing the reduction in house prices seen during the latter stages of last year.

“Homebuyers may not be moving with the same gusto seen during the pandemic boom, but stability has returned, and the boat has well and truly steadied.”

Sarah Coles, the head of personal finance at Hargreaves Lansdown, said: “The spring bump has brought a second month of rising house prices, and a whiff of optimism to the housing market.

“Annual price rises at their lowest in three and a half years will keep a lid on enthusiasm, and sticky inflation could prove its undoing, but there’s an air of hope that the correction may not be as painful as had been feared.”

She added: “The swift downturn at the end of last year has slowed into something far less terrifying, and Halifax highlighted some positive signs – notably the fact that mortgage rates have continued to trend downwards, housing transactions have picked up slightly, and the employment market remains robust.

“It’s worth noting that the inflation figures and subsequent rate rise have halted the gradual fall of rates, and according to Moneyfacts, the average five-year rate is back up above 5% again.

“However, these aren’t sudden or horrifying moves, and at the moment this is expected to be a temporary reversal. Assuming inflation retreats as expected, we’re likely to see them resume their shuffle south.”

Previous Article

Ever thought about becoming a Deal Sourcer?

steve watt

Become a Member

If you login or become a member you can view this members profile, comments, posts and send them messages!

Sign Up9:06 AM, 8th April 2023, About A year ago

Nationwide March report shows negative 3.1% annual price decline however.

With inflation at 10% any nominal increase below 10% is, by definition, negative real growth.