0:01 AM, 17th October 2019, About 5 years ago 1

Text Size

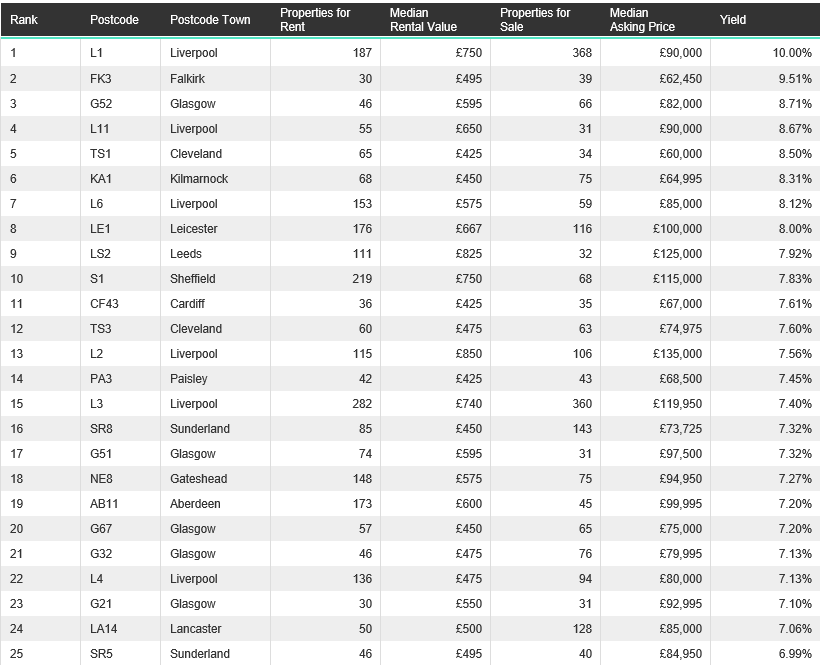

Liverpool’s L1 boasts a strong 10% profit margin, smashing the 3% yield many of the UK’s postcodes offer. In L1, landlords snap up a property for an average of £90,000 and support their investment with a significant asking rent of £750 per month.

But it’s not just Liverpool that’s doing well. Landlords may want to keep gazing North. Completing the top three is Falkirk’s FK3 and Glasgow’s G52, returning 9.51% and 8.71% yields respectively. And 16 of the top 25 postcodes are in the North West (predominantly Liverpool) and Scotland.

That said, the North East also has some top performers. TS1 and TS3 in Cleveland rank fifth and 12th respectively, while Sunderland features twice (SR8 and SR5), and Gateshead’s NE8 has a 7.27% yield —putting it in 18th position.

The majority of the strongest UK postcodes return a yield of 7%. These include Leeds’ LS2 (7.92%), Cardiff’s CF43 (7.61%), Aberdeen’s AB11 (7.20%) and Lancaster’s LA14 (7.06%).

Weak performing postcodes for investment property

Many well-known commuter belt areas have the lowest yields. At the very bottom is AL5 in St Albans. The average buying price for a property is £800,000, and asking rent is £1,300 per month. Total yield: just 1.95%.

This puts it below London’s W8 postcode (Kensington), which still manages to squeeze out a 2.05% return for landlords even though average property prices are a hefty £1,962,500.

Other commuter spots in the bottom 10 include RG10 in Reading (2.26%), GU10 in Guilford (2.22%) and KT7 in Kingston upon Thames (2.20%).

Guiding property investors to buy-to-let success

Spokesperson for credit experts TotallyMoney, James McCaffrey, comments on the findings: “Many existing and would-be landlords wonder if buy-to-let is still worth it. Our findings are another source to help property investors answer that question.

“The maps and data clearly show there are pockets of profit for landlord investment this year. And it seems that Scotland and the North are good places to start a buy-to-let property search.

“Landlords should always do their research before committing to a property purchase. Understanding current market trends is part of that. Making sure they’re financially prepared is another.

“To negotiate the best mortgage rates, investors need a clear knowledge of where they stand in the credit market. A free credit report from TotallyMoney can help. It gives property investors a detailed picture of their credit rating so they can make sure they’re in the strongest financial position before applying for a mortgage.”

Methodology — working out the buy-to-let yields for 2019/2020

Data for this report has been gathered from Realyse.

The data for a total of 478,486 properties were analysed. Of these, 217,055 properties were listed as for sale and 261,431 properties were listed to rent.

The buy-to-let yield is defined as average annual rent divided by the average asking price. To be included in the study, postcodes needed to have more than 30 properties for sale and 30 properties for rent.

Postcode map data collated from Wikipedia.

Previous Article

Advanced rent leads to higher net tax?Next Article

Landlords selling up in frustration - Rightmove

user_ 8640

18:11 PM, 18th October 2019, About 5 years ago