Tag: Cashflow

“Rent 2 Rent” strategy under the microscope

According to Francis Dolley who regularly leaves comments on this forum, “Rent 2 Rent” is being widely debated on various...

Squatters Rights – what’s not changed

In this blog I intend to dispel a few urban myths which appear to be forming, both amongst landlords and squatters themselves judging...

Tax Treatment of Property Development vs Property Investment

With so many buy to let property investors now considering buy/refurb/sell deals I feel the time is right to explain the tax treatment...

Buy to let Exit Strategies – Readers Questions

Following my article regarding Landlord Tax Strategies, I’ve woken up this morning to a very full inbox. I will do my very best...

My tenants have flooded my property but who’s probl...

I received a phone call a month or so ago to saying that my tenants have flooded my property and wanted me to pay to get the damage...

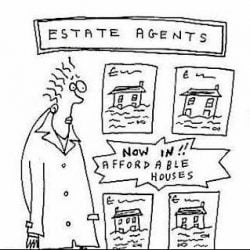

Property Values vs Interest Rates

A question that came up in conversation this evening whilst in the car on the way back from my fiancée’s offices was “which...

What to do if you can’t make your mortgage payment

Hopefully none of my regular readers will ever find themselves in this position as they will have built up a liquidity reserve, enjoy...