Tag: Aldermore Bank

Brokers Review of Aldermore Bank’s Buy to Let Mortg...

Aldermore Bank have recently refreshed their buy to let rates and terms. I asked my mortgage broker what he thought and what the interesting...

When is family not family for BuyToLet mortgage purposes?

I received an email today from one of the Financial Advisers we have a close working relationship with. I’ve decided to share...

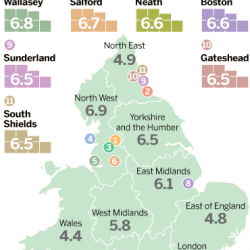

Booming Buy to Let Reality Check for Landlords

Buy to let mortgage lenders are creaming off the best borrowers and leaving the rest without any real hope of raising loans.

The reality...

Aldermore Announce 80% LTV

News Sourced by Property118 News Team

Aldermore have increased the loan-to-value on its fixed buy to let range to 80%, as well as...

New Tracker Lender for Buy to Let

“State Bank of India set to enter the buy to let market”

A new buy to let mortgage lender is about to enter the market...

Housing Market Boosted by Surge in Buy to Let

Surging buy to let mortgage applications have boosted mortgage valuations to record summer levels, according to surveyors.

Property...

Yorkshire Launches Limited Buy to Let Lending

Yorkshire Building Society is taking a tentative step in to buy to let lending with a limited range of mortgages for landlords.

Buy...