9:33 AM, 30th January 2017, About 7 years ago 8

Text Size

Hi All

I am a new member to Property 118.

I am an Investor building high yield property portfolios in the North of England primarily the North West.

Like most Landlords I have been concerned at the trend of Government policy. I am not an economist or an expert but as an informed observer my perception has been that the Government is using the wrong remedies to fix the wrong problem.

They are doing so because of lobbying from well funded pressure groups and because the proposed solutions seem reasonable, but counter intuitively I think they are not.

Below are two posts I did on Facebook groups where I am a member and a number of commentators on those posts, which aroused a lot of interest, suggested I should put my points on Property118. They thought Property118 was one of the better campaigning groups for Landlord (as opposed to say RLA and NLA), so here I am.

You can read what I say on these posts but the summarised version of my points is this …

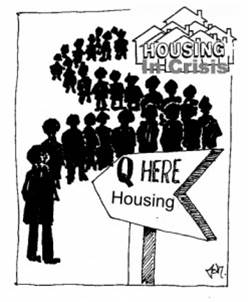

I am questioning if outside London (and a few selected areas where prices are being driven by the London effect) there is actually a housing crisis in terms of lack of supply of affordable homes.![]()

The Government is clearly persuaded there is., so they have two remedies. The first is to encourage much more housebuilding across the country. The second is to force buy to let Landlords out of the market to ensure more properties are available for first time buyers.

https://www.facebook.com/groups/UKProperryTraders/permalink/1842163396028594/

https://www.facebook.com/groups/UKProperryTraders/permalink/1844939955750938/

When I look around where I operate from Carlisle to Liverpool and across to Sunderland I see almost no evidence of lack of affordable housing. There are tens if not hundreds of thousands of houses that I would consider affordable at all levels from lowish paid workers to executives. Houses and flats aplenty are available from £40,000 to £250,000 which are levels I would say are affordable.

So why is there a perceived housing crisis?

My view is that the real problem is not lack of property but lack of finance. No matter what mortgage brokers may say many people really struggle to get finance and to find the deposits required in the modern market. At the lower level many people are shut out because lenders do not lend below £75,000. At the higher level, to find a £50,000 deposit for a £200,000 home is a struggle.

There are good reasons why finance is restricted in light of the madness before 2008. In the North many people got their fingers badly burnt when prices collapsed and they have yet to go back to 2008 levels. There is little growth so why make the sacrifice?

I believe this situation prevails in 80% of the Country, but that the London bubble which most MPs are experiencing means they are taking remedies that may well be needed for London and applying them to the whole country where they will actually make things worse not better.

Sounds wrong?

Just think about it this way.

If 1,000s of houses are built in areas with current low demand prices will fall. But what evidence is there that if say a £100,000 house falls to £90,000 they will be snapped up? If people are not buying them today at £100,000 why would they buy them at £90,000? If they cannot get finance for £100,000 I do not think they will get it for £90,000, especially if they perceive the market is in decline so prices might fall further. People are not going to be encouraged to buy in a falling market. People buy in a rising market.

But make controlled finance available in a sensible way then at a stroke the housing problem will be solved as people make the effort to buy, prices will rise and more people will be encouraged to buy and build. That does not mean go back to 2007. It means craft sensible finance incentives. Carry on as we are and we are going to slide into a European model of low prices , low demand, low home ownership and much more renting. If that is the goal fine but please do not let MPs get away with saying they want to increase home ownership and believe in a property owning democracy, because their current policies will not have that effect in my view.

The question that then arises is who is there to put the case to MPs in a way that will make them listen? That is why some of the many who agreed with me suggested I join your group and do this post. They thought this might be a forum where there are people who can put these points forward to the Government.

I welcome your thoughts

Marcus Selmon

Previous Article

Ownership SplitNext Article

Capital gains maize!!

Mark Alexander - Founder of Property118

9:37 AM, 30th January 2017, About 7 years ago

Very thought provoking and I agree with you.

Several Property118 members have been discussing these issues with there MP's but the way to be heard is in the masses.

Too many people want somebody else to fight their battles for them. They make excuses such as lack of time, lack of confidence etc. and that's why nothing changes.

At Property118 we do the best we possibly can in terms of campaigning, and that includes inspiring others to join in and to show their friends and acquaintances the way too.

.

