7:01 AM, 17th May 2018, About 6 years ago

Text Size

Public perception of private landlords is often that they are a tight fisted bunch looking for any opportunity to hike up rents or make tenants homeless. However, a recent Just Giving campaign goes at least some way to dispelling this myth.

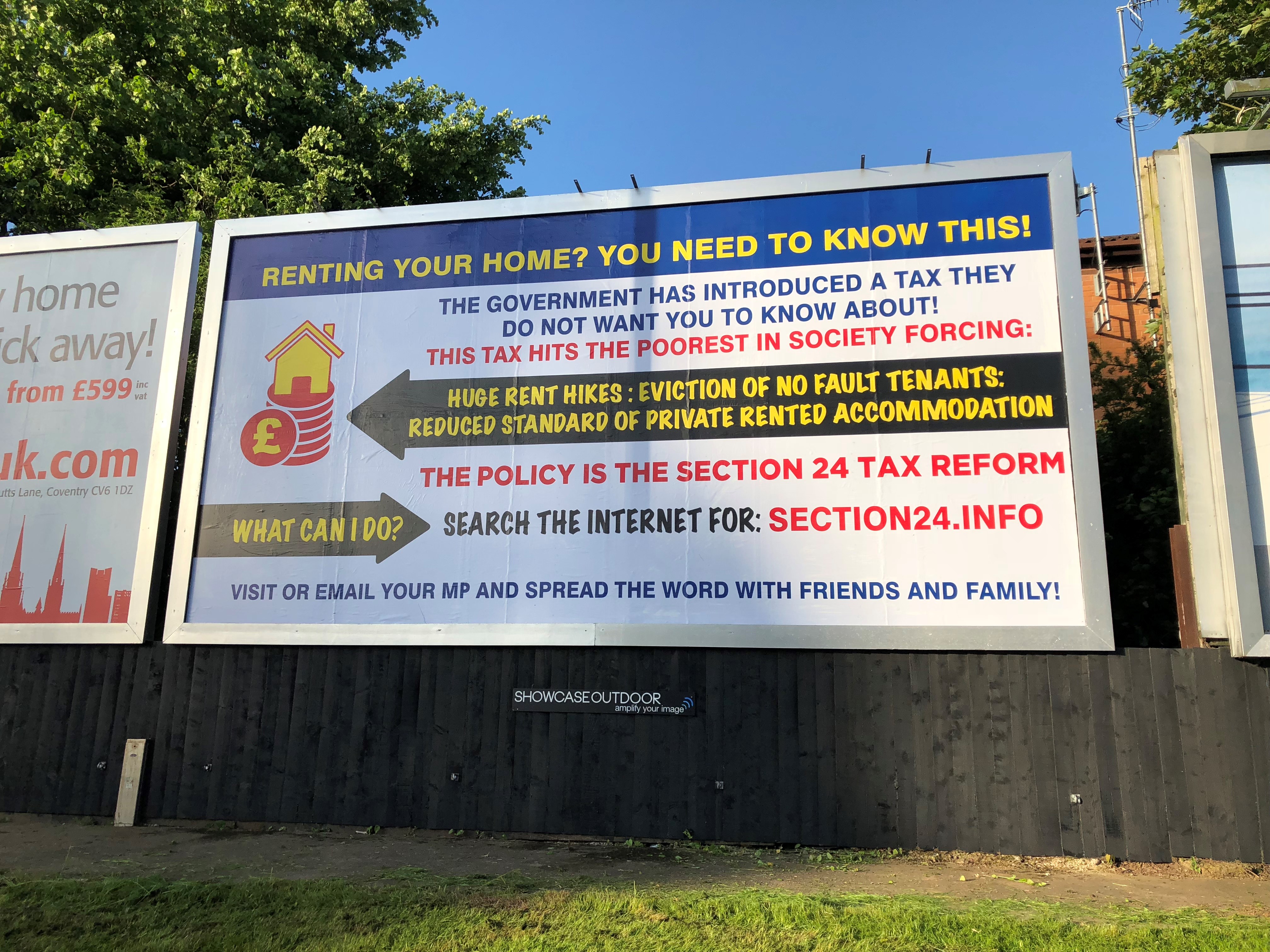

A group of landlords has raised funds to pay for the billboard pictured below to be erected at Radford Road, Coventry CV6 3BU.

This is just one of 10 campaign billboards to be erected following a Just Giving fundraising campaign started by Property118 Managing Director Neil Patterson just over a week ago.

The campaign was inspired by David Heard, a landlord based in Portsmouth, who was so frustrated that his MP was “stone-walling” him that he decided to dedicate his own billboard to attract her attention.

The Just Giving campaign is ongoing and we would like to see more of these billboards in many other towns and cities. Please see the link below for further details of the campaign.

https://www.justgiving.com/crowdfunding/section-24-billboard

Another criticism of landlords is that their typical six month tenancy contracts provide insufficient security of tenure to the tenants paying rent. Some groups like to give the impression that landlords crave for a regular turnover of tenants, but the evidence all points in the opposite direction.

