13:49 PM, 9th January 2020, About 4 years ago 1

Text Size

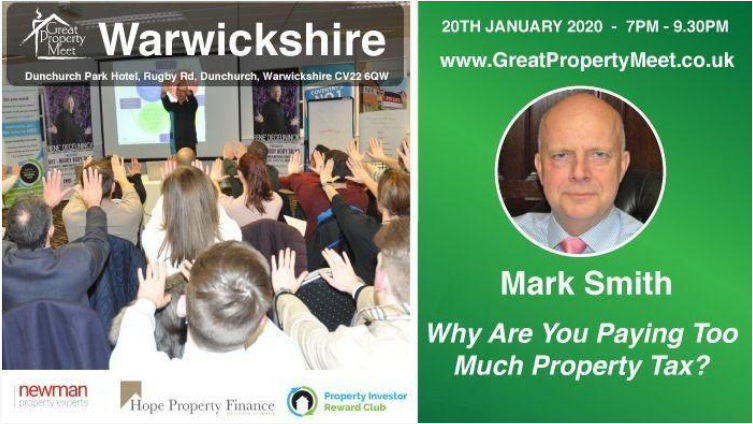

Our Hon. Legal Counsel, Mark Smith, Head of Chambers at Cotswold Barristers will be presenting an overview of several landlord tax strategies at the Great Property Meet networking event taking place Monday 20th January 2020 from 7pm to 9:30pm at Dunchurch Park Hotel Rugby CV22 6QW: Click here to attend.

Great Property Meet want to help any landlord with 2 or planning to have 2 or more properties save TAX on the 20th January 2020

I’ve heard so many myths about Buy to Let and Tax planning and it’s about time we busted these Myths once and for all. Nobody in their right mind wants to pay more tax than they are supposed to pay!

I have organised for the Top Property Tax Barrister, Mark Smith, to answer your questions on this exclusive never done before session including breaking new 2020 updates to be revealed to save you Thousands in Tax.

HURRY! This is going to be the most valuable session you ever attend and already selling very fast.

I can guarantee you that most Accountants don’t have the right answers to help you and this is based around them not having paid to take advice from a Tax Barrister and not wanting to risk their PI insurance. Accountants are not Tax specialists, they produce accounts. Tax experts don’t produce accounts.

As a late Christmas gift Why not invite your accountant along to join you! Offer to buy their ticket they might do your next accounts free when they see how much money they can make from other clients thanks to you and they get to learn from the Top Property Tax Barrister in the UK.

Myths we plan to bust for you

Q. Section 24 tax regime makes Buy 2 Let dead.

A. WRONG – It will make it more profitable for you

Q. Incorporation is costly.

A. WRONG – its less than you think and can release cash into your pocket to begin buying again

Q. I’ve heard incorporation is risky

A. WRONG – thousands of businesses have done this since 2015 – HMRC has 2 years to challenge and not one challenge has been brought to date

Q. I can only incorporate if I am a partnership and its more than 2 years old.

A. WRONG –New solutions have been developed

Q. I have to pay Capital Gains Tax and Stamp Duty to beat Section 24.

A. WRONG – Property transfers between owners on a regular basis with no SDLT or CGT using HMRC reliefs

Q. I have to re-mortgage my properties.

A. WRONG – only if you wish to remortgage do you need to

Q. It will affect my inheritance tax.

A. WRONG- it will save you IHT

Q. I need 10 or more properties

A. WRONG – New solutions have been developed

If your accountant says he doesn’t think it can be done – bring them with you perhaps even charge your accountant to educate them.

Mark Smith is a Barrister, hon counsel to property118.com and the co-designer of a range of solutions for business structures wherever you are on your property career.

Effective landlord tax planning utilises all available tax breaks legislation provides for. Nobody in their right mind wants to pay more tax than they are supposed to pay, but not everybody knows how to go about optimising their tax position or even the existence of many forms of tax relief or ownership structures available to them.

With the correct planning it may well be possible for you to utilise tax legislation to optimally restructure your property rental business, without any requirements to refinance or to pay capital gains tax or stamp duty. We are not referring to loopholes or tax dodges, but perfectly legal structures that your average accountant might never consider bringing to your attention.

Join us on 20th January 2020 for this TAX SAVING session.

Email your questions to me in advance as we want to answer them all and will prioritise those received in advance.

VIP’s don’t forget to book your boardroom place for a private session with Mark Smith already half have sold this month.

BOOK HERE

If you’re in property you cannot afford to miss this meeting.

Visit http://www.greatpropertymeet.co.uk/book/ to reserve your place

To reserve your place at the best independent property meeting in the Midlands visit www.GreatPropertyMeet.co.uk

When – Monday 20th January 19:00 – 21:30 (arrival from 18:00)

Where – Dunchurch Park Hotel Rugby CV22 6QW

Cost – £20

Event info – refreshments provided

Dress code – Smart Casual

Previous Article

Poor communication the biggest cause of deposit disputesNext Article

REMINDER - CGT rules are changing in April 2020

Andrew

12:00 PM, 20th January 2020, About 4 years ago

Looking forward to Mark Smith joining us tonight at the Great Property Meet in Rugby CV22 6QW

A packed room and lots of portfolio landlords present. The place to be on a Monday night in January