Yvonne B.

12:07 PM, 30th January 2017, About 7 years ago

None of this is about people or houses - it's about getting more TAX.

The landlords who can't afford to continue will sell and pay Capital Gains TAX.

Those that switch to LTD company will pay Capital Gains TAX.

House prices will start to drop as more housing comes on the market.

At the same time rents will rise due to a massive shortage of rentals. More TAX from higher yields

Those who can will buy as it will be cheaper than renting. More Stamp Duty TAX

Company landlords will snap up cheaper housing - 3% Stamp Duty TAX

Lots of house movement = Lots of TAX for the government - it's a WIn WIn for them.

They don't care about the landlords or the tenants, that's irrelevant, Clause 24 won't be overturned - it's just a way to get the market moving and earn more TAX.

Rachel Hodge

12:07 PM, 30th January 2017, About 7 years ago

Marcus,

Agree with your points.

I, and many others, have been to see their MPs following extensive communications with them.

There is an enormous thread on here which has been active for well over a year discussing government policy. You may want to start at the most recent post and work backwards.

https://www.property118.com/budget-2015-landlords-reactions/76164/

Dr. Rosalind Beck compiled an impact assessment study on the effects of recent housing policy. You can download it here, and perhaps send it to your MP with your thoughts. It's well worth a read; perhaps before embarking on the Summer Budget thread above!

https://www.property118.com/section-24-comprehensive-report/91755/

Good luck,

Rachel

Simon Bentley

12:08 PM, 30th January 2017, About 7 years ago

As someone who lives in you the area where Marcus operates I tend to agree.

I won't go into the details but we moved up here because we could pull together the deposit for a house in this region, something I couldn't have done 100miles further south whilst renting. Fortunately though both full time employed our jobs are such that this was possible.

As noted by Marcus there are plenty of truly affordable houses on the market up here, many of which have been on the market for a long time and many that are standing empty. - Oh and it's a lovely part of the country to live too, no smog, no congestion (or its associated charges etc) and views to die for (looking straight "up the dale" from my desk as I type).

Heather G.

12:19 PM, 30th January 2017, About 7 years ago

Hi Marcus,

It might be worth putting a constructive argument to a Mortgage Strategy journalist. I've been in touch with Leah Milner about a couple of mortgage-related issues and she's been quite receptive. I think the point about the cost of lenders reclaiming a £50K house being the same as those of reclaiming a £500K house is probably very valid. However, offering a £50K mortgage at a higher interest rate, with shorter repayment duration and possibly higher arrangement fees would limit their exposure and might make it worthwhile for them.

Best of luck with your crusade!

Heather.

Mark Alexander - Founder of Property118

12:27 PM, 30th January 2017, About 7 years ago

Reply to the comment left by "Heather G." at "30/01/2017 - 12:19":

Sam Barker at Mortgage Strategy is also very approachable. We talk to each other regularly.

.

Paul Green

13:22 PM, 30th January 2017, About 7 years ago

Buy to let is a cottage industry and we all know what happened to then, up and down the country. Corporations have the government in their pockets and dictate policy by their lobbyists. They have their own door into Westminster, just as the do in Washington. They have and spend billions of pounds on lobbying and government is also a revolving door for CEO's. Corporate Britain, China and the US companies want in on the buy to let market and have shaped policy in their their favour. A level playing field for corporations is one tilted at 60 degrees towards them. The train has already left the station and these behemoths can't be stopped. Government Is a shadow cast by corporations. Fair well buy to let cottage industry, the big boys (speculators & hedge funds) are coming and with that means corruption......read Noam Chomsky...

Old Mrs Landlord

18:45 PM, 30th January 2017, About 7 years ago

Reply to the comment left by "Paul Green" at "30/01/2017 - 13:22":

A few cottage industries survived and even thrive because they are the most efficient way of producing a specific good. This would certainly apply to buy to let on individual family homes if we were competing on a level playing field with corporate landlords. A video on the House Prices and the Economy thread of the HPC forum details how corporates such as Blackstone, and including overseas buyers, have messed up in the US, despite buying repossessions, They were sneakily bailed out at public expense in the dying hours of the Obama administration. Ironically, the verdict is that this type of venture is most efficiently operated by "mom and pop" type individual local investors, Apologies for referencing this site but don't know how to get to the original.