10:27 AM, 14th March 2014, About 10 years ago 3

Text Size

With days to go until the 2014 Budget, time is running out for Osborne to make a real difference. Naomi Heaton, CEO of London Central Portfolio, highlights a four point plan which could help the Conservatives get back in favour, whilst providing some much needed Viagra to the UK economy. Listen closely George; it is time for the Government to do something positive.

2013 Residential Policy Change Recap: Following increased Stamp Duty for properties over £2 million in 2012, a CGT and annual tax for enveloped dwellings (ATED) was levied on owner-occupiers buying through corporate vehicles.

In the Autumn Statement in December, a further CGT was announced for all non-resident buyers.

Whilst these taxes are projected to have negligible economic benefit, they were undoubtedly populist pleasers as CGT is already paid by UK investors on second homes. Having pursued the popular vote in previous Budgets, it is about time that George Osborne looks at stimulating the wider economy rather than simply trying to garner more tax.

1) DO: Re-evaluate the 1% Stamp Duty ceiling at £250,000. This has been on LCP’s Budget ‘to-do’ list for a number of years and it would be a missed opportunity for not to review the £250,000 Stamp Duty threshold in this Budget. This is the point where tax payment jump from 1% to 3%, or £2,500 to £7,500, and has remained unchanged for over 15 years, whilst the average price of a house has increased from £79,242 to £247,549.

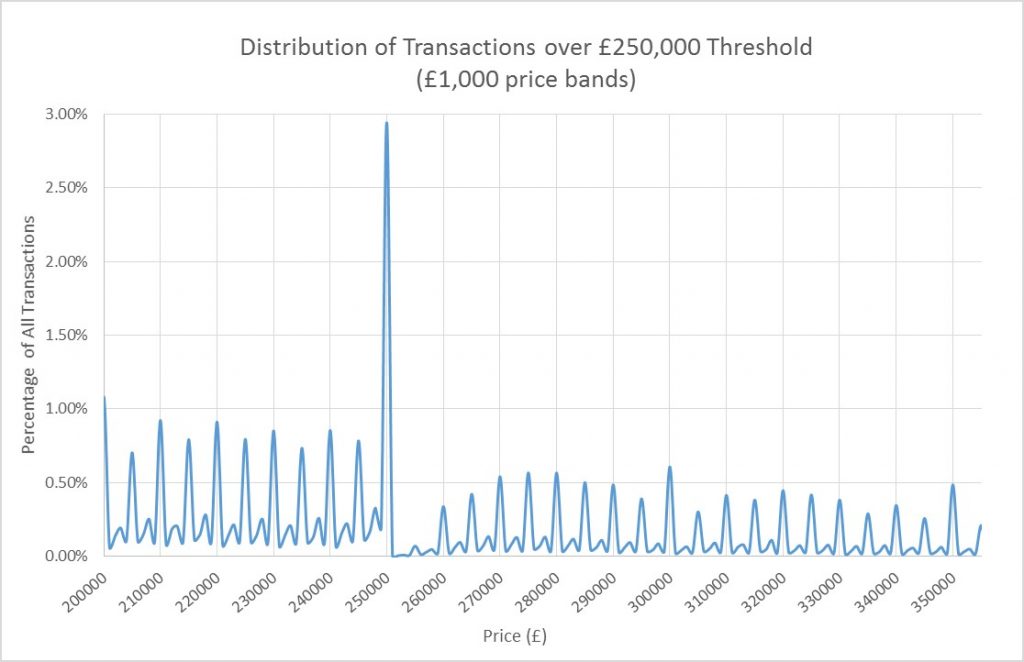

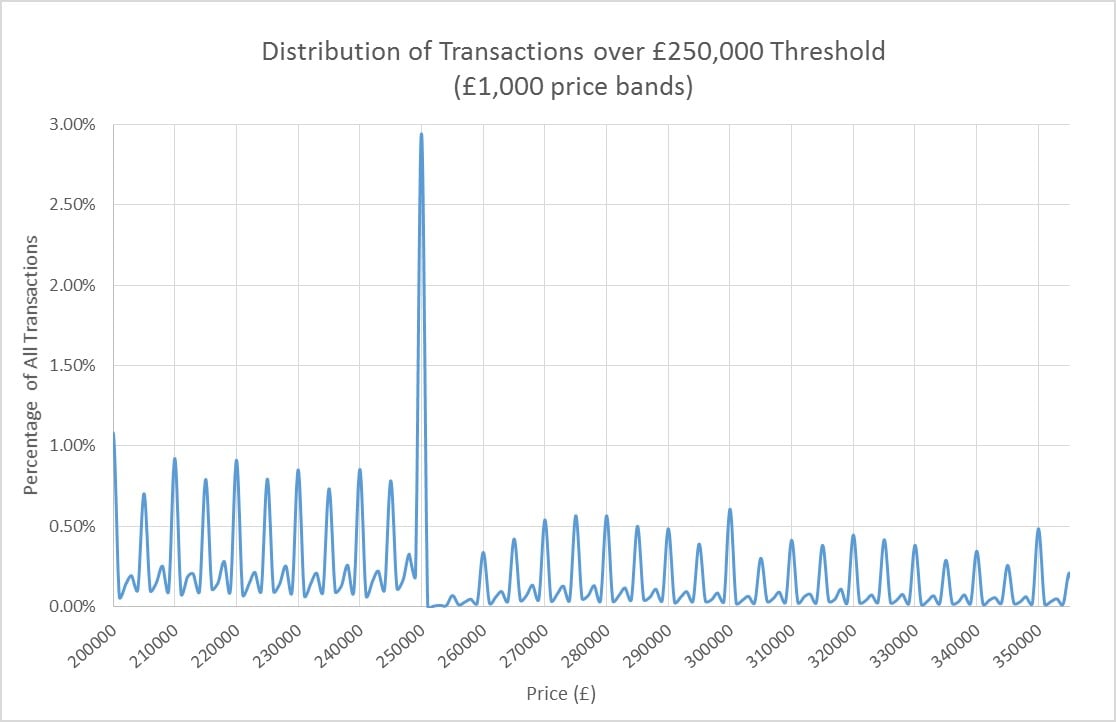

There is clear evidence that the step up in Stamp Duty at £250,000 has suppressed price growth and normal transaction flow. There is a profound spike in transactions just under the 3% stamp duty rise at £250,001. 930% more transactions take place between £240,000 and £250,000 than between £250,000 and £260,000, at which point transactions begin to resume a normal pattern.

