14:24 PM, 13th December 2016, About 7 years ago

Text Size

If you pay more than £20,000 a year in mortgage interest we DEFINITELY need to talk.![]()

Mark Alexander – founder of Property118.com and winner of the “Outstanding Achievements Award” at The Property Investor Awards 2016

We also need to talk if your mortgage interest plus your rental profits and any other taxable income including salary and/or dividends exceeds £43,000 a year.

Why?

Because you are going to be paying more tax, possibly A LOT MORE TAX unless you restructure your business, and some of the solutions available need to be implemented RIGHT NOW for maximum benefit.

There isn’t a ‘one size fits all’ tax strategy and that’s why I provide bespoke consultations to help point you in the right direction.

Book two hours of consultation time with me and if at the end of it you are not completely satisfied that you have received incredible value for money I will refund you in full – GUARANTEED!

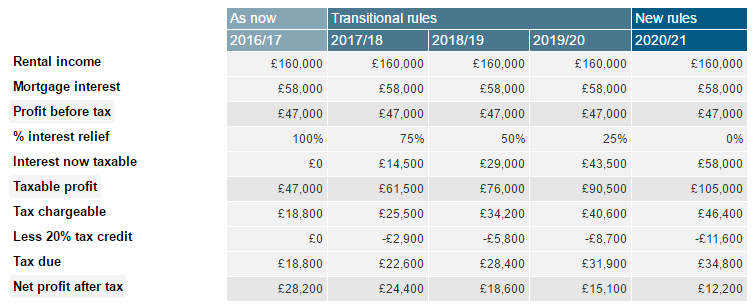

The primary cause is the legislation created by George Osborne – Section 24 of The Finance Act (No.2) 2015. Mr Osborne is no longer the Chancellor of the Exchequer but his legacy lives on. If you are a partnership or a sole trader, the outcome of his legislation is that you will not be able to offset your mortgage interest against rental income. This is being phased in over a four year period from April 2017. You will receive a tax credit of 20% of your disallowed mortgage interest but if your total taxable income (including mortgage interest) exceeds the threshold for basic rate taxation then you WILL pay more tax unless you restructure. Below is a very typical example.

Clarke is 48 years old. He earns £43,000 from his day job which is equal to the basic rate tax threshold of £43,000. He decided 17 years ago to invest into property as a means to fund his retirement. He has since managed to build a portfolio of 16 rental properties which produce rental income of £160,000 a year. Out of this he spend £55,000 a year maintaining them to perfection for the benefit of his tenants, he’s the model landlord. He also spends another £58,000 a year on mortgage interest, leaving him with profits of £47,000 on which he pays tax at the higher rate. His accountant has advised him that the tax on his portfolio will be £18,800 leaving him £28,200 which he had planned to invest into the purchase of another property. Until very recently Clarke thought he wouldn’t be affected by the scheduled tax changes but now he knows differently. This is how the tax changes will affect Clarke if nothing else changes.

You will be unaffected if the beneficial interest in your properties is held in a limited company. However, transferring your properties into a company often triggers CGT, Stamp Duty and a need to refinance. There are solutions but they require very careful planning.

You will also be unaffected if you have no mortgages or other finance costs.

Effective tax planning entails utilising all available tax breaks legislation provides. Nobody in their right mind wants to pay more tax than they are supposed to pay, but not everybody knows how to go about optimising their tax position or even the existence of many forms of tax relief available to them.

HMRC recently had a motto that “tax needn’t be taxing“. If that was their true goal, I’m afraid they failed!

I’ve been studying tax structures for landlords since I began my career in Financial services in 1987 but ever since the 2015 Summer Budget it has been my primary focus.

With the correct planning it may well be possible for you to utilise legislation to optimally restructure your property rental business, without any requirements to refinance or to pay capital gains tax or stamp duty. I’m not referring to loopholes or tax dodges but legislation designed to assist businesses which your average accountant might never consider to advise you about.

