Tag: Bank base rate

Bank of England breaks with Fed lead and increases Base r...

The Bank of England’s Monetary Policy Committee voted 7 to 2 to increase the Base rate by 0.5% against the expected 0.25% to...

Bank of England quarterly inflation report summary

No need to panic about interest rate rises as we are still in a bad place, but an improving place economically.

Yes “Forward...

Bank of England Inflation report and what it means for In...

Unlike the press DON’T PANIC, the economic news is good but not that good in the Bank of England Inflation report.

Reports of...

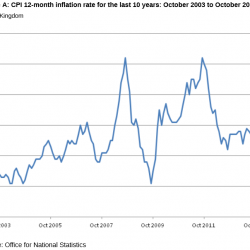

CPI Inflation down – releasing more presure on Bank...

The Consumer Price Index CPI inflation figures for October show a year on year fall to 2.2% from 2.7% in September as released today...

Contra proferentem mortgage conditions

Unless you are a qualified contracts lawyer who has also studied Latin you will probably not have a clue as to how contra proferentem...

Housing Bubble fears – genuine or an overreaction?

There has been a great deal of commentary in the press the last couple of days raising fears of a housing bubble.

Rightmove increased...

Landlords Life Insurance Calculator

What is the minimum amount of Landlords Life Insurance we really ought to purchase?

I suspect the reason most property investors...