9:53 AM, 8th June 2022, About 2 years ago 1

Text Size

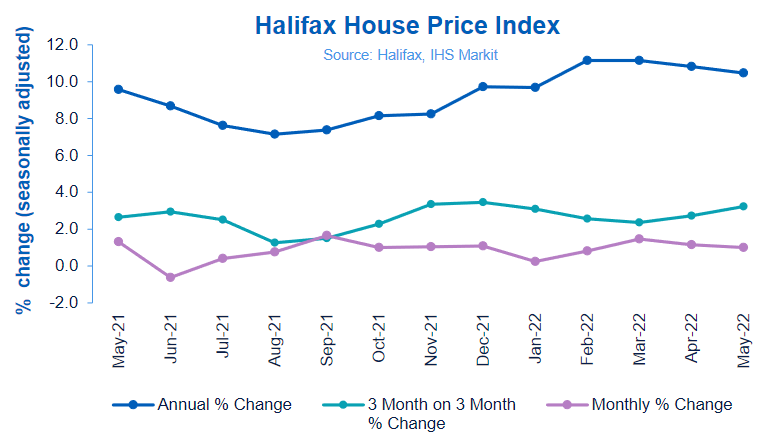

The Halifax House Price index released today shows a minor inflationary cooling with month-on-month prices increasing by 1%, the eleventh consecutive monthly rise.

Over the last 10 years, the average house price inflated by 74% to the current figure of £289,099.

Russell Galley, Managing Director, Halifax, said: “The average cost of buying a home in the UK is up 1%, or £2,857, on last month, and has now risen for eleven consecutive months. Annual growth also remains in double-digits, at 10.5%, although this is the slowest rate of growth seen since the start of the year.

“The average cost to buy a home in the UK is now £289,099, hitting yet another record high. Despite the very real cost of living pressures some people are experiencing, the imbalance between supply and demand for properties remains the primary reason driving the continued climb in house prices.

“For house hunters, the extent of the impact of property price inflation continues to be linked to the type of home they are looking to buy. Compared to May last year, you’d need around £10,000 more to buy a flat, but an additional £50,000 for a detached home. This clearly creates a knock-on effect for those looking to make their first home move, as the rungs on the housing ladder have become increasingly wider.

“However, the housing market has begun to show signs of cooling. Mortgage activity has started to come down and, coupled with the inflationary pressures currently exerted on household budgets, it’s likely activity will start to slow.

“So, there is perhaps one green shoot for prospective purchasers; with overall buying demand down compared to last year, we may be past the peak sellers’ market.”

Regions and Nations house prices:

Northern Ireland topped the table again this month for annual house price inflation, seeing prices rise by 15.2%, equating to an average of £185,386.

The South West of England also recorded a strong rate of annual growth at 14.5%, with an average property cost of £305,173, alongside Wales at 13.7%, where a home is a now a record of £216,120.

Overall, nine regions of the UK registered double-digit annual inflation, with only Yorkshire and the Humber, Scotland and London in single figures. Nonetheless, buying a home in the capital today would still require £541,942, on average.

In Scotland, growth continues to underperform relative to the UK average, with annual inflation at 8.3%. A home in the country now costs an average £198,288.

Previous Article

Open Letter to the UK Buy-To-Let Mortgage Sector

Mick Roberts

8:06 AM, 9th June 2022, About 2 years ago

Yes & what the agents tell u on ground level is what ends up happening around rest of country. And they now noticing less bids.

130k houses now only selling for 138k in a week ha ha.

Instead of 150k in 8 hours.