Tag: Auction

Landlords sell rental properties in record numbers

One firm of chartered surveyors and auctioneers has revealed it has seen a 300% increase in instructions to sell residential buy to...

Home auction market sees more sellers but fewer buyers

More homeowners are turning to auctions to sell their properties quickly in a slowing housing market, but they may face lower demand...

Landlords selling up take a 30% hit to quickly exit the s...

One property auction firm says that more than a third (38%) of their current lots are from buy-to-let investors looking to get out...

Tenant refuses to leave from property I was sold as vacan...

Hello everyone, I’m looking for advice as to what to do in a very difficult situation I’ve landed in.

I bought a property...

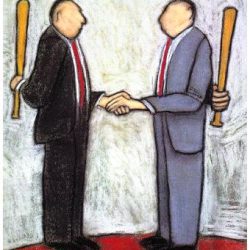

Legislation is destroying our business and we might as we...

Hello, No landlord can be immune to the ever increasing attacks, not only on the buy to let business in general, but also very personal...

Shawbrook Bank – Definitely not for “brand ne...

Shawbrook Bank are now offering a 0.25% discount on the margin or a 0.25% discount in the arrangement fee for clients who have already...

Buy to Let Mortgage products and market update – es...

Having just updated the Buy to Let mortgage products on our own in house Buy to Let Mortgage sourcing system and calculator I thought...