14:01 PM, 6th March 2024, About 2 months ago 6

Text Size

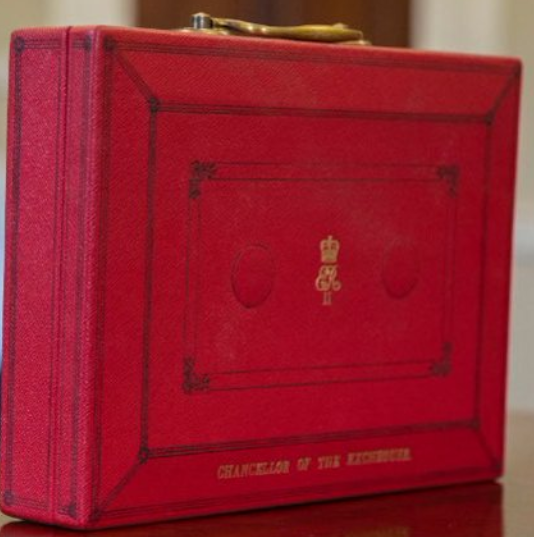

Industry leaders in the property and finance sector have reacted to the Chancellor’s Spring Budget.

The Spring Budget is seen as the last chance to woo voters before the upcoming General Election this year.

Announcements included a crackdown on holiday lets, more housing for first-time buyers and abolishing stamp duty relief for people buying more than one dwelling.

Ben Beadle, chief executive of the National Residential Landlords Association, said the budget failed to tackle the housing crisis: “The Chancellor has once again ignored calls to revitalise long-term investment in quality rented homes in favour of tinkering at the margins for short-term gain.

“Increasing taxes on holiday lets and cuts to Capital Gains Tax will make no meaningful difference to the supply of long-term rental properties. Meanwhile, those reliant on housing benefits still do not know if their benefits will be frozen from next year or not.

“With an average of 11 tenants chasing every home for private rent, social housing waiting lists at 1.3 million, almost 110,000 households in temporary accommodation and the number of first-time buyers slumping, the Budget needed to tackle the housing crisis once and for all. What we got was a deafening silence.

“This was a missed opportunity to make providing new homes to rent and buy the priority it desperately needs to be.”

Rodney Townson, from iHowz, said :“A budget almost exclusively of stick, rather than carrot for landlords.

“Those who have properties in their own name who had pivoted part of their portfolio to serviced accommodation / furnished holiday lets to counter S24 will be penalised from this April for running their businesses efficiently – something the chancellor is spending billions in the public sector to achieve.

“The SDLT relief on multiple property purchase transactions has been removed, making it harder for landlords to sell a portfolio as a going concern.

“The encouragement landlords got was to head for the exit with the top rate of CGT on residential property dropping from 28% to 24% – still a 4% premium on gains on any other asset, and presumably leaving an 8% premium payable for those on basic rate who are paying 18%

“Clearly revoking S24 – which would have expanded investment in long term rental supply didn’t cross his mind.

“The lost tax would have been recovered by increased supply forcing rents down, reducing housing benefit and emergency accommodation costs.

“That’s got to be better than bailing out Birmingham, Nottingham and other failed councils who have forced up rents with indiscriminate licensing schemes.”

Rob Houghton, founder and CEO of reallymoving said: “This is a very disappointing Budget for the property sector. Making the £425,000 Stamp Duty threshold permanent for First Time Buyers was surely an obvious move, but despite the serious challenges they face in terms of affordability and upfront costs, needing to raise over £25,500 on average to buy a first home, no helping hand has been offered to them and the higher threshold remains in place temporarily until next spring.

“The other major issue that has been completely ignored is the dire state of housing supply. Tackling the shortage of new homes, including social housing, would filter through to lower house price inflation for the rest of the market. With net migration into the UK of 670,000 in 2023, increasing supply is the only way to make home ownership more affordable in the long term.

“Cutting Capital Gains Tax will encourage landlords who have been sitting on the fence to sell, but with the supply of rental homes so limited and record high rents, this is going to make life even more difficult for tenants.”

Ben Twomey, chief executive of Generation Rent, claimed to the Chancellor’s announcement to cut Capital Gains Tax on residential property disposals from 28% to 24% could make people homeless.

He said: “This tax giveaway to landlords could make thousands of renters homeless. The only reason the Chancellor is doing this is because of the expectation that a lower tax rate will boost the number of sales, but apparently no thought has been given to the people living in those homes, who will generally face eviction before the landlords put them on the market.

