10:30 AM, 8th July 2022, About 2 years ago

Text Size

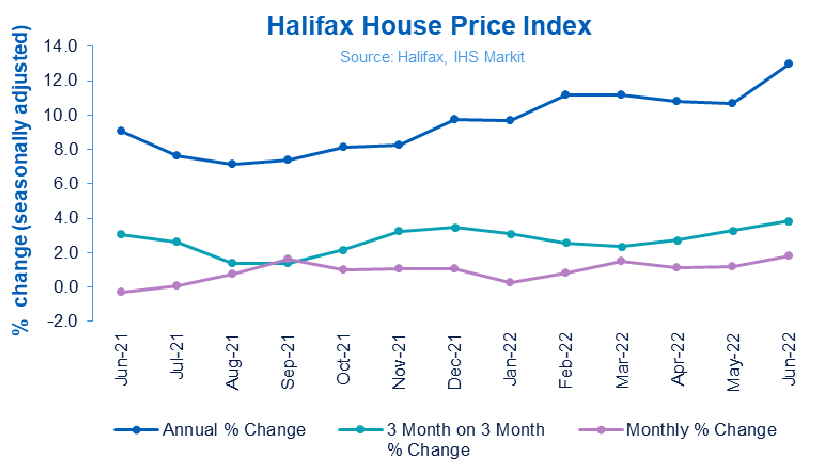

The Halifax House Price Index jumped by 1.8% in June with annual inflation at a record 13% the highest since 2004. The average house price now stands at £294,845.

Northern Ireland continues to display the highest annual inflation in the UK at 15.2%.

Russell Galley, Managing Director, Halifax, said: “The UK housing market defied any expectations of a slowdown, with average property prices up 1.8% in June, the biggest monthly rise since early 2007. This means house prices have now risen every month over the last year, and are up by 6.8% or £18,849 in cash terms so far in 2022, pushing the typical UK house price to another record high of £294,845.

“The supply–demand imbalance continues to be the reason house prices are rising so sharply. Demand is still strong though activity levels have slowed to be in line with pre–Covid averages while the stock of available properties for sale remains extremely low.

“Property prices so far appear to have been largely insulated from the cost of living squeeze. This is partly because, right now, the rise in the cost of living is being felt most by people on lower incomes, who are typically less active in buying and selling houses. In contrast, higher earners are likely to be able to use extra funds saved during the pandemic, with the latest industry data showing that mortgage lending has increased by the highest amount since last September.

“Of course, the housing market will not remain immune from the challenging economic environment. But for now, it continues to demonstrate as it has done over the last couple of years the unique combination of factors impacting prices. One of these remains the huge shift in demand towards bigger properties, with average prices for detached houses rising by almost twice the rate of flats over the past year (+13.9% vs +7.6%).

“In time though increased pressure on household budgets from inflation and higher interest rates should weigh more heavily on the housing market, given the impact this has on affordability. Our latest research found that the strong rise in property prices over the last two years, coupled with much slower wage growth, has already pushed the house price to income ratio up to a record level.

“So while it may come later than previously anticipated, a slowing of house price growth should still be expected in the months ahead.”

Regions and nations house prices

Northern Ireland once again topped the table for annual house price inflation, up by 15.2%, equating to an average property price of £187,833.

Wales also continues to record a strong rate of annual growth, up by 14.3%, with an average property cost of £219,281.

Meanwhile, the South West saw the highest annual house price growth of any region in England, at 14.2%, where a typical home now costs £308,128.

Scotland too saw an increase in the rate of annual house price inflation, up to 9.9%. A Scottish home now costs an average of £201,549, breaking through £200,000 for the first time in history.

London continues to lag behind other regions in terms of annual house price inflation (+7.1%), though with an average property price of £547,031 it remains by far the most expensive place in the UK to buy a home.

Previous Article

LettingSupermarket - Manchester Off-Market New-Build BTL ApartmentsNext Article

New and probably very temporary Minsters