Lots of people who are looking to rent a property want to stay for the long term, especially when they have children in local schools. However, most landlords only offer 6 or 12 month tenancy agreements and there are good reasons for that. Mortgage conditions are cited as one of the main reasons for short tenancies, another is that landlords feel the court systems make it difficult to evict bad tenants who still have time left to run on their initial tenancy term.

There is a solution though, and I’ve been using it since 2007.

Before I tell you what the solution is, I will share a saying that my wife often quotes “Trust But Verify”.

Some landlords and their agents tell lies to rent their properties. They will say they are looking to let long term and then put the property on the market for sale within 6 months. Not only is moving inconvenient, it is also expensive, stressful and can be extremely disruptive. Sadly, tenants cannot rely on the words alone of landlords or their agents, they want something more meaningful, and who could blame them?

From the landlords perspective, any meaningful promise has to cut both ways. Most landlords who are in the rental property business long term only want three things; rent paid on time, respect the property, respect the neighbours. If these criteria are not met then any reasonable person would probably agree that it is only fair that the landlord should be able to evict the tenant with the minimum of fuss. On the flipside, most landlords are happy to allow tenants to move on so long as they can re-let the property. Not only do landlords not want to tie themselves into long term leases they cannot get out of, good landlords are unlikely to insist on a tenant continuing to rent long term if their circumstances require them to move on.

The solution

A Deed of Assurance is a relatively simple legal agreement which sits alongside an Assured Shorthold Tenancy Agreement “AST”. It is a separate agreement between landlord and tenant which does not affect the landlords rights to serve notice or to obtain possession, therefore it does not affect the rights of a mortgage lender either. ![]()

From a tenants point of view, a Deed of Assurance provides far more flexibility than a long term tenancy because they are only tied in for 6 months and can then move on if they need to. What a Deed of Assurance offers in addition to an AST though is peace of mind which carries far more weight than words alone..

A Deed of Assurance is a document in which a landlord promises to pay an agreed level of compensation to a tenant if possession is obtained within a given time period through no fault of the tenant. I have never had to pay out compensation and because I’m in the business to provide quality tenants with quality accommodation long term I see absolutely no reason why I would ever need to.

The compensation amount offered by the landlord can be any amount, but obviously the idea is to agree something which is meaningful to both parties. For example, I offer to pay anything between £1,000 and £5,000 compensation if I obtain possession within the agreed period, providing the tenancy conditions have been observed impeccably by the tenant of course.

Similarly, the agreed period can be as long or short as makes sense too. Typically I offer 3 or 5 year terms but I would happily consider a longer period if the circumstances were right. What this means to the tenant is that if I obtain possession within the agreed period I will pay out compensation. This doesn’t stop me serving notice on a model tenant, it just means that if I obtain possession through no fault of the tenant I am obliged to pay compensation for their inconvenience. In order words, my promises are more than just words. They are legally documented and financially backed.

But what if the tenant has not complied with the tenancy? Well that’s covered too. If the tenant does not comply the compensation isn’t payable, that’s very carefully worded into the Deed of Assurance by the solicitors who drafted it. Obviously there could be a dispute over whether the tenant had complied with all of the reasonable conditions in the AST and in that case the tenant would have to make a claim against the landlord for the compensation through the Small Claims Courts.

Whether you are a landlord or a tenant I recommend you to download the Deed of Assurance template.

If you’re a tenant, and you want meaningful assurances that you landlord is looking for a long term arrangement, then use the Deed of Assurance as a negotiating tool.

If you are a landlord, you have a better chance of letting to your preferred tenants if you have a discussion about a Deed of Assurance.

To purchase the Deed of Assurance document template please see below. The price is £97 for unlimited personal use. 100% of funds raised are donated to The Landlord Union, which funds the sharing of best practice among landlords, tenants and agents through the running of Property118 forums.

Statutory Compliance – the Law of Property (Miscellaneous Provisions) Act 1989

This simply sets out a list of requirements which must be fulfilled by anybody who wishes to create a valid and enforceable contract for a disposition of an interest in land. If you fail to comply with the requirements you just end up with an attempt to create an interest in land which cannot be enforced. The interest in land that we are concerned with is, of course, the term of years granted to the tenant under an AST. Typically an AST is completed by the production of two identical copies of the tenancy agreement, one of which is signed by or on behalf of the landlord and the other of which is signed by or on behalf of the tenant; however, it is equally possible (but less common) for both copies to be signed by or on behalf of both parties.

Whilst it would be technically possible to modify (by addition) the AST so as to include words equivalent to those contained in the deed of assurance, our legal advisers chose not to recommend this for two separate reasons:

(i) the terms of the assurance are not in fact terms of the AST. The AST is one agreement (which creates an interest in land) while the assurance is a separate collateral agreement which does not create any interest in land. The assurance sets out the landlord’s intention as to the extension of the minimum term provided in the AST and in particular provides for certain consequences that will follow in the event that the intention to extend is frustrated or not performed for some reason.

