15:03 PM, 1st August 2022, About 2 years ago

Text Size

The number of Londoners who are buying property outside of the capital has risen by nearly a fifth when compared to pre-pandemic levels – and tenants are joining them, research reveals.

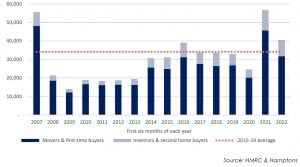

According to real estate firm Hamptons, in the first half of this year, Londoners snapped up 40,540 homes outside of the city, which is 19% higher than the average seen between 2015 to 2019.

The research reveals that first-time buyers account for a record number of properties being bought outside of London with the most popular destination being Thurrock in Essex for 34% of those moving.

Aneisha Beveridge, the head of research at Hamptons, said: “It’s becoming increasingly evident that one of the biggest Covid-related housing market trends – moving out of London for the country – could be here to stay.

“Despite more people returning to London offices this year, the rate at which households have upped-sticks and headed out of town has continued apace.”

She added: “While last year families relocating to gain more space accounted for nearly three in five Londoners buying outside the capital, this year the figures have been driven by first-time buyers, many of whom were renting in the capital.”

Other popular destinations for first-time buyers from London include Dartford, Medway and Basildon.

Around half of the properties being bought are being purchased by someone who has a home to sell – that’s down from 2019’s figure of 59%, and 74% in 2012.

Hamptons also says that there’s an increase in the number of Londoners who are choosing to invest in buy to let outside of the city.

They say, 19% of investors doing so were Londoners, that up from 2019’s figure of 15%.

This trend now means that a record 65% of investors from London now buy their BTL’s outside the capital, that is up from 26% 10 years ago. They spent £1.6bn in the first half of the year, or £210,070 on average.

This trend now means that a record 65% of investors from London now buy their BTL’s outside the capital, that is up from 26% 10 years ago. They spent £1.6bn in the first half of the year, or £210,070 on average.

And it is for the appeal of higher yields found in the North that sees 28% of investors from London buying a BTL there, that’s up from 11% a decade ago.

The average BTL investor is now 102.8 miles away from their home in London – in 2017 it was 77 miles.

Hamptons also reveals that of those who are leaving London, 78% are looking to set up a home, rather than buying a second-home or a buy to let investment.

The reasons for the trend include affordability and flexible working patterns with a record 28% of Londoners who did buy outside the city this year doing so buy their first home. That’s up from 2019’s figure of 22%, and 13% from a decade ago.

The buyers are spending, on average, £383,070 on their first property, while first-time buyer prices in London are, on average, £526,600.

Ms Beveridge said: “Strong house price growth outside of London over the last year has meant that buyers have had to move even further outside the M25.

“The average Londoner moved 35 miles, the equivalent of trading Fulham for Farnham or Canary Wharf for Chelmsford – an extra mile further than in 2021.

“The distance London leavers move is likely to continue rising until at least 2024 as house price growth in the capital continues to lag behind the rest of the country.”

She added: “While many Londoners have traded the city lights for a country abode, we’ve also seen a rise in the number of people moving into the capital this year – both tenants and buyers, from the UK and abroad.

“So far this year 13.3% of people buying a home in London came from the regions, the second highest figure on record.”

Previous Article

How to obtain Class MA Prior approval