Tag: Housing market

UK rents rise by 8.6% in the year to June – ONS

Average rents in the UK increased by 8.6% in the 12 months leading up to June – a slight dip from the 8.7% annual rise seen in...

London renters work over two months just to pay rent says...

A think tank claims renters are working harder than ever to pay landlords.

According to the Adam Smith Institute (ASI), renters in...

Post-election optimism boosts housing market recovery ami...

Despite a sluggish housing market, a post-election bounce could boost optimism as a new government brings fresh hope for recovery.

Housing market shows signs of recovery

The housing market in England and Wales is showing signs of recovery, according to new data from e.surv.

The average sale price of...

Scottish property taxes soar to record highs

Scottish property taxes have reached a record high, exceeding £628 million in the past year, according to analysis by DJ Alexander.

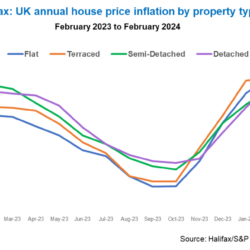

UK house prices show signs of recovery after slowdown

The UK’s housing market appears to be stabilising after a period of decline, with average house prices edging upwards for the...

General Election impact on mortgage rates and house prices

With the upcoming General Election, questions from landlords and homeowners loom over its potential impact on mortgage rates and property...