Tag: Property Developer

I Am A Property Developer – Ask Me Anything!

I run a small property development business in the Reading, Wokingham and South Oxon and Bucks areas.

The company organises planning...

Residential Property Development up by over 15%

The value of private residential property development projects starting on site is up 15.2% compared with the same period in 2012 according...

Mark Garner of Garner Homes Maidstone

Mark Garner of Garner Homes Maidstone

I have been a full time landlord since 1996 with property in Maidstone, Ashford and Gravesend,

Newbie Investor would like to pick your brains

A Newbie Investor, who wishes to remain anonymous, has submitted the following and would really appreciate any help and guidance you...

Development Finance Story of a very happy Property Developer

A Property118 reader has shared this story with us – he’s a Property Developer and was struggling to find the right Development...

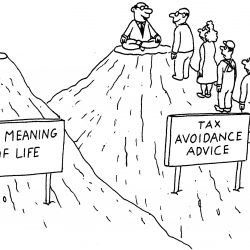

Tax return looms – Readers Question

We have received four questions from one of our readers as the final date for submission on-line of 2011-12 tax return looms asking:...

Landlords Tax Planning Strategy

“Milking the Buy-to-Let” is a Landlords Tax Planning Strategy which is very much under utilised. The strategy applies only...