0:01 AM, 29th April 2024, About 2 weeks ago

Text Size

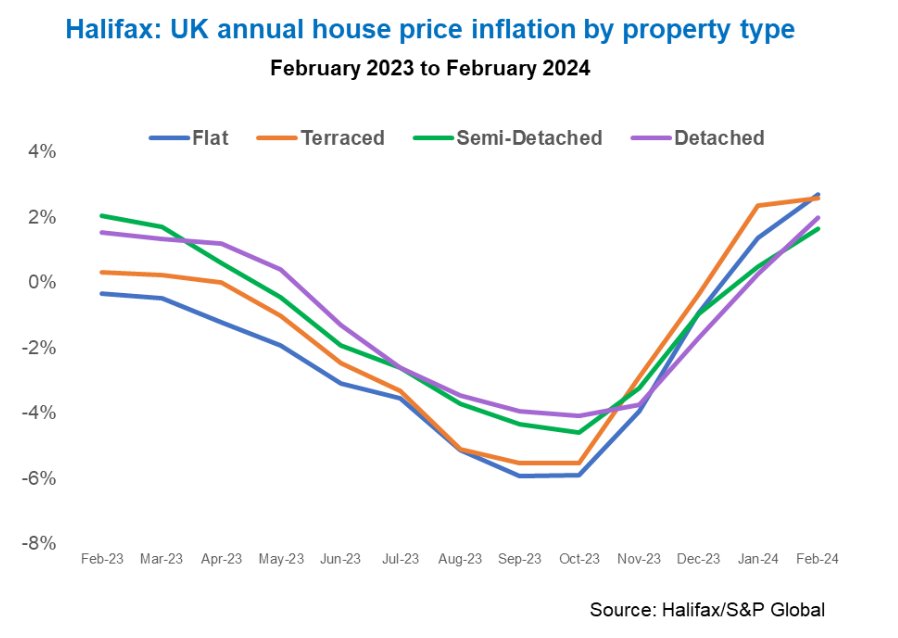

UK property prices have increased by 1.9% over the last year, according to new research by Halifax.

The findings reveal demand among buyers for smaller homes helped to drive growth in UK property prices.

According to Halifax, the average price for flats rose by +2.7%, while terraced houses rose by 2.6%.

The switch in demand among buyers – reversing the ‘race for space’ which was such a dominant feature of the pandemic-era housing market – has seen prices rise most quickly for flats at the start of this year.

The average price of a flat is £163,016 just £5,551 below the peak price recorded for flats in August 2022.

At a regional level, Scotland saw the strongest growth in prices for flats over the last year, rising by 5.9% (£6,489) to sit at £116,477.

Only one UK region saw a decrease in flat prices over the last year, falling by 2.9% in Yorkshire and Humberside.

At the top end of the size scale annual growth for detached houses hit +2.0% (£8,853) in February, with an average price of £451,655.

Yorkshire and Humberside recorded the biggest increase in detached house prices of the last year, up by +5.0% (£17,300).

Detached homes still maintain the biggest increase in average house price of any property type over the last four years, up by +23.9% (£87,034).

Amanda Bryden, head of Halifax Mortgages, says despite challenges in the housing market first-time buyers have proven to be resilient.

She said: “It’s important not to gloss over the challenges facing the UK housing market, given the impact of higher interest rates on mortgage affordability, coupled with a continued lack of supply of new homes.

“But scratch beneath the surface and there is a more nuanced story, one which shows that demand for different property types in different parts of the country can vary hugely.

“As interest rates have stabilised and buyers adjust to the new economic reality of owning a home, one way to compensate for higher borrowing costs is to target smaller properties.

“This is especially true among first-time buyers, who have proven to be resilient over recent years, and now account for the largest proportion of homes purchased with a mortgage in almost 30 years.”

“We see this reflected in property prices for the first few months of this year, with the value of flats rising most sharply, closing the ‘growth gap’ on bigger properties that’s existed for most of the last four years.”

Previous Article

Stuck without lost Deed of Trust?