“Landlords selling up is already one of the leading causes of homelessness, with 16,470 households made or being threatened with homelessness for that reason in the six months to September 2023.

“It is particularly counterproductive given that the government is currently legislating on measures to reduce evictions.

“If the government insists on going ahead with this cut, then renters will need better protection from eviction. The government could make the new rate conditional on selling with a sitting tenant, or even selling to the tenant so that they aren’t forcing people out of their homes.”

Lucian Cook, head of residential research at Savills, comments: “Today’s budget has bigger implications for private landlords and second homeowners than current and aspiring homeowners.

“The abolition of multiple dwellings relief is likely to temper investment among landlords, while the targeted cut in capital gains tax on residential properties may tip the balance for a few landlords who have questioned their ongoing investment in the sector.

“That won’t do much for rental supply, in combination with changes in rental regulation. But neither will it necessarily make it substantially easier for people to get on the housing ladder.

“Without any specific measures to help first-time buyers, it may well accelerate the restructuring of the buy-to-let sector to bigger, less mortgage-dependent landlords, as much as opening up stock to those looking to get a foot on the housing ladder.”

Nick Sanderson, Audley Group chief executive offer, says the Chancellor should have offered a broader approach to housing development: “The focus shouldn’t only be on building more homes for first-time buyers. It’s about building the right types of homes.

“The government must look at how the property market functions as a whole. Instead of continuing its blinkered focus on first time buyers and young families, it has to look at increasing the supply of age-specific housing. This would encourage older homeowners to move out of large family homes, freeing up supply and creating movement up and down the ladder. The benefits of this are numerous.

“Any new development should include provision for age-specific housing.”

Sam Reynolds, chief executive officer of Zero Deposit said: “It’s disappointing to see the government implementing further measures to reduce the financial profitability of many landlords with both a clamp down on short-lets and multiple dwellings relief.

“There’s no denying that the increasing prevalence of short-term lets can have a detrimental impact on local housing markets, but the irony is that this problem has been made substantially worse due to the government war waged against private landlords in recent years.

“Many landlords have made the decision to move the short-term lettings space as a direct result of previous legislations designed to reduce buy-to-let profitability and, as always, the government is now playing catch up in addressing a problem of its own making.

“However, the rabbit out of the hat, albeit a small one, was a capital gains tax reduction. While it could be argued that this might tempt even more landlords to now exit the sector, it should, at the same time, make buy-to-let investment more attractive and encourage more landlords to invest.”

Richard Donnell, executive director at Zoopla said the budget was another “missed opportunity”: “The budget marks another missed opportunity to take action on boosting supply and mortgage availability in the housing market.

“The consensus is that the country needs more new homes. Supply has increased but this has stalled. There is a need for widespread reform of the planning system to encourage supply. More funding is needed for social and affordable homes, and housing infrastructure investment to unlock supply.

“The government should also look to support the emergence of a long-term fixed rate mortgage market as a matter of urgency. This will help more young people with smaller deposits access home ownership – particularly in southern England where deposit size is the biggest barrier to getting on the housing ladder.”

“Another missed opportunity is the decision not to make the £625,000 threshold for first-time buyer relief permanent. This means 30% more first-time buyers will be liable to pay full stamp duty from March next year.”

Chief executive officer of Lomond, Ed Phillips, said: “Disappointing to see the UK property market receive the Budget cold shoulder yet again following what was a lacklustre Autumn Statement.

“However, the property market has weathered a tough few months and has held firm despite many predictions of an impending collapse. We’ve also seen early signs that buyers are returning despite interest rates remaining at their highest since 2008 and this has also caused house prices to start to creep up.

“This resilient performance is no doubt why the Government has chosen to refrain from any property focussed initiative in the Spring Budget and it’s very much a case of no news is good news in this respect.”

Timothy Douglas, head of policy and campaigns, at Propertymark said: “It is pleasing to see property taxation under the spotlight in the Spring Budget and the introduction of measures to level the playing field and support more homes for people to rent.

“However, overall, the Spring Budget stops short in addressing the key issue of lack of supply in the private rented sector which is higher rates of Stamp Duty when purchasing a buy to let property.

“Furthermore, whilst additional funding is welcome for housebuilding, the Chancellor has missed the opportunity to bring in Stamp Duty reliefs and wider reforms to support more people to buy and sell their dream home which comes with a guaranteed boost to the economy.”