(ii) the AST is complete and whole and enforceable under the statute because it does not refer (and does not need to refer) to any other document for its terms. The deed of assurance on the other hand does refer to the AST and hence (by virtue of section 2(2)) is deemed to incorporate the AST. Thus (for the avoidance of doubt) the AST is, for the purpose of the statute incorporated in the deed of assurance, although the deed of assurance is not incorporated in the AST.

For those reasons neither the deed of assurance nor the AST would be struck down as unenforceable by reason of the provisions of section 2 of the Law of Property (Miscellaneous Provisions) Act 1989.

(B) Why utilise two documents instead of one?

This is where the position of the mortgagee comes in. Although there are countless criticisms that one can validly raise against many of the large buy to let mortgage lenders, nevertheless they are to be regarded as a necessary evil. In very many (albeit not all) cases the ability of the landlord to own the property is entirely dependent upon the mortgagee advancing a large part of the purchase price. Typically such mortgagees are imperious and unyielding and often unreasonable in their attitude to the issue of letting so that they (under their terms and conditions, to which the landlord is forced to subscribe whether he likes it or not) will only permit the creation of ASTs with a short primary term, usually six months and almost never more than 12 months. Their justification for that stance is that they will not sanction any arrangement which might hamper or abstract their ability to obtain possession of the property and sell it with vacant possession in the event that the landlord defaults under the mortgage.

Given that the object of our exercise is to provide maximum comfort to the tenant in terms of the prospect of securing an extension in the effective term of the AST (with compensation available if the extension fails) the arrangement must avoid infringing the landlord’s mortgage covenants and the requirements of the mortgagee while still furnishing an enforceable remedy in the event that the tenant does not enjoy the full benefit of the extended term. Although there is some variation from lender to lender, it is in our experience generally the case that if the terms of the deed of assurance were directly incorporated within the AST itself, then the AST would no longer be acceptable to the mortgagee, resulting in a situation in which either consent would be refused or, alternatively, the landlord would all make breaches in mortgage covenants by entering into the (extended) AST. Obviously, we could never advise a landlord to breach mortgage covenants; apart from anything else it would render him liable to immediate adverse action if he were to do so. The reason why the mortgagees would not consent to the extended AST wording is that, if they were to do so, the tenant would or might have a sound argument against the granting of an order for possession and sale in the event that the landlord were to default under the mortgage.

By keeping the terms of the assurance in a separate deed, the possibility of valid objection by the mortgagee is eliminated. The landlord and tenant enter into a separate arrangement (outside the AST although referring to the AST) and the objectives of every party are achieved.

While we are not exactly “worried about lenders”, we cannot ignore them nor the rights and powers which they enjoy.

The problem is that if a mortgagee approves a document which contains an indication that the tenant will or may enjoy an extended term of tenancy, then, whatever protective wording you may put in, it would always be open to the tenant to argue in court (if faced with the prospect of premature eviction by reason of a landlord’s mortgage default) that he entered into the tenancy agreement specifically in reliance on the expectation of that extension, so that the mortgagee who had approved the wording would be unable to recover possession by reason of the rules of estoppel. That problem does not even arise as long as the mortgagee does not consent to nor approve the document which gives rise to the expectation. In other words, however good your wording might be, the “two separate documents” approach is inherently preferable.

(C) Why utilise a deed (as opposed to a simple agreement) for the assurance?

The decision to proceed by way of deed for the assurance was a “belt and braces” election, based on principles of precaution rather than necessity. When we were setting this up we did consider the possibility of having the assurance contained in a simple agreement, not by way of deed. However, it was perceived that in that case there would possibly be some element of risk or prejudice to the tenant. The problem is that it is arguable that a simple agreement not effected by way of deed might perhaps be unenforceable by the tenant. That is because it is not obvious that the tenant provides any “consideration” for the various promises and obligations undertaken by the landlord which form the core of the assurance. In other words, the landlord undertakes responsibilities that go well beyond his responsibilities under the AST while the tenant does not undertake any recognisable responsibilities or obligations beyond those already contained within the AST. In general under contract law a party can only enforce a promise given by another party if the enforcing party has provided some consideration in return for that promise. That rule does not apply where the promise to be enforced is contained within a deed. That is one of the distinctive features which differentiate between a deed on the one hand and a simple written agreement on the other hand.

The use of a deed might be regarded as overkill and unnecessary but it is safer and better for the tenant to have the assurance terms contained within a deed. There is no downside or disadvantage (apart from the modest requirement that signatures be witnessed) from the point of view of either party by employing a deed as the mechanism for the assurance and so that is what our legal advisers recommended.

Previous Article

£1.36 million in TPO awardsNext Article

Shelter want default fees banned