9:57 AM, 9th May 2023, About A year ago

Text Size

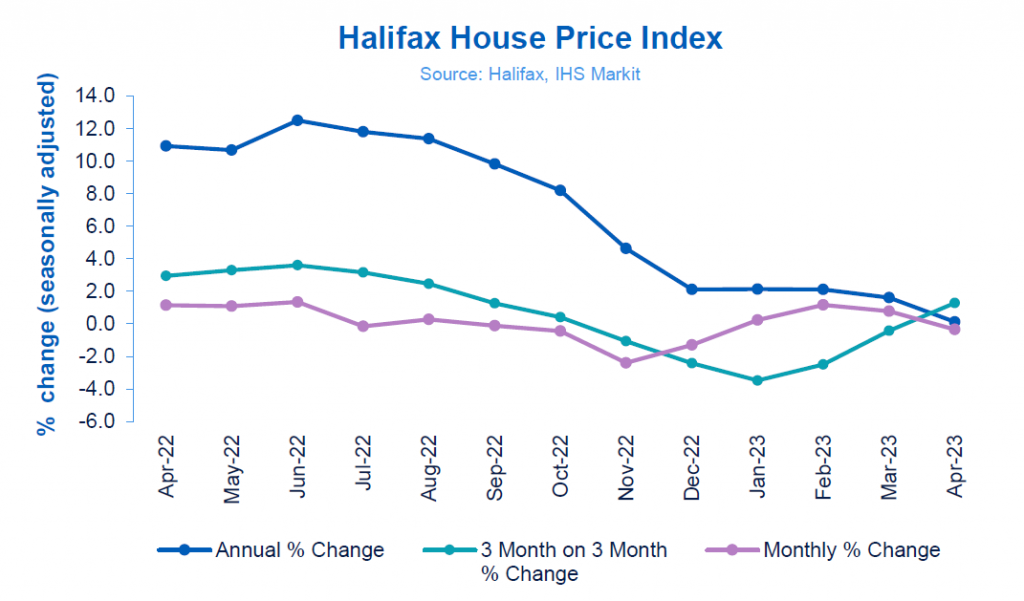

After a strong performance in March, the UK’s annual house price growth was just 0.1% in April, Halifax reports.

Its house price index highlights that three months of growing prices have come to an end after March’s 1.6% rise. Prices dipped by 0.3% between March and April.

The lender says that in April, the UK’s average house price was down by £1,000 to £286,896.

And that is £7,000 lower than the peak recorded last summer.

Kim Kinnaird, the director of Halifax Mortgages, said: “House price movements over recent months have largely mirrored the short-term volatility seen in borrowing costs.

“The sharp fall in prices we saw at the end of last year after September’s mini-Budget preceded something of a rebound in the first quarter of this year as economic conditions improved.”

She added: “The economy has proven to be resilient, with a robust labour market and consumer price inflation predicted to decelerate sharply in the coming months.

“Mortgage rates are now stabilising, and though they remain well above the average of recent years, this gives important certainty to would-be buyers.”

Sarah Coles, the head of personal finance at Hargreaves Lansdown, said: “The Halifax figures pour cold water on the growing fires of optimism that had been lit across the property market in recent weeks.

“After clinging onto dwindling annual growth for a few months, the figures are now at a tipping point.

“The spring has produced a wave of positive announcements – from mortgage approvals rising for a second consecutive month, to Nationwide’s 0.5% bump in April, and Zoopla’s claim that demand has hit a high for 2023.”

She added: “The RICS residential market survey for March still painted a picture of falling demand, dwindling sales and lower house prices, but there was hope that this could all turn around in April.”

Iain McKenzie, the CEO of The Guild of Property Professionals, said: “House prices are in a state of flux across the country, with the picture changing from month to month.

“Clearly we are seeing a slowdown in house price growth, but it is more modest than initially expected.”

He adds: “Sales are holding steady for the time being and many estate agents are now able to offer more choice after spending the winter trying to replenish their stock.

“Living costs are still sky high and while this may be especially challenging for first-time buyers, the demand for good quality housing is unwavering and this is propping up prices in parts of the country.”

Tomer Aboody, a director of property lender MT Finance, said: “Transaction numbers have improved as prices have slightly dipped, suggesting more confidence from buyers, while sellers are either pricing more realistically or accepting lower offers.

“With mortgage rates still volatile, although nothing like what they were in the aftermath of the mini-Budget, buyers are cautious before committing.”

Rich Horner, MetLife’s head of individual protection, said: “UK house prices fall as recent interest rate hikes continue to cause sellers to sit tight and await more stability across the market.

“However, there may be opportunities for buyers in the short-term given mortgage rates are now steadily returning to pre-mini-Budget levels and house price growth is slowing.”

Previous Article

Section 21 - essential documents?Next Article

Skipton unveils deposit-free mortgage for renters