12:06 PM, 7th March 2022, About 2 years ago 1

Text Size

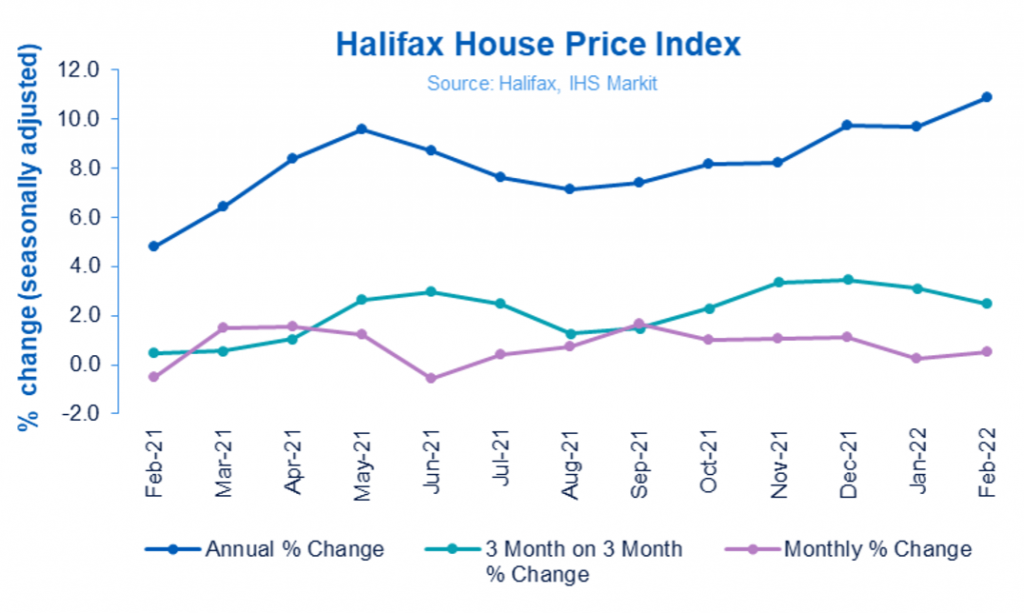

The industry standard Halifax House Price Index for February is reporting a record 10.8% annual rate of growth, which is the strongest level since 11.9% in June 2007.

Monthly house price growth rose to +0.5% following a slower start to the year with the average house price reaching £278,123. However, the squeeze on household finances is still expected to drag on the market this year

Russell Galley, Managing Director, Halifax, said: “The UK housing market shrugged off a slightly slower start to the year with average property prices rising by another 0.5% in February, or £1,478 in cash terms. This was an eighth successive month of house price growth, as the resilience which has typified the market throughout the pandemic shows little sign of easing. Year-on-year prices grew by 10.8%, the fastest pace of annual growth since June 2007, pushing the average house price up to another record high of £278,123.

“Two years on from the start of the pandemic, average property values have now risen by £38,709 (+16%) since February 2020. Over the last 12 months alone house prices have gained on average £27,215. This is the biggest one-year cash rise recorded in over 39 years of index history.

Average

“Lack of supply continues to underpin rising house prices, with recent industry surveys showing a dearth of new properties being listed, now a long-term trend. This may be a particular issue at the larger end of the property market. Over the past year the average price of detached properties (£43,251, +11%) have risen at a rate more than four times that of flats (£10,462, +7%) in cash terms.

“Looking ahead, as Covid moves into an endemic phase and almost all domestic restrictions are removed, geopolitical events expose the UK to new sources of uncertainty. The war in Ukraine is a human tragedy, but is also likely to have effects on confidence, trade and global supply chains.

“Surging oil and gas prices are one immediate consequence, meaning that inflation in the UK – already at a 30-year peak – will remain higher for longer. This will add to the squeeze on already stretched household incomes. While increases in Bank Rate look likely in the near term, the extent of the rises will depend on how it affects prices and companies’ approaches to pay over the months to come.

“These factors are likely to weigh on buyer demand as the year progresses, with market activity likely to return to more normal levels and an easing of house price growth to be expected.”

Regions and nations house prices

Seven UK areas are now seeing double-digit annual house price inflation, highlighting not only the strength but the breadth of gains across the country.

Wales was once again the strongest performing nation or region, with annual house price growth of 13.8%, largely unchanged since January, with the average property price rising to £207,184.

The South West of England also continues to record big gains. Annual house price inflation is now up to 13.4%, with by far the strongest quarterly growth (3.5%) of any region (average house price of £293,968).

While there will be a variety of local factors influencing the strength of these respective housing markets, it’s notable that both areas benefit from greater availability of more rural, scenic living which has proven to be so popular amongst buyers throughout the pandemic.

Elsewhere, Northern Ireland also continues to record strong price growth, with prices up 13.1% on this time last year, giving an average property value in February of £173,911.

House price growth remains robust in Scotland too. That said, despite the annual rate of house price growth picking up to 9.2%, remarkably Scotland now has the ‘weakest’ rate of annual growth of any area outside of London, again testament to the strength of house prices right across the UK. The average property price edged up to £193,777 in February.

As indicated above London remains the weakest performing area of the UK, though the capital continued its recent upward trend with annual house price inflation now standing at 5.4%, its strongest level since the end of 2020.

Previous Article

UK Buy to let tax in Spain?

Mick Roberts

16:26 PM, 12th March 2022, About 2 years ago

We feeling wealthy, but no doubt some bright spark MP may say Ooh u Landlords have made some good money on paper, here's a new Tax, the House Price Growth Tax-Only on Landlords of course.