Matt Hutchinson, director of communications at Spareroom welcomed the news regarding holiday lets: “Today’s announcement is an important step. We don’t have enough houses, so using the properties we have better is crucial to making sure renters have affordable options.

“That’s why SpareRoom has been campaigning for the government to start prioritising homes over holiday lets and level the tax playing field. Every major town and city in the UK saw rents hit all time highs last year and the days of the housing crisis being just a London thing are long gone.

“However, it’s important to note that this is just one step. We got into this mess because successive governments have failed to plan long term and build enough to keep up with demand. We do need more homes, but we also have to use the ones we have better. Sending out the message that we prioritise long term residential lets over short term lets is a start.”

Elliot Vure, Director of Corporate Sales at Together said: “The public will be relieved that – amongst the various party jibes – some concrete news around regional Levelling Up projects were set out. The £242m pot – to deliver 8,000 new homes and assist in the transformation of Canary Wharf would lead to the creation of new jobs, housing and help preserve the green shoots of economic recovery.

“While the creation of new homes will help first-time buyers and movers open doors to properties; overlooking the opportunity to reinvest in the existing disused property and sites across the UK is a costly oversight. To solve the housing puzzle; we need both new homes and brownfields.”

Director of Benham and Reeves, Marc von Grundherr, said: “Yet another disappointing Budget for the UK property market and it’s now abundantly clear that the government is as worried about the housing crisis as they are an alien invasion from Mars, having chosen to ignore the property sector for two Budgets on the trot.

“In fact, it’s fair to say we’ve got more chance of strangers from Mars solving the current issue of housing supply than those currently tasked with the job.”

Reluctant Landlord

14:38 PM, 6th March 2024, About 2 months ago

overall in nutshell. Pointless.

The CGT reduction only goes to show they fully expect more people to now sell.

Writing for the PRS not only on the wall, they are holding the exit door open now too.

Last landlord left, catch their fingers please as you slam it on the way out.....

Cider Drinker

15:56 PM, 6th March 2024, About 2 months ago

Some tenants were being evicted so that landlords could switch to holiday. This was a consequence of Section 24 and other pointless regulation within the PRS. ‘Levelling the playing field’ so holiday let owners are just as unfairly taxed as PRS landlords will cut-off this option for loss-making, Section 24 landlords. Their only option will be to evict their tenants and sell.

Reducing just the highest rate of CGT will win some favour with wealthier landlords who will NEED to sell.

My tenants cannot buy their own homes. They are low earners, often on Housing Benefit and not sufficiently financially disciplined to save for emergencies. They CHOOSE to rent. Sadly, taxes and regulations aimed only at the PRS increases their rents and the Local Housing Allowance isn’t keeping up.

I had planned to keep all four of my rental properties to pass on to my children. Now, my children do not want the burden so I’ll be selling as any become vacant. I’ll be increasing rents to market rates (currently 10% or more below) in the hope that they choose to leave. If they stay, I’ll be watching the timescales for Section 21 removal closely (unless selling up becomes a Ground under Section 8).

Three families in my rentals could not afford to buy the homes that they currently rent.

Reluctant Landlord

16:10 PM, 6th March 2024, About 2 months ago

"I’ll be increasing rents to market rates in the hope that they choose to leave. If they stay, I’ll be watching the timescales for Section 21 removal closely (unless selling up becomes a Ground under Section 8).

Three families in my rentals could not afford to buy the homes that they currently rent."

DITTO

Only mine wont have a choice to leave - they will accrue rent arrears and then I will have to evict. S21 will be the method of choice as cannot be defended. If S21 gone by then, S8 it is with mandatory selling ground BUT also the rent arrears also listed. If Shelter want to know the real reasons for evictions...then they can have it!

Dylan Morris

10:17 AM, 7th March 2024, About 2 months ago

Reply to the comment left by Reluctant Landlord at 06/03/2024 - 16:10

Be careful the draft of the Renters Reform Bill shows that selling up is NOT a mandatory ground.

Seething Landlord

10:39 AM, 7th March 2024, About 2 months ago

Nobody has mentioned that the Courts budget is to be restricted. Where does that leave the pledge that S21 will not be abolished until the Court process is fit for purpose?

Michael Booth

9:59 AM, 10th March 2024, About 2 months ago

Now we finally see this tory party at its worst the nasty party has returned the destruction of the prs to suit their ideology.