LCP estimates that the distortion caused by the increased Stamp Duty led to almost 20,000 sellers discounting their homes in order to effect a sale last year. It is also estimated that, on the UK’s 10 year average growth rates, 120,000 households will breach the £250,000 threshold over the next five years.

Should the band not be reassessed, there are two possible consequences. Firstly, an even larger bunching will occur at £250,000, impeding the recent recovery in the UK housing market. Secondly, some home owners will choose not to ‘trade up’, creating another hurdle for first time buyers getting onto the housing ladder.

OUTCOME: If Osborne were to raise the 1% ceiling, average property prices would burst through the artificial cliff edge at £250,000. The Government would unlock this market and increase sales, boosting the recovery, general morale and consumer spending. If transactions got back to pre-credit crunch levels, which were a 21% higher than today, the 1% Stamp Duty take on these extra sales would more than compensate the Exchequer for this tax give away.

However, Heaton fears “the Chancellor will keep his powder dry until election year, as the opportunity for a popular initiative, just days before the general election, is surely too good to miss.”

2) DON’T: Increase Stamp Duty percentages again. Properties between £1m and £2m were last hit in 2011, when Stamp Duty increased from 4% to 5%. With the next tax threshold standing at 7% for £2m+ properties, raised from 5% at the last budget, it would be another easy move to increase the £1m payment from 5% to 6%.

OUTCOME: Another hike is likely to result in a dramatic drop in transactions, particularly in the domestic market, akin to the 30% collapse in sales over £2m which followed the 2012 Stamp Duty increases. LCP has estimated that the Exchequer would lose £89 million of tax revenue over the year should a similar reduction occur. This will further impact on a core market in Central London, currently 21% of all transactions. It will also strike fear into those in £500,000 to £1m price bracket, 35% of the market, who may be next on the Tax man’s hit list.

3) DON’T: Look at another raid on the foreign investor. Having already targeted these buyers with a non-resident CGT in the Autumn Statement, the Chancellor should think carefully about further disincentivising measures.

‘Brand Central London’ is one of the UK’s biggest international attractions and is a magnet for inward investment. It is a tiny area which represents a negligible 0.8% of all transactions in England and Wales, yet the stamp duty it generated last year was 14% of that raised in the rest of the UK. This equates to 16 times more per property and a contribution close to £0.5 billion. Not only this, but their investment into the vital Private Rented Sector, alone, contributes £1.5m to the general economy. With foreign buyers mainly to thank for this contribution, we should welcome this investment as a core plank in our economic growth strategy.

Further penalties which intend to drive out a few wealthy foreigners in Central London, may have popular appeal in the politics of envy but it is not going to deal with the housing crisis. There are only 6,000 transactions a year in Central London compared with 750,000 in England and Wales. The price point in Central London could never reduce to the national property spend of £250,000 without falling six times, with terrifying economic consequences. Using foreigners as a scapegoat is a clever distraction, not a clever solution and further dampening measures could be highly detrimental to the UK’s new born recovery

OUTCOME: New penalties would seriously eat into the Stamp Duty and overall property spend generated by Central London residential property. Foreigners also contribute significantly to the £10bn spent on the retail trade, education, the night time economy and tourism. Any move to prohibit this investment will have serious knock-on effects for both the UK’s economy and Exchequer’s tax take.

Promoting continued investment into London’s prime housing stock, instead, will raise vital tax revenues without imposing more burdens on austerity-weary Brits. It could also help fund a relief from the 3% stamp duty threshold at £250,000, whilst enabling the Exchequer to hold the other Stamp Duty thresholds at their current levels, which would be both a popular and economically beneficial move.

Previous Article

Message from Anthony Wilson of Ashley Wilson Solicitors LLPNext Article

Landlord responsibilities post break in?

Neil Patterson

11:04 AM, 14th March 2014, About 10 years ago

Hi Naomi,

Very interesting graph showing stamp duty.

I believe in the free market especially in property where price should be lead by supply and demand, so any suggestions to take out artificial demand limiters using fiscal policy is something I would naturally be inclined towards.

However I am conflicted, because it is supply that we really need to be stimulated and the increase in prices recently is not having a great effect. I am hoping it is a lag time as prices have only really been driving continuously upwards for the last year and I would assume it takes the building trade a while to respond. Having said that supply is being affected by monetary policy (availability of finance), Planning laws and the scarcity of land.

Some One

15:56 PM, 14th March 2014, About 10 years ago

Raising the 3% limit on its own merely shifts the distortion up a bit, it needs to be properly gradated like income taxes to avoid the distortion.

Neil Patterson

16:08 PM, 14th March 2014, About 10 years ago

I Totally agree, because as it is proved above you just get a lot of sales at £249,999 or what ever the new figure is.

That does not look like a perfectly pure free mature market to me. Although in reality that will probably never be the case.

How about we go completely rogue and say stamp duty is to be used for cheap loans to the building industry?