There are a number of restructuring options you may wish to consider and some may be more appropriate than others, for example:-

If you are married, the first level of tax planning to consider is a restructure of your income to optimise all available basic rate tax allowances with your spouse (currently £43,000 each) and then to purchase any further properties in a company. The tax changes to mortgage interest relief will only affect you if your total taxable income (including mortgage interest) exceeds £43,000 a year. The Chancellor of the Exchequer confirmed in the 2016 autumn statement that this figure will increase to £50,000 by the year 2020. Restructuring income between spouses is achieved by changing the percentage of beneficial ownership of your rental properties. It only costs £250 + VAT for each property to achieve this and does not necessitate refinancing. If your total taxable income is significantly higher than £43,000 each (you/spouse/partners) then incorporation may well be a better option.

Incorporation is more effective for partnerships where total taxable income including rental profit plus mortgage interest exceeds £43,000 a year for each partner. If your taxable income for each partner is only marginally greater than this figure then incorporation of your existing rental property business might not be the most economical course of action for you to take. The general rule of thumb is the higher your taxable income and mortgage interest is, the better off you will be by considering incorporation.

If you are not already a partnership you may wish to consider a stepped approach to incorporation in order to negate the requirement to pay Stamp Duty on the transfer of assets. There are two methods to achieve this which very much depend on whether or not your are married. The process involves becoming a partnership now and then incorporating after three years of partnership tax returns have been submitted. If you are not married you can minimise the tax and other risks usually associated with forming of a partnership by transferring just 1% of the net value of your business to the new incoming partner, e.g. friend, sibling, company etc. This would incur just a fraction of the CGT and Stamp Duty which would otherwise become payable. With the correct structure there will be no necessity to refinance.

Within a half hour telephone consultation I can usually glean enough information to identify what the best options would be for you to consider. Within another 90 minutes I can run all the numbers and prepare a report for you to consider, which includes the number crunching, explains your options, recommends the professional advisers to use for implementation and quotes for doing the work. The total cost of my two hour consultations is £400 inclusive of VAT, i.e. £100 for each 30 minutes x 4 = 2 hours in total.

Upon receipt of payment I can usually schedule an initial call with you within two working days and submit my full written report to you by close of business the following working day at the latest.

Please note that I do not promote “schemes”. Any guidance offered will point you directly to legislation which can be used to your advantage and fully insured, fully qualified professional advisers to assist you with implementation.

I look forward to hearing from you.

Yours sincerely

Mark Alexander – founder of Property118.com

IS TAX PLANNING LEGAL?

The law regarding tax planning was clarified nearly 80 years ago.

In 1936 a landmark legal case was heard in the House of Lords (Inland Revenue Commissioners v Duke of Westminster [ 1936 ] AC1 (HL)). The Duke of Westminster won the case. The judge, Lord Tomlin, stated:

“Every man is entitled if he can to arrange his affairs so that the tax attaching under the appropriate Acts is less than it otherwise would be. If he succeeds in ordering them so as to secure that result, then, however unappreciative the Commissioners of Inland Revenue or his fellow taxpayers may be of his ingenuity, he cannot be compelled to pay an increased tax.”

WHAT ABOUT GAAR?

HMRC now has a very powerful weapon called General Anti Abuse Rules. It is GAAR which renders the vast majority of tax avoidance “schemes” as ineffective.

Beware any advice which may fall foul of DOTAS “Disclosure of Tax Avoidance Schemes”. The hallmarks are templated advice and confidentiality agreements. Such arrangements allow HMRC to call for repayment of all tax saved under an Accelerated Payment Notice “APN” whilst the “scheme” is being investigated. This can take years!

BEWARE INSPIRED AMATEURS

People dream up new ‘tax schemes’ every day, most of which can be pulled apart within minutes by a tax expert. This is why it pays to obtain professional advice and to consider strategies which are already proven. Some people chance their arm in terms of tax strategies and most of these end up much worse off, often bankrupt.

USEFUL LINKS

This article explains how spouses can divide their income and the benefits of doing so – LINK

This article explains the legislation used to offset CGT when incorporating – LINK

This article explains incorporation of a large rental property business partnership and the benefits of doing so – LINK

This article explains how a single landlord with a large property rental business can utilise all tax breaks by taking a stepped approach to incorporation over a three year period – LINK

Show Book a Tax Planning ConsultationPrevious Article

Freeholder ignoring my calls to fix leaking roof