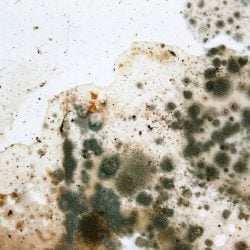

Tag: mould

Half of renters are living in cold, damp homes – Ci...

Nearly half of private renters in England are enduring freezing, damp or mouldy homes, Citizens Advice has warned.

And, the charity...

Universal Credit issues – How do I claim rent arrears?

Hi, I have tenants in Glasgow on Universal Credit. The tenants paid the rent to me until I asked them to find another property due...

Social housing landlord slammed for mushrooms growing in ...

The Housing Ombudsman has severely criticised social landlord Guinness Partnership for failing to fix problems in tenants’ homes...

Council tenants awarded £40,000 for damp and mould issues

Three council tenants have been awarded a total of £40,000 by the Housing Ombudsman after enduring unacceptable living conditions...

Call for more PRS enforcement funding in England

A charity is calling for more government funding to help councils enforce housing and health standards in the private rented sector...

How to avoid damp and mould in homes this winter

It’s a common issue for landlords around the country – dealing with tenants who are reporting issues with damp and mould.

When condensation and mould is caused by the tenant?

Hello, We are currently dealing with a tenant who has complained to environmental health about the damp in their property. We have...