11:21 AM, 2nd August 2022, About 2 years ago

Text Size

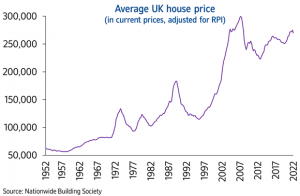

Despite the UK’s cost of living crisis, lower affordability and high inflation, annual house prices reached double-digit growth in July, Nationwide has revealed.

However, one leading estate agent is predicting that the figures are pointing to an ‘apocalyptic, once-in-a-generation crash’.

Mortgage lender Nationwide says that the annual rate of increase in July reached 11%, that’s up from June’s figure of 10.7%.

According to the Nationwide House Price Index (HPI), the average property price is £55,000 higher at £271,209 – that’s still higher than before the Covid-19 pandemic in February 2020.

Robert Gardner, Nationwide’s chief economist, said: “Despite growing headwinds from the squeeze on household budgets due to high inflation and a steady increase in borrowing costs, the housing market has retained a surprising amount of momentum.

“Demand is being supported by strong labour market conditions, where the unemployment rate has fallen towards 50-year lows, and with the number of job vacancies at a record high.”

Nationwide UK house prices continue to rise

He added: “At the same time, the stock of homes on the market has remained low, keeping upward pressure on house prices.”

Mr Gardner is now predicting that the housing market will slow as the year progresses with household finances remaining under pressure and inflation set to reach double digits in the coming quarters if global energy prices remain high.

He also points to falling consumer confidence affecting annual house price growth and the Bank of England is expected to raise interest rates further later this week.

Simon Gerrard, the managing director of Martyn Gerrard Estate Agents, told Property118: “These figures reflect a very scary time for buyers with so few properties coming to the market and mortgage rates seemingly going up by the day.

“However, if Liz Truss’ economic plan leads to interest rates rising to the region of 7%, as has been widely predicted, the housing market would likely face an almost apocalyptic, once-in-a-generation crash.”

James Forrester, the managing director of estate agents Barrows and Forrester, said: “A twelfth consecutive monthly increase and yet another double-digit rate of house price growth is quite remarkable, but against the current backdrop of economic uncertainty it really does demonstrate the resilience of UK bricks and mortar.

“Market momentum remains unwavering, having weathered a prolonged period of Brexit uncertainty, a global pandemic, increasing inflation and the most incompetent prime minister in living memory.”

He added: “All things considered; it seems as though nothing short of an apocalypse can bring the property market to its knees.”

Director of mortgage broker Henry Dannell, Geoff Garrett, said: “A combination of rising mortgage rates, inflation and the increased cost of living have already started to cool the property market where buyer appetites in the form of mortgage approvals are concerned.

“Although this is yet to filter through to topline house price growth, it’s inevitable that these headwinds will eventually impact the price buyers are willing to pay.”

And the managing director of investors HBB Solutions, Chris Hodgkinson, said: “While house prices remain sky high, home sellers would be well advised to fasten their seatbelts as we’re likely to witness a period of heightened turbulence before the year is out.

“Buyer demand levels are already starting to wane and when the well runs dry, home sellers will have to adjust their asking price expectations in order to secure a sale, as a perfect storm of increasing mortgage costs, record inflation levels and the steep cost of living all put pressure on the UK property market.”

Previous Article

BTL lenders asking for EPC C or above?Next Article

Voids hit record low - but rents hit record high