Tag: House prices

UK house prices rise as top-end market booms

Asking prices for new properties are on the rise, with the average price reaching near-record highs, according to Rightmove.

This...

UK rents reach the highest level on record – ONS

Renting costs in the UK continue to grow with average rents jumping by 9.2% in the year to March – the steepest annual rise since...

Housing market shows signs of slow recovery

There are signs of a slow recovery in the UK’s housing market with the average house price in England and Wales increasing by...

UK housing market shows signs of improvement

There has been a positive shift in the housing market with buyer demand and expectations for future sales on the rise, one survey has...

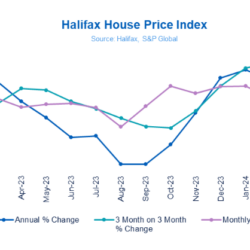

UK house price growth slows after five months of rises

UK house prices continued to rise year-on-year in March, although the pace of growth slowed compared to the previous month, Halifax...

UK house prices edge up despite monthly seasonal dip R...

The UK’s house prices rose by 1.6% in March compared to the same period last year, following a 1.2% growth in February, according...

UK housing market gets early sales boost

The UK’s housing market has shown positive signs in the first quarter of 2024 with sales activity up 9% compared to the same...