Tag: interest only

Shawbrook Bank slash arrangement fees and rates

Shawbrook Bank specialists in commercial and BTL finance have reduced their arrangement fees to 1.70% a saving of 0.80%, and their...

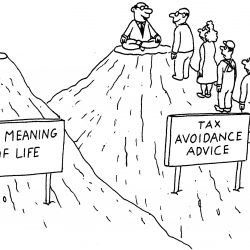

Landlords Tax Planning Strategy

“Milking the Buy-to-Let” is a Landlords Tax Planning Strategy which is very much under utilised. The strategy applies only...

Commercial Finance Loan Directory

The Loan Directory is a regular feature publishing examples of the most competitive and frequently used products in the commercial...

FSA Mortgage Market Review and the PRS

The FSA Mortgage Market Review rules will come into effect on 26 April 2014 and I have listed the FSA’s own summary at the bottom...

Commercial Finance Loan Directory

The Loan Directory is a regular feature publishing competitive and innovative product offerings to help clients identify appropriate...

Godiva BuytoLet save £2499 on the same rate!

Godiva BuytoLet, owned by the Coventry Building Society, have further tweaked their Flexible variable and Flexible fixed products by...

Leeds Building Society BuytoLet two and three year produc...

Leeds Building Society BuytoLet department have discounted their two and three year products whilst keeping their 5 year deals at the...