Tag: Property Investor

Expat property investor – the need for professional help

Case study relating to an expat property investor interested in keeping a foot on the London property ladder.

Two years ago a potential...

Lawnmowers – do landlords have to provide them?

“I need to use grass cutting machine” said my Polish tenant when he called me one Saturday afternoon. You mean a lawnmower...

My first intentional property investment part 5

By 1999 I had realised that I needed to put money aside for maintenance. Tenants were moving in and out all the time and I was bleeding...

Property Management Checklist

My first intentional property investment part 4 – “My first Property Management Checklist“

In the last instalment of...

My first intentional property investment part 3

Just two years after buying my first intentional property investment I owned 9 more. Buying that first one was like finding a magic...

Confident landlords plan to buy more homes to let

Falling prices and relaxed buy to let finance lending has let landlords swoop to add properties to their portfolios.

The average professional...

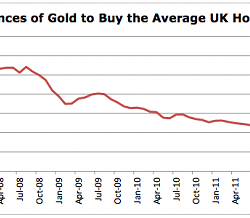

Do property investments have a golden lining?

Property investors often have a key question – is my money better off in property or in some other form of investment?

Many companies...