14:45 PM, 8th January 2020, About 4 years ago 1

Text Size

The 2010s have shown the weakest decade for house price growth since the 1990s, but affordability metrics present a mixed picture.

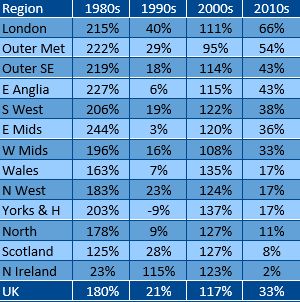

– House prices were up 33% in 2010s vs 180% in 1980s

– London was the top performer in 2010s with house prices rising twice as fast as the UK average

– However the lowest rates of interest have helped support affordability through the last decade

– High house prices to earnings ratios make saving for a deposit a major barrier for first time buyers

Commenting on the figures, Andrew Harvey, Nationwide’s Senior Economist, said:

“We’ve looked at how the last 10 years compares with previous decades across a variety of housing metrics. The 2010s has been the weakest decade for house price growth since the 1990s; nevertheless, prices still rose by 33% over the decade, somewhat above the 20% rise in average incomes over the same period.

“Despite recent weakness, London has been the top performing region over the last decade, with house prices rising twice as fast as the UK average (at 66%). The neighbouring Outer Metropolitan region (which includes places such as Slough, Guildford, Crawley and Chelmsford) also significantly outperformed, with prices rising 54% during the 2010s.

“The northern regions, in particular the North, Yorkshire & Humberside and North West, saw relatively weak house price growth over the decade, with prices slow to recover following the financial crisis. House price growth has remained subdued in Scotland, with just an 8% rise over the past 10 years. Northern Ireland saw the lowest growth, with prices up 2% compared with the end of 2009.

Mixed story on affordability metrics

“House price growth has continued to exceed earnings growth, resulting in a further rise in the house price earnings ratio. At the end of 2019, the UK First Time Buyer (FTB) house price to earnings ratio stood at 5, close to 2007’s record high of 5.4, and up from 4.4 at the end of 2009.

“The last decade has also seen a significant widening in the gap between the least affordable and most affordable regions. London been the least affordable region for most of the past 40 years, but its house price earnings ratio (HPER) has reached new highs in recent years, reaching 10.2 in 2016, from 6.1 at the start of the decade, with only a modest improvement to 8.8 at the end of 2019.

“The region with the lowest house price to earnings ratio in 2019 was Scotland with a HPER of 3.2 – a decade ago it was the North with a HPER of 3.3.

“One of the consequences of high house prices relative to earnings is that it makes raising a deposit a significant challenge for prospective first time buyers. Indeed, at present a 20% deposit is currently equivalent to the entire pre-tax income of an average earner, up from 88% a decade ago, though there is significant variation across the UK.

“The chart below shows the average time it would take someone earning the typical wage in each region to save a 20% deposit to buy the typical FTB property, assuming they set aside 15% of their take home pay each month.

“Reflecting the trend in overall house prices, some regions have seen a substantial increase in the time taken to save a deposit. For example, in the South West it would now take around 10 years for an average earner to amass a 20% deposit, up from eight years at the end of 2009. The pressures are most acute in the capital, where someone earning an average income would need around 15 years to save a 20% deposit on a typical London property, up from 10 years a decade earlier.

Low rates mean monthly mortgage payments still affordable Outside London and SE

“However, looking at mortgage affordability, this has actually improved for prospective first time buyers in recent years, with the cost of servicing the typical mortgage as a share of take home pay in most regions now lower than it was in 2009. This is due to the fall in borrowing costs, with average interest rates for new mortgages falling from around 5% in 2009 to 2.4% currently.”

Indices and average prices are produced using Nationwide’s updated mix adjusted House Price Methodology, which was introduced with effect from the first quarter of 1995. The data is drawn from Nationwide’s house purchase mortgage lending at the post survey approvals stage.

More information on the house price index methodology along with time series data and archives of housing research can be found at http://www.nationwide.co.uk/about/house-price-index/headlines

Historical figures including index levels can be viewed using the following link: http://www.nationwide.co.uk/about/house-priceindex/download-data

Previous Article

R2R exit strategies?Next Article

Government UC guide for landlords

David Lawrenson

11:41 AM, 9th January 2020, About 4 years ago

And where will house prices be headed in the future?

Merryn Somerset Webb of the FT wrote a very interesting piece quoting very long term research, in which she concluded that house prices will not go up very much at all, may even fall.

It was a very interesting piece, which I quote here:

https://www.lettingfocus.com/blogs/2018/12/will-house-prices-keep-rising/

However, I did not agree with her conclusions.

There are many determinants of house prices over time, but looking at demographics, economic measures (income growth and its distribution) and amount of housing supply forecast are good places to start!

David Lawrenson

http://www.LettingFocus.com

Private Rented Sector Advice and Consulting