8:05 AM, 2nd December 2022, About 2 years ago 3

Text Size

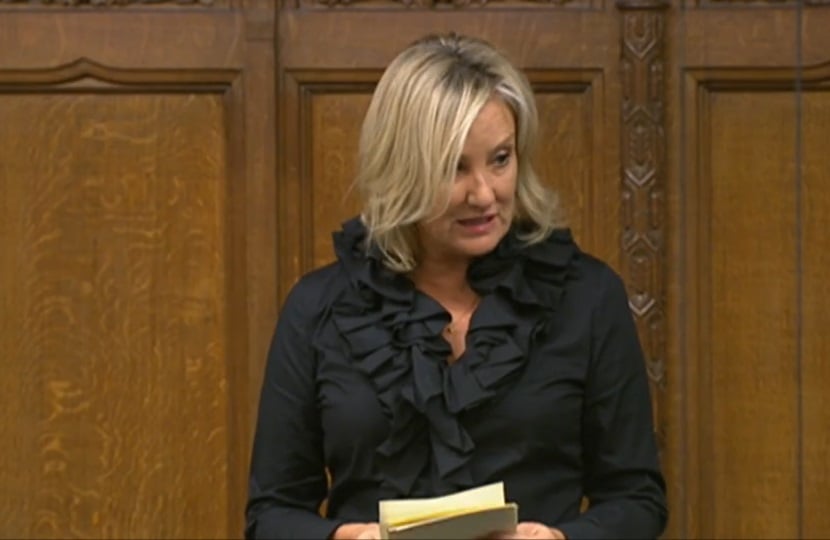

A bid by the Valuation Office Agency (VOA) to re-band individual HMO rooms for council tax purposes looks set to end after an amendment to a Bill by Conservative MP, Caroline Dinenage.

She was compelled to act over growing instances of councils handing individual tenants living in an HMO a council tax bill.

Usually, a landlord is liable for paying the council tax on the dwelling, but a trend has appeared for the VOA to reband the HMO’s bedrooms as individual dwellings.

Ms Dinenage has spent the last two years campaigning over the issue with fellow MP Penny Mordaunt and Portsmouth businessman Daryn Brewer who is converting properties in Gosport High Street into shared living spaces.

She tabled an amendment to the Levelling-up and Regeneration Bill and the concession was secured after a debate.

Caroline told MPs in the debate: “There is a huge financial strain on people, often young professionals, at the very start of their careers, suddenly landed with a council tax bill of up to £1,000, even once they’ve allocated the single person discount.

“Shared housing is a core pillar of the housing sector. In 2018, HMOs provided 3 million sharers with rental accommodation across England and Wales.

“So, this has the potential to become a major problem.”

She added: “Council tax is a property tax, it is not a head tax, and it should not be down to individuals who are simply paying for a bedroom to foot this bill.”

As a result of Caroline’s amendment, the Secretary of State for Levelling Up, Michael Gove, has written to confirm that an accelerated consultation will now investigate how the Valuation Office Agency apply council tax bands, especially to HMOs.

The move would see HMOs not being ‘disaggregated’ which is when the HMO is separated into individual rooms and will remain as a single dwelling that attracts one council tax bill.

Paying this bill would remain the landlord’s responsibility without tenants having to worry how they will pay it.

One of the issues raised by campaigners is that councils believe they would earn more council tax but, in reality, many tenants would not or could not pay the bill which would lead to more council administration making them pay – and campaigners say it is better that the landlord pays.

In his letter, Mr Gove said: “You have very clearly set out concerns that the approach taken to the council tax banding of some properties could act as a deterrent to entering the HMO market, as well as causing financial hardship for tenants.

“In light of those points, I will consult on the way that HMOs are valued for council tax.

“This will allow us to ensure that HMOs are valued as a single dwelling, unless exceptional circumstances apply.”

More information

You can watch Caroline’s appearance in the debate here (She appears at 16:04:50):

More information is available on the HMO Council Tax Reform Group.

Previous Article

Tenants prepared to pay more for energy efficient homesNext Article

Labour supports 'Right to buy' - but not in Wales

DAMIEN RAFFERTY

Become a Member

If you login or become a member you can view this members profile, comments, posts and send them messages!

Sign Up11:39 AM, 2nd December 2022, About 2 years ago

Wow the Government actually seeing sense and not trying to Tax people to death.

How can a bedroom with maybe a small ensuite be classed as a separate dwelling and attract Council Tax Band A of £1200/£14000 a year.

One can only hope this is implemented and the VOA can chase non Council Tax payers

Sam B

Become a Member

If you login or become a member you can view this members profile, comments, posts and send them messages!

Sign Up18:34 PM, 2nd December 2022, About 2 years ago

Reply to the comment left by DAMIEN RAFFERTY at 02/12/2022 - 11:39

Given this bonzers banding has gone on for some years now and they did nothing I am skeptical. I hope I am wrong but I fear the exceptional circumstances will be far from that. But if not all credit to Gove for this.

pbez64 pbez64

Become a Member

If you login or become a member you can view this members profile, comments, posts and send them messages!

Sign Up9:54 AM, 3rd December 2022, About 2 years ago

Anyone who administers Council tax will welcome this. Getting a report from VOA about another change to the Valuation List splitting a former sole entry into multiple units only causes more work and frustration especially when it is late. When they were functioning normally it wasnt great but on their current performance levels its even worse. Having to issue bills to people who may have already left the dwelling or who have agreements stating rent includes Council Tax doesn't exactly help the situation either. Will stop the inconsistencies as well where an owner might have two properties in same area both being operated as himo's but due to the VOA one of them is a single entry and charged as a himo whereas his other property is split into individual rooms and charged accordingly.