10:53 AM, 14th November 2018, About 6 years ago 3

Text Size

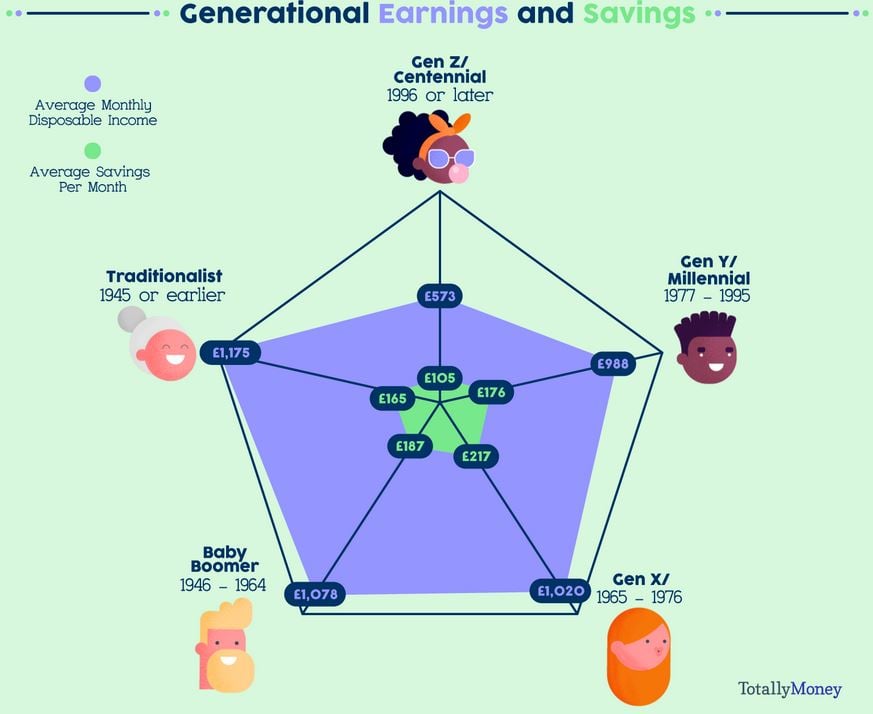

With the average semi-detached house costing £225,674 in the UK, the housing crisis has left many of those within the younger generations short of an opportunity to own their own home. As the UK experiences a widening generational wealth gap, research from credit comparison experts TotallyMoney uncovers how much different generations are saving, and overspending, and how that affects their chances of owning a home.

How Much are Millennials Saving?

While the average Brit puts away £183.50 into savings each month, the research revealed millennials (born between 1977 and 1995) save less at around £176 a month. The survey also showed that 16% of millennials do not put any money into monthly savings, whilst around 11.5% save between £100-200 a month.

Millennials are also the most likely to run out of money before payday – with 24% saying this is the case, and the majority of these blaming their expensive spending habits rather than an overall lack of funds. In comparison to traditionalists (born in 1945 or earlier), with only 3% of this generation running out of money before payday.

With expensive rental costs, rising commuting fares and inflation – saving up for a deposit on a home almost seems impossible for many, but between the generations, there is a clear difference between who runs out of money before the end of each month. According to ONS research, 67% of the 25 to 34 age group were homeowners in 1991 and by 2014, this had declined to 36%.

16 to 24-year-olds also saw a sharp decline in home ownership, from 36% to 9% and for the 35 to 44 age group, from 78% to 59%, despite homeownership increasing among older age groups.

How Long Would It Take to Save For a Home?

With the average UK salary being around £27,600 and the average cost of rent in the UK being £928 each month – people are left with £1,372 to cover food, transport, bills, and other living costs. According to TotallyMoney’s research with millennials only saving £176 each month, meaning it would take around 10 years to save just 10% for a deposit on a semi-detached home, costing £225,674.

For those living in London, affording a home will be a much bleaker reality, with the average price of a semi-detached house being £580,930. Currently, the average renting cost in London is £1,619 a month, meaning people are only left with £618 to cover all their needs.

In order to save up for a 10% deposit of £58,000, it would take a millennial 27 years in total if they were only saving £176 per month.

Henry Keegan from TotallyMoney commented: “Property is certainly more expensive than ever, and interest rates are notably low at the moment – both of which make it hard for younger people to be as well off as their parents or grandparents.

“But there is a noticeable trend that younger people might not be acting with a clear view towards saving for the future. Whether it’s higher spending on unnecessary purchases or an approach to spending which means that they run out of money when they need it, their spending habits may not always be in their best interests.

“We encourage everyone to do research, keep a budget, and use helpful tools to ensure they’re making smart financial decisions.”

Previous Article

Deed Poll name change eviction?

Ed Tuff

10:51 AM, 15th November 2018, About 6 years ago

I'm a millennial, and "saving 10 years for a deposit" is exactly what I did: Started saving at 18 and bought my first place in London at 28 on my own with no help from anyone.

As a result, I don't have much sympathy for these millennials feeling sorry for themselves.

Kate Mellor

11:30 AM, 15th November 2018, About 6 years ago

The more the media reinforces the “impossibility” of young people affording a home of their own the more it becomes a self fulfilling prophecy! When you raise your children you teach them that they can achieve anything they set their mind on if they work hard for it and plan out their goals in stages. I think this negativity just gives people an excuse not to try. Their failure is a forgone conclusion and there is nothing they can do about it! (What bollocks!!)

When I was young we didn’t expect to start a family or buy luxuries until we’d already saved a deposit and owned a home. Sadly if you have 5 kids and are paying rent plus all the bills that go along with it you make the job that much harder for yourself, but that’s a choice. If it means enough to you to own your own home then you make it a priority. Everything non-essential gets trimmed back, you house-share or live in a cheaper area, or stay with mum & dad while you work hard and get the deposit together.

Michael Barnes

23:31 PM, 15th November 2018, About 6 years ago

It seems unreasonable to use UK average salary outside London (too high) and inside London (too low),