10:14 AM, 29th March 2019, About 5 years ago

Text Size

Three years after this article was first published in March 2019 an update has been added to show the impact and outcomes of our recommended restructure.

This case study is based on a Merchant Banker resident in Central London. For the benefit of his retirement and legacy planning he has been building a UK rental property business for several years, mainly within the City.

Due to having no mortgages at all he was completely unaffected by the Section 24 restrictions on finance cost relief. Nevertheless, incorporation was massively beneficial to him in regards to income tax planning, CGT planning and IHT planning.

I will begin with a simple overview of his circumstances when he first approached us.

The incorporation structure we recommended enabled him to transfer the entire £8million of capital gains in his properties into shares in the company he incorporated into, meaning no Capital Gains Tax fell due – see TCGA92/S162. This enabled his company to sell several of the London properties and to reinvest elsewhere without having to pay the 28% CGT which would have fallen due previously.

His company DID have to pay Stamp Duty Land Tax to complete the incorporation transaction but Multiple Dwellings Relief applied. If his business had been a partnership then SDLT may not have been payable.

Prior to his incorporation we arranged a £4million overdraft to enable him to withdraw his personal capital investment from the business. At the point of incorporation this funding was novated to his company. He then made a shareholders loan personally to the company for £4million using the funding raised prior to the incorporation, thus taking the company overdraft back to £0. NOTE the company now owes him the £4million, which he can now withdraw from the company completely tax free when the money exists to do so, e.g. from future retained profits or net proceeds of property sales. This linked HMRC manual provides several very simplistic examples of the use of this structure, thus confirming it does not fall foul of either DOTAS or GAAR. The company could also take a mortgage against the properties and use the proceeds of that to repay some or all of the shareholders loan if necessary.

This is what we had achieved for him at that stage.

Our services

We charge £400 for an initial landlord tax planning consultation process which includes:-

The Property118 Tax team, in association with Cotswold Barristers, are specialists in advising on incorporation relief, but not all landlords qualify for reliefs to make a viable case to proceed down this path. Therefore, we also recommend a variety of other ownership structures.

All recommendations are bespoke, we do not believe in a ‘one-size-fits-all’ approach.

Our specialist landlord tax consultants provide guidance on the pros and cons of sole ownership, joint ownership, Partnerships, LLP’s, Limited Companies and Plc.’s as well as transitional relief available to switch between these various ownership structures. Our tax and legal team also provide guidance on non-resident status and benefits as well as property related business continuity, legacy and inheritance tax planning.

Our barristers each carry £10,000,000 of Professional Indemnity insurance and prepare each case as if it will be investigated by HMRC.

TESTIMONIALS – LINK

Download our free eBook by clicking on the image below

The next stage of tax planning was to cap the value of his shares for inheritance tax “IHT” purposes.

Half of the existing residential portfolio was sold.

Without the restructure, this would have crystallised £4,000,000 of Capital Gains. However, as a result of the base values of the properties being re-set at the point of incorporation, the actual gains were minimal. This alone resulted in £1,120,000 of Capital Gains Tax being mitigated at this point.

The £6,000,000 of net proceeds resulting from the sale of just half of the portfolio was reinvested as seed capital into re-purposing commercial properties to residential at a total project cost of £15,000,000. Initially, commercial funding of £10,000,000 was raised against the security of all assets of the business (including the properties being acquired), leaving a healthy £1,000,000 liquidity reserve. However, since these developments were completed their value is now £23,000,000. This additional £8,000,000 of profit has not been taxed because the units have all been let and retained as long term investments.

Following completion of the above developments they were refinanced to £14,000,000 on far more attractive long term mortgages.

The remaining half of the existing portfolio has also increased in value from £6,000,000 to £6,800,000 resulting in an additional £800,000 of unrealised and untaxed profits being added to the value of the business.

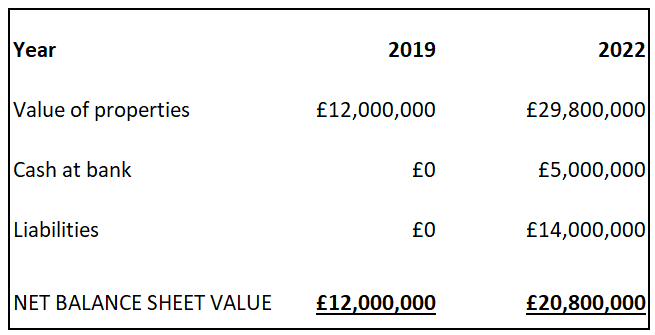

The following is a before and after snapshot of the balance sheet.

Cashflow has also increased significantly as a result of the new properties producing significantly higher rental yields.

Having now retired from his ‘day-job’ the former Merchant Banker and his family are now enjoying his early retirement in Portugal with the benefit of NHR tax resident status. This means he can take dividends or loan interest from the company tax free for the next 10 years.

The family rented for the first year whilst the children settled into their new International schools, which they absolutely love. They also get to enjoy the warmer climate and the beaches but best of all they get to see Dad a lot more than ever before. However, it goes beyond this in terms of spending more quality time with family who visit regularly.

Their brand new mansion in the Algarve will soon be completed and this will be paid for as result of the company using its cash reserves to repay the £4,000,000 Directors Loan arranged as part of the planning recommended by Property118.

A SmartCo structure was also implemented soon after incorporation, meaning that business continuity and legacy planning has also been addressed to mitigate future Inheritance Tax liabilities for the family.

“The investment into legal and professional fees required to implement this structure, including the financing required for the pre-incorporation Capital Account Restructure, amounted to just under £100,000. That has already paid for itself more than tenfold in CGT savings alone, not to mention the income tax savings and other ‘life-changing’ outcomes!

Previous Article

More than just bricks and mortar