Tag: british gas

British Gas urges government action on EPC upgrades for l...

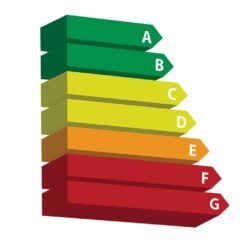

British Gas is calling on the government to provide more green grants to landlords.

The energy supplier says one of the main barriers...

Can I pursue for these costs or will it be a waste of time?

Hello, we moved to Dubai and rented out our property in Peterborough appointing an estate management company. One tenant left the property...

Homecare maintenance contracts – alternatives to Br...

Hello, I’ve had BG boiler plumbing and drains homecare contract cover for some 20 years now for a modest portfolio of London...

Landlords lose the Zero Tariff with the energy companies

Most savvy landlords will have negotiated with their energy providers, so that in between tenants the tariff automatically reverts...

My tenant is trashing my house!!

At Landlord Action we just don’t evict tenants for rent arrears or ending the tenancy because the landlord wants the property back. ...

Alternatives to Landlord Licencing Schemes

The alternatives to Landlord Licensing Schemes require joined up thinking, changes to data sharing protocols within local authorities...

First Timer – Let to Buy

I bought a one bed flat in North London a few years ago to live in with my partner. Recently we purchased our first flat together and...