Tag: Nationwide Building Society

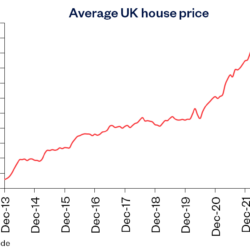

House prices down 1.8% over 2023

The last Nationwide House Price index for 2023 shows a fall in the market of 1.8% over the last year with the average Uk house price...

UK house prices see the biggest fall since 2009

The UK’s housing market saw prices dip at their fastest annual decline in 14 years, Nationwide reports.

The data reveals an annual...

House prices slip again – interest rates to remain ...

House prices have fallen by 3.4% in the year to May – which is a bigger decline than the drop of 2.7% seen the month before,

Remember our background is in BuytoLet and Commercial fin...

Mark, Mike and I met through the common background of BuytoLet and Commercial Finance. Over the years through The Money Centre and...

Private Rented Sector Review – Conclusions and reco...

The Private Rented Sector Review conclusions and recommendations published by the Communities and Local Government Committee:

Simplifying...

Consent to let dilemma

Can you help me with my “Consent To Let” dilemma please?

I own a small property portfolio, 4 buy to let property, one property...

Major buy to let lender shuns benefits tenants

Mortgage Brokers across the UK have been advised by Nationwide Building Society’s specialist buy to let mortgage arm (The Mortgage...