Tag: cml

Age discrimination from buy to let mortgage lenders?

Last year I was in the process of identifying a good interest only re-mortgage – nothing out of the ordinary – just over...

CML reports 26% growth in Mortgage Lending

The Council of Mortgage Lenders CML reports that total gross mortgage lending increased to £15 billion in June, which is 2% more...

Oven Cleaning is one of the biggest issues in a rented pr...

Oven cleaning is one of the biggest issues and this article is to help Landlords present this particular item in their property in...

The 2013 Budget and how it affects Landlords and property...

The 2013 Budget is hoped to boost the housing market and construction industry. Yesterday Chancellor George Osborne announced new plans...

Landlords investing more according to new data from ARLA

The latest market data from the Association of Residential Lettings Agents (ARLA) has revealed an upward trend in landlord investment...

You can remortage within six months!

It is possible to remortage within six months of purchase, even on a buy to let property, I promise you! Forget everything you...

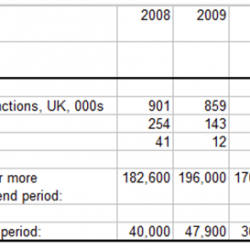

Tenants in severe arrears tops 100,000

The number of tenants in severe arrears has risen to a massive 100,400 as rents continue to rise while the economy and jobs falter.