Tag: further advance

Castle Trust Equity Loan Finance

Castle Trust Equity Loan Finance has the potential to be the biggest game changer in the UK mortgage market since Buy to Let came about...

BTL Second Charge Mortgages / No Monthly Payments

No this is NOT a wind up, it’s 100% genuine and is important that you know how it works so that at the very least you can make...

Buy to Let Mortgage products and market update – es...

Having just updated the Buy to Let mortgage products on our own in house Buy to Let Mortgage sourcing system and calculator I thought...

Second charge BuytoLet loans via Shawbrook

I received an email today from Shawbrook outlining their Secured BuytoLet Loans which on first glance I nearly ignored as I normally...

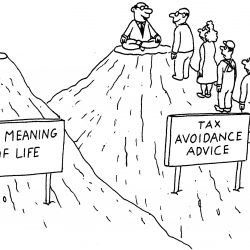

Landlords Tax Planning Strategy

“Milking the Buy-to-Let” is a Landlords Tax Planning Strategy which is very much under utilised. The strategy applies only...

Bridging finance surge in demand

Brooklands Commercial Finance have witnessed a significant upsurge in demand from referred Property118 readers for bridging finance...

Buy to let property portfolio building – Readers Ad...

I received the email below from one of my readers yesterday morning requesting advice on buy to let property portfolio building. I’m...